South Korea Fluoroelastomer Market Size, Share, and COVID-19 Impact Analysis, By Type (Fluorocarbon, Fluorosilicone, and Perfluoroelastomer), By End-use (Automotive, Aerospace, Chemicals, Oil & Gas, and Energy & Power), and South Korea Fluoroelastomer Market Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Fluoroelastomer Market Size Insights Forecasts to 2035

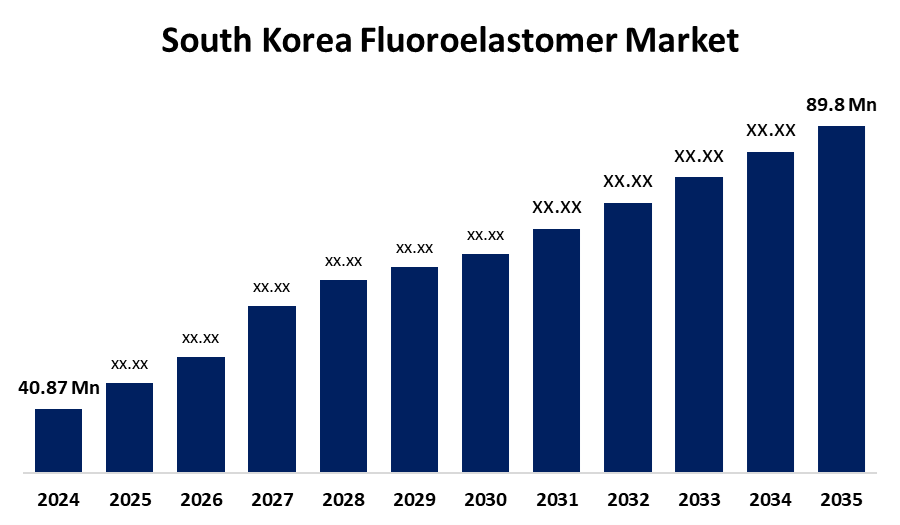

- The South Korea Fluoroelastomer Market Size Was Estimated at USD 40.87 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.25% from 2025 to 2035

- The South Korea Fluoroelastomer Market Size is Expected to Reach USD 89.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Fluoroelastomer Market Size is anticipated to reach USD 89.8Million by 2035, growing at a CAGR of 7.25% from 2025 to 2035. The growing need for high-performance sealing solutions in the automotive and aerospace industries, as well as its growing application in chemical processing because of its exceptional chemical and heat resistance, are driving the fluoroelastomer market.

Market Overview

The fluoroelastomer market involves the production and use of high-performance synthetic rubbers known for their exceptional resistance to heat, chemicals, oils, and solvents. These elastomers are widely used in demanding industries such as automotive, aerospace, oil & gas, and electronics. The long-term durability, minimal degradation under extreme conditions, and excellent sealing performance. The market presents strong opportunities driven by rising demand for electric vehicles, advanced manufacturing, and stringent emissions standards. In South Korea, government initiatives promoting innovation in mobility, clean energy, and high-performance materials support market expansion. R&D funding, tax incentives for green technology, and collaboration between industrial and academic sectors further encourage the development and adoption of advanced fluoroelastomer-based solutions across critical applications.

Report Coverage

This research report categorizes the market for South Korea fluoroelastomer market based on various segments and regions forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea fluoroelastomer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea fluoroelastomer market.

South Korea Fluoroelastomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 40.87 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.25% |

| 2035 Value Projection: | USD 89.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Type, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Sampyo Group, DL E&C, Sungshin Cement Co., Ltd., Asia Cement, Dongkuk R&S, Sambo Mining, Daesung Industrial Co. Ltd., POSCO CHEMTECH, Seongshin, Eugene Basic Materials Company, KCC Corporation, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for high-performance materials in automotive, aerospace, and chemical industries due to their superior resistance to heat, oil, and aggressive chemicals. The rise in electric vehicle production, which requires durable and thermally stable components, further boosts demand. Additionally, stricter environmental and safety regulations fuel the need for advanced sealing and insulation materials.

Restraining Factors

The complex manufacturing processes and expensive raw materials contribute to elevated prices, limiting adoption in cost-sensitive industries. Traditional fluoroelastomers often contain perfluorinated compounds (PFCs), which are not biodegradable and can be harmful to the environment. Materials like thermoplastic elastomers (TPEs) and silicones offer comparable performance at lower costs, posing challenges to fluoroelastomers' market share.

Market Segmentation

The South Korea fluoroelastomer market share is classified into type and end-use.

- The fluorocarbon segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea fluoroelastomer market is segmented by type into fluorocarbon, fluorosilicone, and perfluoroelastomer. Among these, the fluorocarbon segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its exceptional resistance to heat, chemicals, and aging makes it ideal for demanding automotive and industrial applications. Its widespread use in seals, gaskets, and O-rings in high-performance engines and machinery drives consistent demand. With South Korea's strong automotive and electronics sectors, the need for durable.

- The automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea fluoroelastomer market is segmented by end use into automotive, aerospace, chemicals, oil & gas, and energy & power. Among these, the automotive segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The material's superior heat, fuel, and chemical resistance, essential for modern vehicle components like seals, hoses, and gaskets. South Korea's advanced automotive industry, with a strong focus on durability and emissions reduction, drives high demand for reliable materials. Additionally, the shift toward electric and hybrid vehicles increases the need for thermal and chemical-resistant components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea fluoroelastomer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sampyo Group

- DL E&C

- Sungshin Cement Co., Ltd.

- Asia Cement

- Dongkuk R&S

- Sambo Mining

- Daesung Industrial Co. Ltd.

- POSCO CHEMTECH

- Seongshin

- Eugene Basic Materials Company

- KCC Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea fluoroelastomer market based on the below-mentioned segments:

South Korea Fluoroelastomer Market, By Type

- Fluorocarbon

- Fluorosilicone

- Perfluoroelastomer

South Korea Fluoroelastomer Market, By End-Use

- Automotive

- Aerospace

- Chemicals

- Oil & Gas

- Energy & Power

Need help to buy this report?