South Korea Fertilizer Catalyst Market Size, Share, and COVID-19 Impact Analysis, By Product (Iron Based and Nickel Based), By Process (Haber-Bosch Process, Urea Production, and Nitric Acid Production), and South Korea Fertilizer Catalyst Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Fertilizer Catalyst Market Insights Forecasts to 2035

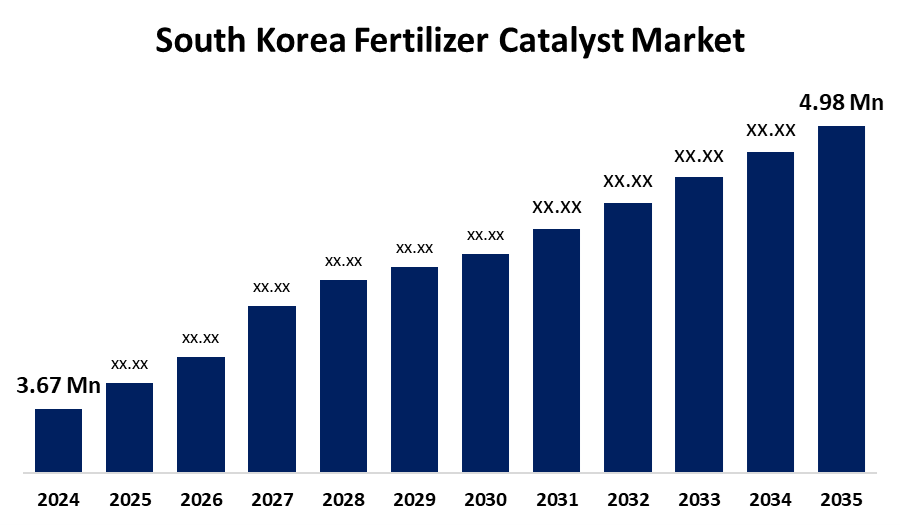

- The South Korea Fertilizer Catalyst Market Size Was Estimated at USD 3.67 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.81% from 2025 to 2035

- The South Korea Fertilizer Catalyst Market Size is Expected to Reach USD 4.98 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Fertilizer Catalyst Market Size is anticipated to reach USD 4.98 Million by 2035, Growing at a CAGR of 2.81% from 2025 to 2035. Enforcing more stringent environmental rules, the product innovation sought to reduce greenhouse gas emissions and improve process efficiency, both of which are critical.

Market Overview

The industry that produces and sells specific materials that improve fertilizer production efficiency and nutrient delivery to plants is included in the fertilizer catalyst market. In the process of making fertilizer, these catalysts speed up chemical reactions and enhance plant uptake of fertilizer ingredients, which eventually results in higher crop yields and less waste. In the process of making fertilizer, catalysts quicken chemical processes, increasing fertilizer yields and, as a result, crop yields. By reducing waste and losses during the production and application of fertilizer, catalysts can improve resource efficiency and lessen their negative effects on the environment. Catalysts that increase fertilizer efficiency and lower emissions are being developed and adopted as a result of growing knowledge of the environmental effects of fertilizer production and use. Better fertilizer production procedures are possible because to catalysts that are more effective, selective, and long-lasting, advancements in catalyst design and materials. Adoption of biofertilizers and balanced fertilizer use are two examples of initiatives aimed at advancing sustainable agriculture that are gaining momentum. The demand for catalysts that improve fertilizers' efficacy and environmental friendliness is indirectly increased by these initiatives.

Report Coverage

This research report categorizes the market for South Korea fertilizer catalyst market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea fertilizer catalyst market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea fertilizer catalyst market.

South Korea Fertilizer Catalyst Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.67 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 2.81% |

| 2035 Value Projection: | USD 4.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Process |

| Companies covered:: | OCI Company Ltd., Namhae Chemical Corporation, Kumho Petrochemical Co., Ltd., LG Chem, Ltd., Hanwha Corporation, KG Chemical Corporation, Lotte Chemical Corporation, Daeil Fertilizer Co., Ltd., Miwon Commercial Co., Ltd., KD Corporation, Ltd., Chemsteel Global Co., Ltd., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Catalysts optimizing nutrient efficiency to boost yields and ensure food security. Environmental pressures and sustainable agriculture trends are pushing the adoption of eco-conscious catalyst solutions. Technological innovations, including precision farming, nano-/bio-catalysts, and energy-efficient processes, are enhancing production efficacy and reducing emissions. Additionally, increasing government support and regulatory mandates favoring efficient, low-waste fertilizer production further stimulate market expansion

Restraining Factors

High initial costs and ongoing maintenance for advanced catalysts, especially those using precious metals, deter adoption among cost-sensitive manufacturers and small-scale farmers. Complex, varied environmental regulations and compliance burdens increase production costs and delays. Volatility in raw material prices disrupts supply chains and margins.

Market Segmentation

The South Korea fertilizer catalyst market share is classified into product and process.

- The iron-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea fertilizer catalyst market is segmented by product into iron based and nickel based. Among these, the iron-based segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its cost-effectiveness, high catalytic efficiency, and widespread use in ammonia production. The growing demand for nitrogen-based fertilizers and advancements in catalyst technologies.

- The haber-bosch process segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea fertilizer catalyst market is segmented by process into haber-bosch process, urea production, and nitric acid production. Among these, the haber-bosch process segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its critical role in large-scale ammonia production. Increasing agricultural demand for nitrogen fertilizers and ongoing improvements in energy-efficient catalyst systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea fertilizer catalyst market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OCI Company Ltd.

- Namhae Chemical Corporation

- Kumho Petrochemical Co., Ltd.

- LG Chem, Ltd.

- Hanwha Corporation

- KG Chemical Corporation

- Lotte Chemical Corporation

- Daeil Fertilizer Co., Ltd.

- Miwon Commercial Co., Ltd.

- KD Corporation, Ltd.

- Chemsteel Global Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea fertilizer catalyst market based on the below-mentioned segments:

South Korea Fertilizer Catalyst Market, By Product

- Iron Based

- Nickel Based

South Korea Fertilizer Catalyst Market, By Process

- Haber-Bosch Process

- Urea Production

- Nitric Acid Production

Need help to buy this report?