South Korea Ferro Alloys Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ferro-Manganese, Silico-Manganese, Ferro-Silicon, Ferro-Chrome, Ferro-Molybdenum, Ferro-Vanadium, Ferro-Tungsten, Magnesium Ferro-Silicon, Ferro-Silicon-Zirconium, Ferro-Titanium, Ferro-Boron, and Ferro-Niobium), By Application (Steel, Construction, Electronics, Automotive & Transportation, and Others), and South Korea Ferro Alloys Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Ferro Alloys Market Insights Forecasts to 2035

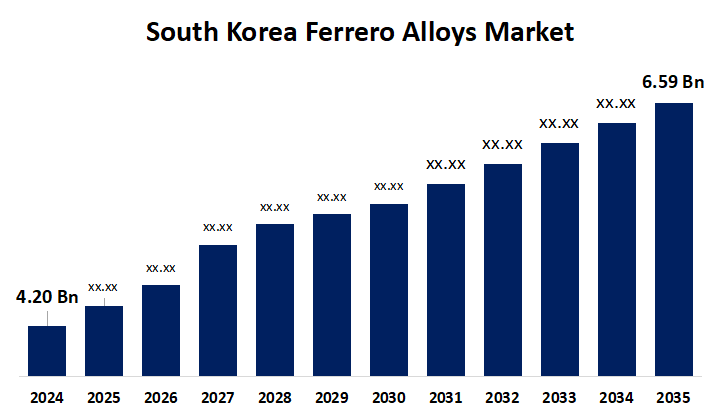

- The South Korea Ferro Alloys Market Size was estimated at USD 4.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.18% from 2025 to 2035

- The South Korea Ferro Alloys Market Size is Expected to Reach USD 6.59 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Ferro Alloys Market is anticipated to reach USD 6.59 billion by 2035, growing at a CAGR of 4.18% from 2025 to 2035. The demand for premium ferro alloys is rising as a result of technological developments in alloy production and rising demand from the renewable energy industry.

Market Overview

The South Korea ferro alloys market refers to the industry engaged in the manufacture, distribution, and use of ferro alloys metallic compounds used to improve the properties of steel and other alloys is referred to as the South Korean ferro alloys market. In the production of steel and other industrial applications, these materials such as ferro-silicon, silico-manganese, and ferro-manganese are crucial for enhancing strength, durability, and resistance to corrosion. Additionally, higher-grade alloys, which are essential for the manufacturing of complex components in these cutting-edge industries, are becoming more and more popular as the focus on electric vehicles and renewable energy sources grows. There are many opportunities for exploration in South Korea, especially given the growing demand for eco-friendly and sustainable materials. Moreover, to encourage businesses to invest in more ecologically friendly ferro alloy production techniques, the government is also funding research and development. This will lead to cleaner production processes. Suppliers of ferro alloys now have the chance to reach a new customer base that values sustainability by implementing eco-friendly procedures as a result of South Korea's reduction in carbon emissions. The market for ferro alloys in South Korea has seen changes in recent years, moving toward technological improvements in production and refinement.

Report Coverage

This research report categorizes the market for the South Korea ferro alloys market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea ferro alloys market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea ferro alloys market.

South Korea Ferro Alloys Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.20 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.18% |

| 2035 Value Projection: | USD 6.59 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Dongkuk Steel Mill Co., Ltd, Metal Tech Co., Ltd, Dong-A Special Co., Ltd., Taekyung Industrial Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The steel industry, one of the biggest users of ferro alloys, is driving the strong demand for ferro alloys in South Korea. South Korea is the sixth-largest producer of steel in the world, with about 70 million tons of crude steel produced in 2022. According to the Korean Iron and Steel Association, more infrastructure projects as part of the government's Green New Deal program are expected to drive an annual growth in domestic steel production of about 2%. The broader trend towards environmentally sustainable steel production, which increasingly uses ferro alloys to achieve desired properties, is reflected in this drive for improved infrastructure. As a result, the growing steel output will greatly support the ferro alloys market in South Korea, boosting market expansion overall.

Restraining Factors

The South Korea ferro alloys market faces several restraining factors that could hinder its growth. One major challenge is the volatility in raw material prices, particularly for manganese, chromium, and silicon, which affects production costs and pricing stability. Additionally, strict environmental regulations and rising pressure to adopt cleaner production methods increase operational burdens for manufacturers.

Market Segmentation

The South Korea ferro alloys market share is classified into product type and application.

- The silico-manganese segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea ferro alloys market is segmented by product type ferro-manganese, silico-manganese, ferro-silicon, ferro-chrome, ferro-molybdenum, ferro-vanadium, ferro-tungsten, magnesium ferro-silicon, ferro-silicon-zirconium, ferro-titanium, ferro-boron, ferro-niobium. Among these, the silico-manganese segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The main purpose of this alloy is to improve the strength and quality of steel products by adding silicon and manganese. It is made by smelting silica and high-carbon ferromanganese slag together.

- The steel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea ferro alloys market is segmented by application into steel, construction, electronics, automotive transportation, others. Among these, the steel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Ferro alloys are primarily consumed by the steel industry, which is the main driver of demand because it needs high-quality raw materials to improve steel production's performance and durability. This sector makes a substantial contribution to the country's economic activity because South Korea is one of the world's top producers of steel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea ferro alloys market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dongkuk Steel Mill Co., Ltd

- Metal Tech Co., Ltd

- Dong-A Special Co., Ltd.

- Taekyung Industrial Co., Ltd.

- Others

Recent Developments:

- In October 2022, The Directorate General of Trade Remedies (DGTR) of India launched a bilateral safeguard investigation on imports of ferro molybdenum from South Korea to determine whether the increase in this product was harming the domestic industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Ferro Alloys Market based on the below-mentioned segments:

- South Korea Ferro Alloys Market, By Product Type

- Ferro-Manganese

- Silico-Manganese

- Ferro-Silicon

- Ferro-Chrome

- Ferro-Molybdenum

- Ferro-Vanadium

- Ferro-Tungsten

- Magnesium Ferro-Silicon

- Ferro-Silicon-Zirconium

- Ferro-Titanium

- Ferro-Boron

- Ferro-Niobium

- South Korea Ferro Alloys Market, By Application

- Steel

- Construction

- Electronics

- Automotive Transportation

- Others

Need help to buy this report?