South Korea Energy Market Size, Share, and COVID-19 Impact Analysis, By Type (Coal, Oil, Gas, Renewables, Nuclear), By Application (Transport, Electric Power, Agriculture, Industrial, Others), and South Korea Energy Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerSouth Korea Energy Market Insights Forecasts to 2035

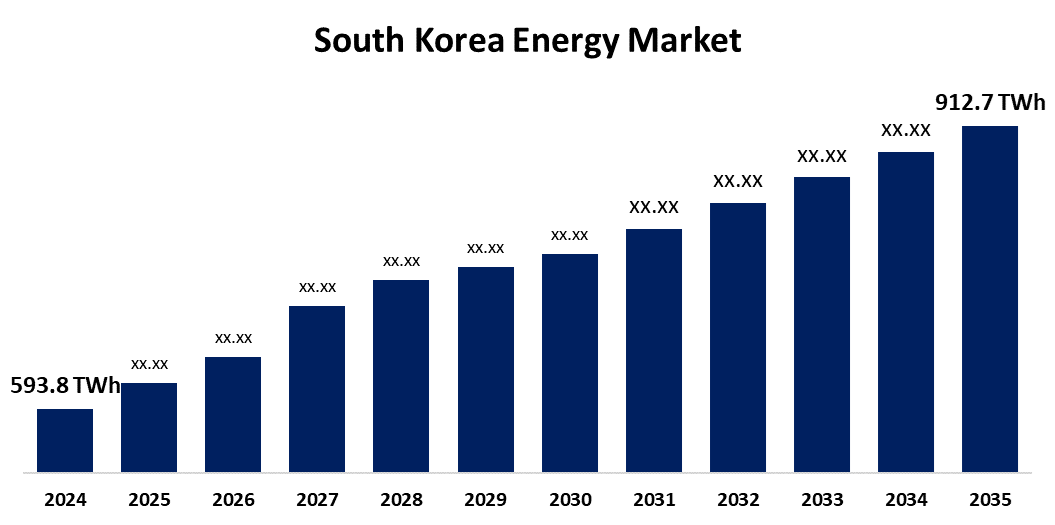

- The South Korea Energy Market Size Was Estimated at USD 593.8 TWh in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.99% from 2025 to 2035

- The South Korea Energy Market Size is Expected to Reach USD 912.7 TWh by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Energy Market Size is anticipated to reach USD 912.7 TWh by 2035, growing at a CAGR of 3.99% from 2025 to 2035. The market is expanding significantly due to the strong push for cleaner technologies, nuclear expansion, and renewable energy. Future investments and the nation's overall energy mix are being further shaped by policy changes, energy security objectives, and decarbonization initiatives.

Market Overview

The South Korea energy market encompasses the domestic production, distribution, and consumption of energy resources are all included in the South Korean energy market. A wide range of energy sources are used in it, such as nuclear power, renewable energy sources like solar, wind, and hydropower, and fossil fuels like coal, oil, and natural gas. Power generation facilities, transmission and distribution networks, and end-user consumption in the commercial, industrial, and residential sectors are all examples of the market's complex infrastructure. Additionally, the future of the South Korean energy market is being shaped by developments in energy technologies, including energy storage systems, smart grids, and energy management tools. These developments are intended to increase energy efficiency and make it easier for the grid to incorporate renewable energy sources. Moreover, the South Korean government has set aggressive targets to raise the proportion of renewable energy in its energy mix and lower greenhouse gas emissions.

Report Coverage

This research report categorizes the market for the South Korea energy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea energy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea energy market.

South Korea Energy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 593.8 TWh |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.99% |

| 2035 Value Projection: | USD 912.7 TWh |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Korea Electric Power Corporation (KEPCO), POSCO Energy Co. Ltd., Hanwha Q CELLS, Gridwiz Inc., S-Energy Co. Ltd. an others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea is speeding up its shift to renewable energy as part of a larger plan to cut carbon emissions and lessen reliance on fossil fuels. This change is reshaping the energy mix and investment landscape of South Korea and is the primary driver of the country's energy market growth. Incentives from the government are supporting solar and wind power more, and hydrogen is becoming a key component of the development of clean energy. Intermittent renewable energy integration is being supported by the rollout of infrastructure upgrades, including energy storage systems and smart grids. Greener alternatives are being adopted by utilities and private sector companies in response to the government's long-term carbon neutrality goals. Due to this momentum, large-scale renewable projects are receiving a substantial amount of foreign investment.

Restraining Factors

The growing proportion of renewable energy, particularly from offshore wind and solar projects, is difficult for the grid's current infrastructure to handle. Local resistance and regulatory obstacles frequently cause delays in transmission lines, resulting in longer project timelines.

Market Segmentation

The South Korea energy market share is classified into type and application.

- The coal segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea energy market is segmented by type into coal, oil, gas, renewables and nuclear. Among these, the coal segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The especially in the production of electricity. Coal still plays a major role because of its established infrastructure and affordability, even in spite of the nation's continuous efforts to diversify its energy mix.

- The electric power segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea energy market is segmented by application into transport, electric power, agricultural, industrial and others. Among these, the electric power segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the high demand for electricity in the commercial, industrial, and residential sectors. Despite continuous efforts to increase the capacity of renewable energy sources, the nation primarily depends on coal, natural gas, and nuclear power to generate electricity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea energy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korea Electric Power Corporation (KEPCO)

- POSCO Energy Co. Ltd.

- Hanwha Q CELLS

- Gridwiz Inc.

- S-Energy Co. Ltd.

- Others

Recent Developments:

- In March 2025, Recurrent Energy, alongside 3M Korea and local leaders, signed a Carbon Neutrality Agreement at the 2025 Capital Region Investment Roadshow. The partnership focused on developing a 200MW solar power plant in Naju City, promoting decarbonization, creating jobs, and advancing sustainable energy independence in South Korea.

- In August 2023, the new government reaffirmed its commitment to renewable energy growth, maintained nuclear power levels, and accelerated coal phase-outs. This shift was intended to reduce reliance on imported fossil fuels and enhance energy security.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Energy Market based on the below-mentioned segments:

South Korea Energy Market, By Type

- Coal

- Oil

- Gas

- Renewables

- Nuclear

South Korea Energy Market, By Application

- Transport

- Electric Power

- Agricultural

- Industrial

- Others

Need help to buy this report?