South Korea Endoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Type of Device (Endoscopes, Endoscopic Operative Devices, and Visualization Equipment), By Application (Gastroenterology, Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, Neurology, Urology, and Others), End User (Hospitals and Outpatient Facilities Segments) and South Korea Endoscopy Devices Market Insights Forecasts 2022 – 2032

Industry: HealthcareSouth Korea Endoscopy Devices Market Insights Forecasts to 2032

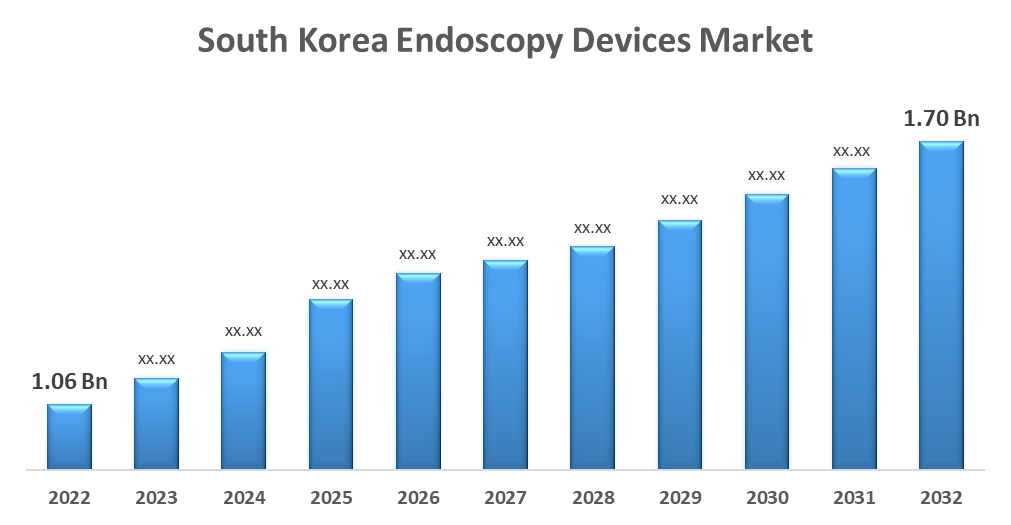

- The South Korean Endoscopy Devices Market Size was valued at USD 1.06 Billion in 2022.

- The Market Size is growing at a CAGR of 4.84% from 2022 to 2032.

- The South Korean Endoscopy Devices Market Size is expected to reach USD 1.70 Billion by 2032.

Get more details on this report -

The South Korea Endoscopy Devices Market Size is expected to reach USD 1.70 Billion by 2032, at a CAGR of 4.84% during the forecast period 2022 to 2032.

The growing demand for endoscopy devices in diagnostic and therapeutic procedures, as well as the growing use of endoscopes in surgical procedures such as arthroscopy, laparoscopy, and others is the most important factor driving the growth of the South Korean endoscopy devices market.

Market Overview

Endoscopy, or the use of an endoscope, is a medical procedure that allows doctors to examine the inside of the body. Endoscopes are typically made up of a long, thin tube that is inserted directly into the body to provide a detailed view of an internal organ or tissue. Endoscopy can also be used to perform a variety of other tasks, such as imaging and minor surgery. A cutting tool is attached to the end of the endoscope, which is then connected to the apparatus that will be used to perform the procedure. Endoscopy devices are equipped with a variety of additional components, such as a camera or light source at the tip of the endoscope, to help doctors or other medical professionals (endoscopists) examine the internal organs of interest during an examination. It performs procedures on more vulnerable patients, such as the elderly, as well as the treatment of more serious diseases, such as cancer. Endoscopic devices are used in a wide range of surgical fields, including gastroenterology, pulmonology, orthopedic surgery, and many others.

Report Coverage

This research report categorizes the market for South Korean endoscopy devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean endoscopy devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea endoscopy devices market.

South Korea Endoscopy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.06 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.84% |

| 2032 Value Projection: | USD 1.70 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type of Device, By Application, By End User |

| Companies covered:: | SUNGYONG MEDITECH, Karl Storz SE & Co. KG, Medex Worldwide, TECHCORD Co., Ltd., Fujifilm Holdings, PENTAX Medical, Olympus Corporation, Sometech, MENFIS KOREA, Endovision Co., Ltd., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased demand for endoscopic equipment in diagnostic and therapeutic procedures is the primary driver of growth in the endoscopy devices market. A growing desire for less invasive procedures is expected to fuel the market during the forecast period. Furthermore, R&D investment and technological advancement are expected to create lucrative opportunities for market participants. Furthermore, the growing preference among medical professionals for technologically advanced endoscopy devices equipped with high-definition cameras and light sources to assist physicians in analyzing internal organs of interest drives market growth.

Restraining Factors

Infections caused by a small number of endoscopes are expected to hinder market growth. Lack of skilled labor is a major challenge that could stymie market growth in the coming years; additionally, supply chain disruptions and changes in surgical procedure laws are among the issues that could stymie market growth.

Market Segment

- In 2022, the visualization equipment segment accounted for the largest revenue share over the forecast period.

Based on the type of devices, the South Korean endoscopy devices market is segmented into endoscopes, endoscopic operative devices, and visualization equipment. Among these, the visualization equipment segment has the largest revenue share over the forecast period. SD (standard definition) camera systems are used in both 2D and 3D endoscopic equipment. The first-generation endoscopic SD camera is made up of one or three chips and always outputs to a recording device or an analog display. Endoscopic cameras that use standard definition (SD) transmissions produce 4:3 aspect ratio images. These visualization systems employ charge-coupled device chips to generate a high-resolution image in SD format. Many technological advancements, such as complementary metal-oxide-semiconductor (CMOS) and CCD innovations, have resulted in minor chips that ease the endoscopic process and improve resolution.

- In 2022, the gynecology segment accounted for the largest revenue share over the forecast period.

Based on application, the South Korean endoscopy devices market is segmented into gastroenterology, orthopedic surgery, cardiology, ENT surgery, gynecology, neurology, urology, and others. Among these, the gynecology segment has the largest revenue share over the forecast period. One of the most common minimally invasive procedures for obtaining a clear view of the pelvic area is gynecologic laparoscopic surgery. The uterus, ovaries, and fallopian tubes can all be examined during a pelvic laparoscopy. These instruments are also used to remove fibroids, uteri, ovarian cysts, and lymph nodes, as well as to detect ovarian, uterine, and cervical cancer. As a result of the rising prevalence of gynecologic cancer, the market is expected to expand rapidly over the forecast period.

- In 2022, the outpatient facilities segment accounted for the largest revenue share over the forecast period.

Based on end users, the South Korean endoscopy devices market is segmented into hospitals and outpatient facilities segments. Among these, the outpatient facilities segment has the largest revenue share over the forecast period. Outpatient facilities such as ambulatory surgery centers and diagnostic clinics are expected to see profitable growth as a result of the growing preference for minimally invasive procedures to reduce overall costs and the number of days of hospital stays, which is expected to drive the segment's growth. Furthermore, shorter recovery times and less discomfort due to the use of less invasive keyhole endoscopic procedures accelerate the adoption of endoscopy devices in outpatient facilities, which is expected to propel segment growth over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea Endoscopy Devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SUNGYONG MEDITECH

- Karl Storz SE & Co. KG

- Medex Worldwide

- TECHCORD Co., Ltd.

- Fujifilm Holdings

- PENTAX Medical

- Olympus Corporation

- Sometech

- MENFIS KOREA

- Endovision Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, Boston Scientific agreed to buy the majority stake in M.I.Tech, a maker and distributor of non-vascular metal stents used in endoscopic and urologic procedures, from South Korean firm Synergy Innovation. Boston Scientific offered nearly 14,500 South Korean won (approximately USD 11) per M.I.Tech share, for a total price of 291.2 billion won (approximately USD 230 million).

- In February 2022, Mediintech, a Korean startup focused on developing smart endoscopes for the digestive system, raised 8 billion won (approximately USD 6.6 million) in Series A funding for its smart endoscope innovation from Atinum Investment, Smilegate Investment, and Future Play.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea Endoscopy Devices Market based on the below-mentioned segments:

South Korean Endoscopy Devices Market, By Device Type

- Endoscopes

- Endoscopic Operative Devices

- Visualization Equipment

South Korea Endoscopy Devices Market, By Application

- Gastroenterology

- Orthopedic Surgery

- Cardiology

- ENT Surgery

- Gynecology

- Neurology

- Urology

- Others

South Korea Endoscopy Devices Market, By End User

- Hospitals

- outpatient facilities segments

Need help to buy this report?