South Korea Edible Fungus Market Size, Share, and COVID-19 Impact Analysis, By Type (Shiitake, Oyster, Enoki, Black Fungus, and Others), By Category (Fresh, Dried, and Processed), and South Korea Edible Fungus Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesSouth Korea Edible Fungus Market Size Insights Forecasts to 2035

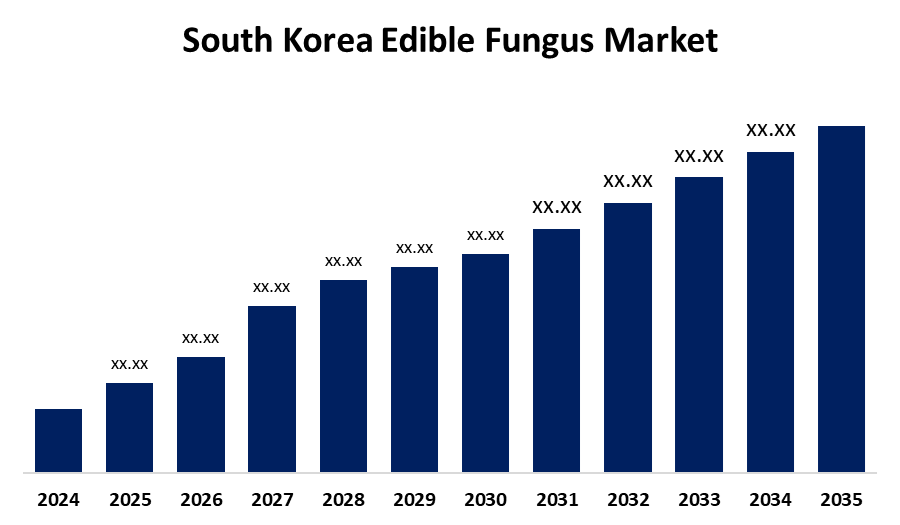

- The South Korea Edible Fungus Market size is Expected to Grow at a CAGR of around 5.8% from 2025 to 2035

- The South Korea Edible Fungus Market size is expected to hold a significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Edible Fungus Market Size is anticipated to grow at a CAGR of 5.8% from 2025 to 2035. The market is driven by rising health consciousness, demand for low-fat and high-fiber foods, and the growing use of mushrooms in both traditional Korean cuisine and modern plant-based diets and Expansion in urban farming and increased visibility in online and retail platforms are also supporting market accessibility and growth.

Market Overview

South Korea edible fungus market is experiencing a consistent growth fueled by growing demands for healthy, plant-based foods and rising culinary application of mushrooms and fungi in traditional and emerging cuisine. Shiitake, oyster, enoki, and black fungus are edible mushrooms that are widely utilized in Korean soups, stews, side dishes, and health meals. Their low-calorie, high-fiber, and immunity-enhancing qualities are also in line with the nation's growing adoption of functional food and nutrient food. Increased availability has also emerged with the growth in organic cultivation, indoor growing systems, and availability at retail store and online portal levels through supermarkets. Despite the market facing obstacles like perishability, seasonality in supply volatility, and price elasticity in higher varieties, the long-term demand is set to be driven by increasing vegetarian and flexitarian diets. Advances in drying, packing, and vertical farming technology are also facilitating broader consumption and efficient supply chains.

Report Coverage

This research report categorizes the market for the South Korea edible fungus market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea edible fungus market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea edible fungus market.

South Korea Edible Fungus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Category and COVID-19 Impact Analysis |

| Companies covered:: | CJ CheilJedang Corporation, Pulmuone Co., Ltd., Nonghyup Mushroom Farming Association, Namyang Mushroom Co., Ltd., Jeongwoo Mushroom Co., Ltd., Lotte Food Co., Ltd., Daesang Corporation, Samyang Food Co., Ltd., Dongwon F&B, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korean consumers are also adding edible mushrooms such as shiitake, enoki, and oyster mushrooms to their diets because of their nutritional benefits such as fiber, antioxidants, and immune system-strengthening phytochemicals. Growing demand of flexitarian and veg diets and the utilization of fungi in soups, stews, and vegetable alternatives are fueling market demand. Current growth patterns in the form of indoor and vertical farming provide year-round supply stability, and online and offline distribution provides consumers with plenty of room for fresh and processed variety.

Restraining Factors

Market penetration is constrained by perishable nature of living fungi, which necessitates cold-chain transport and contributes to distribution expense. Price sensitiveness of consumers constrains specialty or exotic product penetration. Further, restricted understanding of the nutritional values of non-conventional fungi and rivalry from other protein alternatives like tofu or legumes may influence wider utilization.

Market Segmentation

The South Korea Edible Fungus Market share is classified into type and category.

- The shiitake segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea edible fungus market is segmented by type into shiitake, oyster, enoki, black fungus, and others. Among these, the shiitake segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. It holds large market share due to its popularity for Korean food and established health benefits. Shiitake mushrooms are prized for their intense umami flavor, health benefits, and ease of preparation. They can be found fresh or dried and are widely utilized in broths, stews, and side dishes.

- The fresh segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea edible fungus market is segmented by category into fresh, dried, and processed. Among these, the fresh segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It dominates market due to customer preference for freshness, texture, and taste. Live mushrooms are extensively distributed across supermarkets, online retailers, and wet markets. The Dried segment is also on the upswing because of its longer shelf life, convenience, and use in medicines and specialty dishes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea edible fungus market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ CheilJedang Corporation

- Pulmuone Co., Ltd.

- Nonghyup Mushroom Farming Association

- Namyang Mushroom Co., Ltd.

- Jeongwoo Mushroom Co., Ltd.

- Lotte Food Co., Ltd.

- Daesang Corporation

- Samyang Food Co., Ltd.

- Dongwon F&B

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea edible fungus market based on the below-mentioned segments:

South Korea Edible Fungus Market, By Type

- Shiitake

- Oyster

- Enoki

- Black Fungus

- Others

South Korea Edible Fungus Market, By Category

- Fresh

- Dried

- Processed

Need help to buy this report?