South Korea E-Invoicing Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (Cloud-based and On-premises), By Channel (B2B, B2C, and Others), and South Korea E-Invoicing Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologySouth Korea E-Invoicing Market Insights Forecasts to 2035

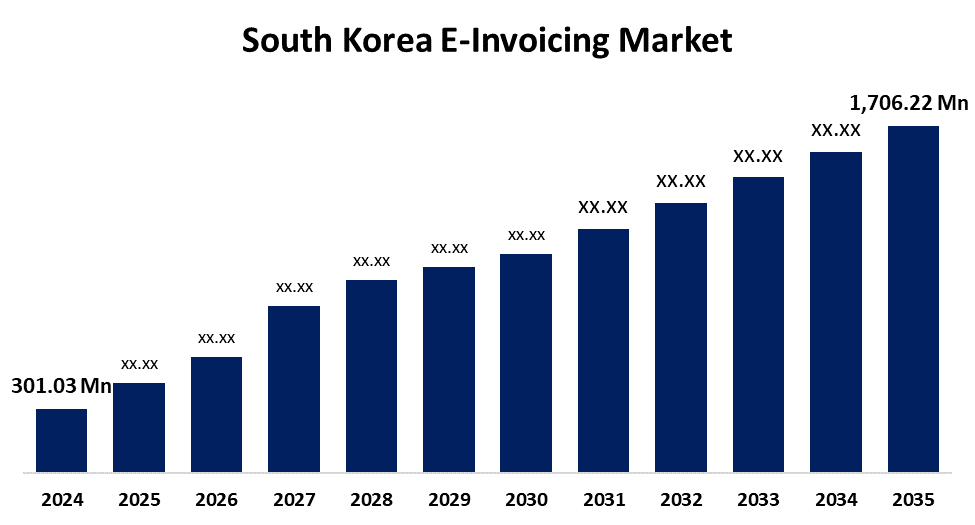

- The South Korea E-Invoicing Market Size was estimated at USD 301.03 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.08% from 2025 to 2035

- The South Korea E-Invoicing Market Size is Expected to Reach USD 1,706.22 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea E-Invoicing Market Size is anticipated to reach USD 1,706.22 Million by 2035, growing at a CAGR of 17.08% from 2025 to 2035. The market share of e-invoicing in South Korea is influenced by a number of factors, including the need for real-time tax reporting, the digital transformation of finance, mandatory adoption by tax authorities, and robust internet infrastructure. Government incentives and the widespread use of enterprise software promote automation and compliance in businesses.

Market Overview

The South Korea e-invoicing market refers to the ecosystem of online platforms, legal frameworks, and service providers that make it possible to electronically issue, transmit, and store VAT invoices in accordance with NTS regulations is known as the South Korean e-invoicing market. Additionally, E-invoicing is becoming more than just a compliance tool in South Korea. These systems are currently being used by businesses to manage cash flow, expedite payments, and integrate with new fintech services. With integrated finance options, e-invoice data feeds straight into payment gateways, enabling suppliers to receive payments more quickly. Further, lenders are providing short-term credit to small suppliers with little borrowing history by using invoice data. These services eliminate the need to switch between apps by frequently being integrated into the e-invoicing interface itself. Targeting mid-market companies seeking greater working capital visibility, some Korean fintech startups have begun combining e-invoicing with AR/AP automation, credit scoring, and invoice factoring. Banks are also getting involved in this market by collaborating with software companies to collect invoice data at an early stage of the transaction cycle. Originally a legal necessity, this is now a gateway to more extensive digital finance. The distinction between digital banking tools and e-invoicing platforms is becoming increasingly hazy as integration gets better. The competition between banks, tech firms, and ERP vendors is changing as a result of this change.

Report Coverage

This research report categorizes the market for the South Korea e-invoicing market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea e-invoicing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea e-invoicing market.

South Korea E-Invoicing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 301.03 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.08% |

| 2035 Value Projection: | USD 1,706.22 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment Type, By Channel |

| Companies covered:: | Douzone Bizon, Webcash, Korea Electronic Certification Authority, Raonsecure, EDICOM Korea, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of e-invoicing has increased dramatically in South Korea due to the country's push for digital tax administration. Government mandates caused large companies to be early adopters, but as regulators increase enforcement, smaller businesses are now catching up. Real-time invoice reporting is becoming standard, and the National Tax Service (NTS) has been investing in sophisticated auditing tools. Businesses are under pressure to update their internal systems as a result. E-invoicing features are now standard on ERPs and accounting platforms, frequently tailored to Korean tax regulations. As automation takes care of more of the repetitive work, accountants and tax consultants are also refocusing their attention from filing and reconciliation duties to advisory work. Demand for cloud-based platforms in local languages that adhere to Korea's unique legal frameworks and data retention regulations has clearly increased. Although local providers currently hold a dominant market, foreign SaaS companies are starting to enter the market with modules tailored to Korea. South Korea is one of Asia's fastest-maturing markets for digital invoicing due to its clear regulations, stiff penalties for non-compliance, and tech-savvy populace. The growth of the South Korean e-invoicing market is being accelerated by these factors.

Restraining Factors

E-invoicing systems must remain up to date due to frequent regulatory updates from the National Tax Service (NTS). It can be time-consuming and technically difficult for companies without dedicated IT teams to stay on top of these changes, which frequently leads to compliance gaps or delayed reporting.

Market Segmentation

The South Korea e-invoicing market share is classified into deployment type and channel.

- The cloud-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea e-invoicing market is segmented by deployment type into cloud-based and on-premises. Among these, the cloud-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. South Korean cloud-based e-invoicing platforms are able to promptly adapt their systems to the National Tax Service's (NTS) requirements, including new reporting formats or due dates. In contrast to on-premises solutions, which necessitate more manual intervention and longer update cycles, they are more dependable and compliant due to their flexibility.

- The B2B segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea e-invoicing market is segmented by channel into B2B, B2C, and others. Among these, the B2B segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. B2B transactions, such as monthly supplier invoices or expensive bulk orders, frequently take place on a regular basis and in significant quantities. Handling these by hand would be laborious and prone to mistakes. E-invoicing streamlines workflows throughout intricate supply chains, improves accuracy, and cuts down on delays.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea e-invoicing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Douzone Bizon

- Webcash

- Korea Electronic Certification Authority

- Raonsecure

- EDICOM Korea

- Others

Recent Developments:

- In April 2025, South Korea continued expanding its e-Tax Invoice system, which was first launched in 2011. The latest update, which took effect in July 2023, required businesses earning over KRW 100 million to issue electronic VAT invoices via the National Tax Service. Initially, the system targeted large firms, but its scope steadily widened through phased thresholds in 2012, 2014, 2019, and 2022. These measures aimed to streamline reporting and reduce tax fraud

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea E-Invoicing Market based on the below-mentioned segments:

South Korea E-Invoicing Market, By Deployment Type

- Cloud-based

- On-premises

South Korea E-Invoicing Market, By Channel

- B2B

- B2C

- Others

Need help to buy this report?