South Korea Dry Beer Market Size, Share, and COVID-19 Impact Analysis, By Type (Lager, Ale, Stout, Pilsner, and Wheat Beer), By Packaging Type (Cans, Bottles, Kegs, Draft, and Growlers), and South Korea Dry Beer Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesSouth Korea Dry Beer Market Size Insights Forecasts to 2035

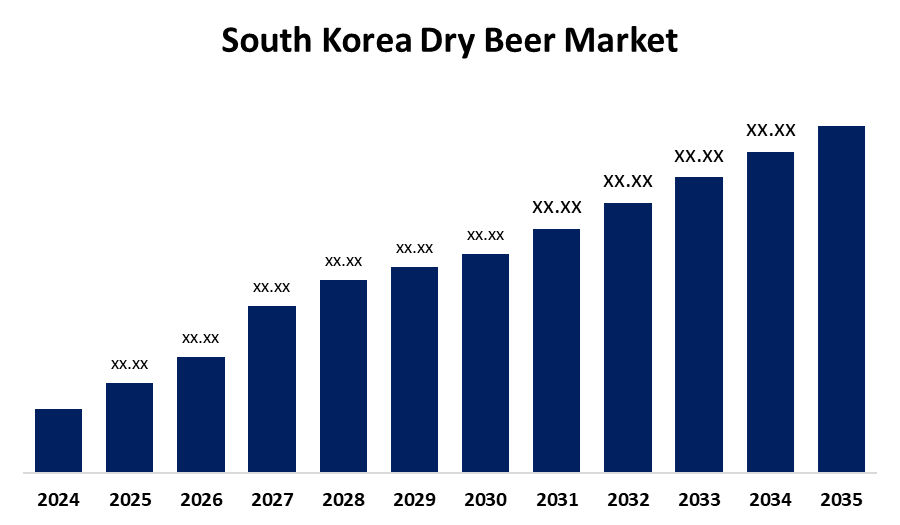

- The South Korea Dry Beer Market size is Expected to Grow at a CAGR of around 7.1% from 2025 to 2035

- The South Korea Dry Beer Market size is expected to hold a significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Dry Beer Market Size is anticipated to grow at a CAGR of 7.1% from 2025 to 2035. The market is driven by shifting consumer preferences toward lighter, low-sugar alcoholic beverages, rising health awareness, and increased demand for convenient packaging formats like cans and bottles.

Market Overview

South Korea's dry beer market is witnessing consistent growth, driven by consumer demand for fewer sugars, crisper, and lighter alcoholic drinks. Dry beer, which has a clean finish and crisp taste, is winning over health-focused millennials and Gen Z shoppers. The trend also finds support from the success of Japanese dry beers, which have developed a good following in the country. Local breweries are fighting back with new product introductions, such as dry versions of lager, pilsner, and even craft beer. The market is also enhanced by widening retail networks, such as off-trade sectors such as convenience stores and internet sales contributing significantly to product availability. On-trade consumption in pubs and restaurants remains strong, particularly in city centers. Competition from other alcoholic drinks, taxation, and regulatory controls are the menaces that remain. In spite of all these, the dry beer category is still setting a solid footing in South Korea's lively beverage drinking culture.

Report Coverage

This research report categorizes the market for the South Korea dry beer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea dry beer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea dry beer market.

South Korea Dry Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 186 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Packaging Type and COVID-19 Impact Analysis |

| Companies covered:: | Oriental Brewery Co., Ltd. (OB), HiteJinro Co., Ltd., Lotte Chilsung Beverage Co., Ltd., The Booth Brewing Co., Jeju Beer Company, Asahi Group Holdings, Kirin Holdings Company, Limited, Heineken Korea, AB InBev Korea, Sapporo Holdings Limited, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean dry beer market is driven by changing consumer trends towards lighter, crisper, and less-sugar alcoholic beverages because of rising health awareness and lifestyle demands. Increased demand comes from the popularity of Japanese dry beer and expanding youth market with a desire for premium but moderate drinking patterns. Convenience packaging, particularly for cans and bottles, and growing availability in off-trade channels such as online and convenience stores also drive the market forward. The breweries are also changing to stay in sync with these developments.

Restraining Factors

The South Korean dry beer market faces restraints such as high competition from soju and flavor liquor, traditional alcoholic drinks. Excessive taxation on alcohol and stringent advertisement regulations restricts market penetration. On top of that, restricted awareness among consumers of other dry beer types apart from lager and resistance by traditional consumers could hamper the uptake of styles such as dry stout or wheat beer.

Market Segmentation

The South Korea Dry Beer Market share is classified into type and packaging type.

- The lager segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea dry beer market is segmented by type into lager, ale, stout, pilsner, and wheat beer. Among these, the lager segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.It holds large share as lager is best characterized by dry beer descriptors like fresh finish, clean and low residual sugars, and is thus extremely attractive to the mass market. Its extensive distribution, economy, and association with regular consumption contribute to further popularity. In contrast, pilsner and ale styles are gaining traction, especially among youth and enthusiasts, while wheat beer and stout are niches but experiencing gradual evolution with craft-inspired innovation.

- The cans segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea dry beer market is segmented by packaging type into cans, bottles, kegs, draft, and growlers. Among these, the cans segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cans hold dominant share due their convenience, affordability, and capability of conforming to single-serve consumption habits particularly with urban millennials and Gen Z. Bottles are still strong among upscale brands, draft and kegs stay in the restaurants and bars, and growlers are of interest to a niche but loyally committed group of craft beer consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea dry beer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oriental Brewery Co., Ltd. (OB)

- HiteJinro Co., Ltd.

- Lotte Chilsung Beverage Co., Ltd.

- The Booth Brewing Co.

- Jeju Beer Company

- Asahi Group Holdings

- Kirin Holdings Company, Limited

- Heineken Korea

- AB InBev Korea

- Sapporo Holdings Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea dry beer market based on the below-mentioned segments:

South Korea Dry Beer Market, By Type

-

·Lager

-

·Ale

-

·Stout

-

·Pilsner

-

·Wheat Beer

South Korea Dry Beer Market, By Packaging Type

-

·Cans

-

·Bottles

-

·Kegs

-

·DraftGrowlers

Need help to buy this report?