South Korea Domestic CEP Market Size, Share, and COVID-19 Impact Analysis, By Business Model (Business-to-Business (B2B), Business-to-Customer (B2C), Customer-to-Customer (C2C)), By End User (Services, Wholesale & Retail Trade, Healthcare, Industrial Manufacturing, Others), and South Korea Domestic CEP Market Insights Forecasts to 2032

Industry: Consumer GoodsSouth Korea Domestic CEP Market Size Insights Forecasts to 2032

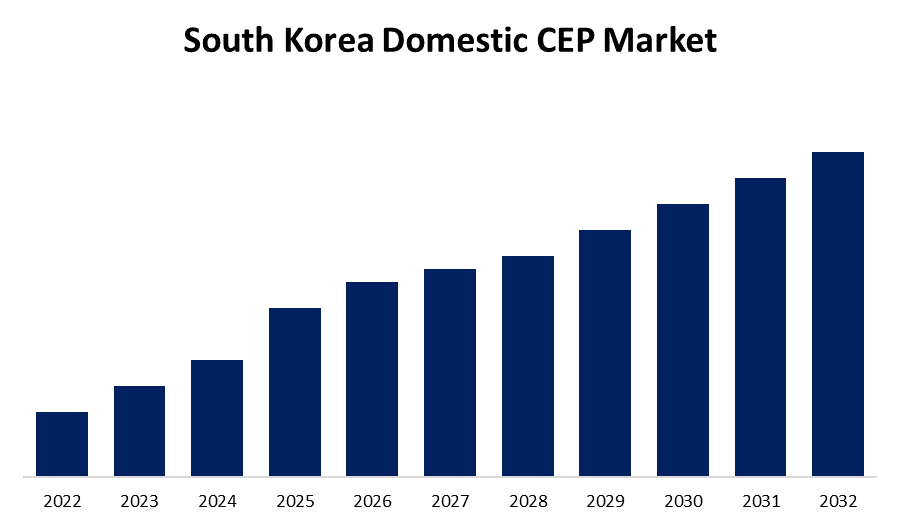

- The Market Size is Growing at a CAGR of 9.74% from 2022 to 2032.

- The South Korea Domestic CEP Market Size is Expected to Hold a Significant Share by 2032.

Get more details on this report -

The South Korea Domestic CEP Market Size is expected to hold significant share by 2032, at a CAGR of 9.74% during the forecast period 2022 to 2032.

Market Overview

The term CEP describes domestic courier, express, and parcel services that include the delivery and transportation of products inside national borders. Sorting centres, logistics networks, delivery trucks, and tracking systems are just a few of its components. Secure delivery, multiple delivery options, and real-time tracking are just a few of the features that domestic CEP provides. It finds use in a variety of industries, including manufacturing, retail, food and beverage (F&B), e-commerce, and healthcare. Furthermore, domestic CEP demand is increasing due to South Korea's burgeoning e-commerce industry, which is propelling market growth. The market is expanding as a result of the cutting-edge logistics and transportation infrastructure developing quickly, which makes it easier for CEP operations to run smoothly. In addition, the market is expanding due to rising urbanization and the founding of new cities in South Korea, which are expanding the opportunities for domestic courier services. Moreover, the growing E-commerce sector is a major driver influencing the growth of the market in South Korea. The E-commerce sector is leading to an increase in business opportunities for transporting goods and products. The increase in Courier, Express and Parcel (CEP) market growth is estimated majorly in developing countries owing to the increase in international trade across cities, the rise in internet-based services, and the growing number of smartphones among users.

Report Coverage

This research report categorizes the market for South Korea domestic CEP market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea domestic CEP market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South Korea domestic CEP market.

South Korea Domestic CEP Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022 to 2032. |

| Forecast Period CAGR 2022 to 2032. : | 9.74% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Business Model, By End User, and COVID-19 Impact Analysis |

| Companies covered:: | CJ Logistics, Nippon Express, Seko Logistics, Lotte Global Logistics, Hanjin Express, Aramex, CH Robinson, DB Schenker, SF International, FedEx, Korea Post, Linex Solutions, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding as a result of the increasing use of artificial intelligence (AI), machine learning (ML), and data analytics, which improve operational efficiency and route planning. The South Korea market is growing because of the growing number of local businesses that are selling their products nationally, which is driving up demand for domestic delivery services. In addition, the market is expanding more quickly due to the adoption of advantageous government policies and incentives that support safe and effective transportation and logistics services. Another factor driving market growth is the increasing incorporation of CEP services into the business models of small and medium-sized enterprises (SMEs) to increase their market penetration.

Restraining Factors

Inefficiency caused by a lack of proper infrastructure and technology may limit the market growth. Also, while courier services may be cost-effective for small parcels, they might become expensive for larger or heavier shipments due to weight or size restrictions.

Market Segment

- In 2022, the business-to-business (B2B) segment accounted for the largest revenue share over the forecast period.

Based on the business model, the South Korea domestic CEP market is segmented into business-to-business (B2B), business-to-customer (B2C), and customer-to-customer (C2C). Among these, the business-to-business (B2B) segment has the largest revenue share over the forecast period. the rise in international e-commerce sales and online shopping. The increase in product and goods trade between various organizations worldwide is expected to fuel growth in the business-to-business segment.

- In 2022, the wholesale & retail segment accounted for the largest revenue share over the forecast period.

Based on end users, the South Korea domestic CEP market is segmented into services, wholesale & retail trade, healthcare, industrial manufacturing, and others. Among these, the wholesale & retail segment has the largest revenue share over the forecast period. The retail or wholesale company can have products available to customers when they need them, whether it is to replenish an out-of-stock item or to quickly replace a mis-shipped order. So, the wholesale& retail sector specializes in getting products on time.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea domestic CEP market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ Logistics

- Nippon Express

- Seko Logistics

- Lotte Global Logistics

- Hanjin Express

- Aramex

- CH Robinson

- DB Schenker

- SF International

- FedEx

- Korea Post

- Linex Solutions

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, CJ Logistics signed a business agreement with IGAWorks, a big data platform company, to establish a data cooperative relationship between the two. To increase the value of the data involved, CJ Logistics plans to combine it with external data, such as consumer profile data and big data generated by its delivery service.

Market Segment

This study forecasts regional and country revenue from 2021 to 2032. Spherical Insights has segmented the South Korea domestic CEP market based on the below-mentioned segments:

South Korea Domestic CEP Market, By Business Model

- Business-to-Business (B2B)

- Business-to-Customer (B2C)

- Customer-to-Customer (C2C)

South Korea Domestic CEP Market, By End User

- Services

- Wholesale & Retail Trade

- Healthcare

- Industrial Manufacturing

- Others

Need help to buy this report?