South Korea Digital Payment Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Services), By Deployment Model (SaaS, PaaS, and On-Premise), and South Korea Digital Payment Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Digital Payment Market Insights Forecasts to 2035

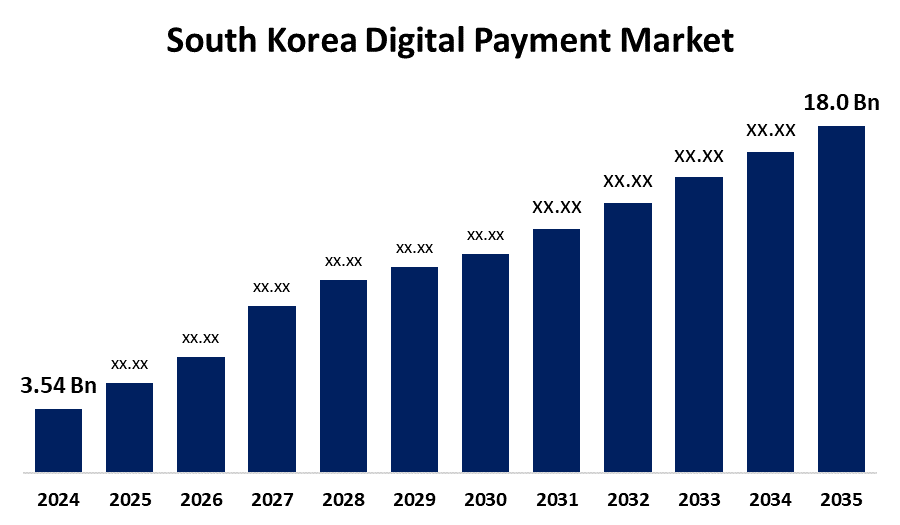

- The South Korea Digital Payment Market Size was Estimated at USD 3.54 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.93% from 2025 to 2035

- The South Korea Digital Payment Market Size is Expected to Reach USD 18.0 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Digital Payment Market Size is anticipated to reach USD 18.0 Billion by 2035, growing at a CAGR of 15.93% from 2025 to 2035. The increasing popularity of smartphones, government programs encouraging cashless transactions, and growing customer demand for contactless, safe, and convenient payment methods particularly in the retail and e-commerce industries are the main drivers of this growth.

Market Overview

The digital payment market in South Korea is the collection of platforms, services, and technologies that make it possible to conduct financial transactions electronically through digital channels, such as contactless cards, online banking, mobile wallets, and QR code payments. It includes business and consumer transactions carried out online or through mobile devices, facilitated by fintech advancements, legal frameworks, and the prevalence of smartphones and the internet. The market offers goods and services used in industries like retail, e-commerce, healthcare, and entertainment with the goal of lowering cash dependence and improving payment effectiveness. Additionally, Consumers now have an easier time making purchases with the adoption of increasingly complex digital payment solutions by major e-commerce players like Coupang and market. The digital payment market is poised for significant expansion in the upcoming years due to the increasing corporate focus on improving the customer experience through speedy and secure payment methods. Moreover, Businesses should focus on enhancing cross-border payment solutions or expanding their services to underbanked populations in order to meet the demands of a globalized market. Recent trends also indicate a strong focus on security and privacy as consumers become more aware of the risks associated with online transactions.

Report Coverage

This research report categorizes the market for the South Korea digital payment market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea digital payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea digital payment market.

South Korea Digital Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.54 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.93% |

| 2035 Value Projection: | USD 18.0 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 173 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component and By Deployment Model |

| Companies covered:: | Payple, CyrexPay, PayGate, SmilePay, Samsung Pay, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea's digital payments market is growing rapidly as a result of a combination of consumer preferences, government initiatives, and technology advancements. Given that a sizable portion of the populace actively uses mobile applications for transactions, the rapid adoption of smartphones and internet connectivity provides a crucial basis for digital payments. The government has implemented favorable regulations to encourage cashless transactions and the use of digital platforms as part of its efforts to reduce the economy's reliance on cash. A key driver of the market is consumers' increasing demand for convenience, as evidenced by their growing use of digital wallets and QR code payments for everyday transactions. Incorporating cutting-edge technologies like biometric authentication, AI-powered fraud detection, and smooth app-based interfaces is also improving user experience and trust, hastening the transition to a fully digital payment ecosystem.

Restraining Factors

Digital payment platforms are particularly vulnerable to cyberattacks such as phishing, hacking, and data breaches because they handle private and sensitive financial information. These dangers erode user confidence and have the potential to cause monetary losses, identity theft, and harm to one's reputation. Because of this, some customers and companies are still reluctant to embrace or increase their use of digital payment systems.

Market Segmentation

The South Korea digital payment market share is classified into component and deployment model.

- The solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea digital payment market is segmented by component into solution and services. Among these, the solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Solutions component is crucial and includes technologies that improve user experience and transaction efficiency, such as contactless payment systems, online payment gateways, and mobile wallets. since South Korea is still at the forefront of technological development, the government's efforts to support the digital economy are driving up demand for creative payment solutions.

- The SaaS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea digital payment market is segmented by deployment model into SaaS, PaaS, and on-premise. Among these, the SaaS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The SaaS model stands out in particular because it makes scalability and accessibility simple, which appeals to companies that want to quickly adjust to shifting customer preferences.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea digital payment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Payple

- CyrexPay

- PayGate

- SmilePay

- Samsung Pay

- Others

Recent Developments:

- In July 2025, South Korea had announced a sweeping new initiative to provide direct cash payments to its citizens, marking one of the most significant economic stimulus measures in the country’s recent history. The plan had come as South Korea faced mounting economic headwinds, including sluggish growth, persistent inflation, and concerns over consumer confidence

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Digital Payment Market based on the below-mentioned segments:

South Korea Digital Payment Market, By component

- Solution

- Services

South Korea Digital Payment Market, By Deployment Model

- SaaS

- PaaS

- On-Premise

Need help to buy this report?