South Korea Digital Freight Brokerage Market Size, Share, and COVID-19 Impact Analysis, By Transportation Mode (Road Freight and Rail Freight), By Service Type (Full-Truckload (FTL) Brokerage and Refrigerated Freight (Temp-Controlled)), By Customer Type (Business-To-Business (B2B) and Business-To-Consumer (B2C)), By End-User Industry (Retail & E-Commerce, Manufacturing, Automotive, Food & Beverages, Healthcare & Pharmaceuticals, Oil & Gas, and Others), and South Korea Digital Freight Brokerage Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea Digital Freight Brokerage Market Insights Forecasts to 2035

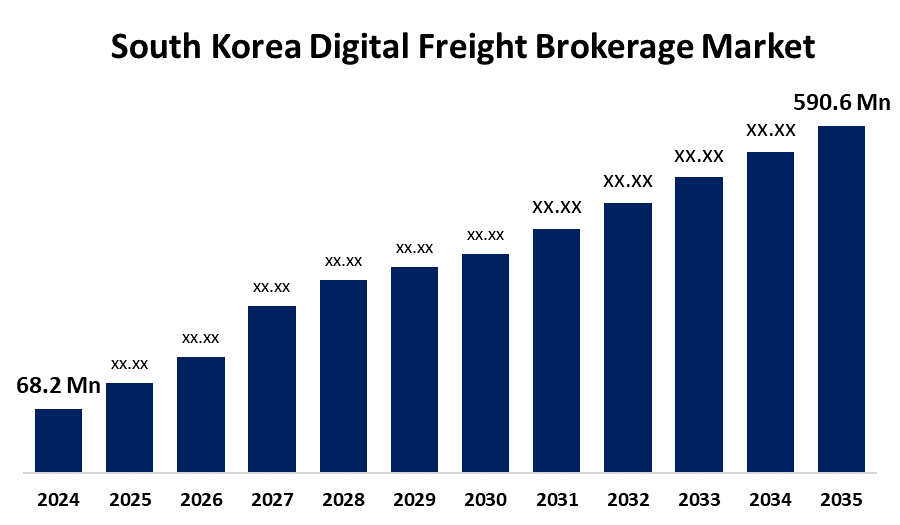

- The South Korea Digital Freight Brokerage Market Size Was Estimated at USD 68.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.68% from 2025 to 2035

- The South Korea Digital Freight Brokerage Market Size is Expected to Reach USD 590.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Digital Freight Brokerage Market is anticipated to reach USD 590.6 Million by 2035, growing at a CAGR of 21.68% from 2025 to 2035. Traditional freight brokerage has a number of issues, including capacity limitations, erratic pricing swings, inefficiencies brought on by manual procedures, and a lack of real-time tracking. Businesses are concentrating on digital freight brokerage solutions by utilizing automation, artificial intelligence, and real-time data analytics to get beyond these obstacles.

Market Overview

The process of connecting shippers and carriers through online platforms and technology to expedite the matching of freight demand with available capacity is known as "digital freight brokerage." It uses automation and digital tools to increase the transportation and logistics sector's productivity, cost-effectiveness, and transparency. Check calls and emails are less necessary because of digital technologies that offer real-time shipment tracking. Fast and effective freight quote production and booking are made possible by automated systems. Automation reduces manual labor by streamlining processes like communication and documentation. Digital platforms increase overall operational efficiency by streamlining human labor-intensive tasks like booking, tracking, and payment. Blockchain technology, data analytics, and real-time tracking provide more insight into shipping status, boosting confidence and cutting down on delays. Digital platforms can lower fuel use and optimize routes, which is in line with the increased focus on environmentally friendly logistics techniques. To increase efficiency, increase transparency, and streamline operations in the freight brokerage sector, governments are aggressively promoting the use of digital freight platforms and technologies. To build a strong and effective logistics ecosystem, investments in digital integration, multimodal connectivity, and port modernization are essential.

Report Coverage

This research report categorizes the market for South Korea digital freight brokerage market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea digital freight brokerage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea digital freight brokerage market.

South Korea Digital Freight Brokerage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 68.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.68% |

| 2035 Value Projection: | USD 590.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Transportation Mode, By Service Type, By Customer Type and COVID-19 Impact Analysis |

| Companies covered:: | CJ Logistics, LX Pantos, Samsung SDS, KTNET, MeshKorea, DOHANDS, ZIM Solution Co. Ltd., valuelinku, Lordam International, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing adoption of smartphones and mobile applications among shippers and carriers has enhanced operational efficiency, enabling on-demand carrier matching and price transparency. Technological advancements, such as artificial intelligence and machine learning, facilitate real-time shipment tracking, dynamic pricing, and optimized routing, leading to cost reductions and improved customer satisfaction. Additionally, the surge in e-commerce has heightened demand for faster and more efficient logistics solutions, further propelling the market's expansion

Restraining Factors

High initial investment costs and the need for technological infrastructure can be prohibitive, especially for small and medium-sized enterprises. Resistance to adopting new technologies within the traditional logistics sector further complicates integration. Additionally, regulatory complexities and compliance requirements add operational burdens, while cybersecurity risks and data privacy concerns threaten the security and trustworthiness of digital platforms.

Market Segmentation

The South Korea digital freight brokerage market share is classified into transportation mode, service type, customer type, and end-user industry.

- The road freight segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea digital freight brokerage market is segmented by transportation mode into road freight and rail freight. Among these, the road freight segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The movement of products on highways and road networks by trucks and other vehicles is referred to as road freight. Road freight is utilized for cross-border trade, last-mile deliveries, and both short- and long-haul cargo.

- The full-truckload (FTL) brokerage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea digital freight brokerage market is segmented by service type into full-truckload (FTL) brokerage and refrigerated freight (temp-controlled). Among these, the full-truckload (FTL) brokerage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. FTL shipping occurs when a single consignment fills a truck or trailer. In contrast to less-than-truckload (LTL) shipping, full-truckload (FTL) freight brokerage connects shippers and carriers to convey items that fill an entire truck, providing direct delivery and perhaps quicker travel times.

- The business-to-business (B2B) segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea digital freight brokerage market is segmented by customer type into business-to-business (B2B) and business-to-consumer (B2C). Among these, the business-to-business (B2B) segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. The movement of commodities and products between companies, wholesalers, manufacturers, and distributors is referred to as business-to-business (B2B) freight. Large-scale, high-volume exports were its primary focus. Shipments of equipment to other companies finished goods to warehouses, or raw materials to factories are a few examples. In sectors like manufacturing, automotive, and industrial goods, it is crucial.

- The retail & e-commerce segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea digital freight brokerage market is segmented by end-user industry into retail & e-commerce, manufacturing, automotive, food & beverages, healthcare & pharmaceuticals, oil & gas, and others. Among these, the retail & e-commerce segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period. With the increased demand for effective and adaptable logistics solutions brought about by the growth of online retail and e-commerce, digital freight brokerage is a useful tool for these sectors. Freight services supporting both online and physical retail supply chains are part of the retail & e-commerce market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea digital freight brokerage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ Logistics

- LX Pantos

- Samsung SDS

- KTNET

- MeshKorea

- DOHANDS

- ZIM Solution Co. Ltd.

- valuelinku

- Lordam International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea digital freight brokerage market based on the below-mentioned segments:

South Korea Digital Freight Brokerage Market, By Transportation Mode

- Road Freight

- Rail Freight

South Korea Digital Freight Brokerage Market, By Service Type

- Full-Truckload (FTL) Brokerage

- Refrigerated Freight (Temp-Controlled)

South Korea Digital Freight Brokerage Market, By Customer Type

- Business-To-Business (B2B)

- Business-To-Consumer (B2C)

South Korea Digital Freight Brokerage Market, By End-User Industry

- Retail & E-Commerce, Manufacturing

- Automotive

- Food & Beverages

- Healthcare & Pharmaceuticals

- Oil & Gas

- Others

Need help to buy this report?