South Korea Diaper Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Baby Diaper (Disposable Diapers, Training Diapers, Cloth Diapers, Swim Pants, and Biodegradable Diapers), Adult Diaper (Pad Type, Flat Type, and Pant Type)), By Distribution Channel (Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, and Others), and South Korea Diaper Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSouth Korea Diaper Market Insights Forecasts to 2035

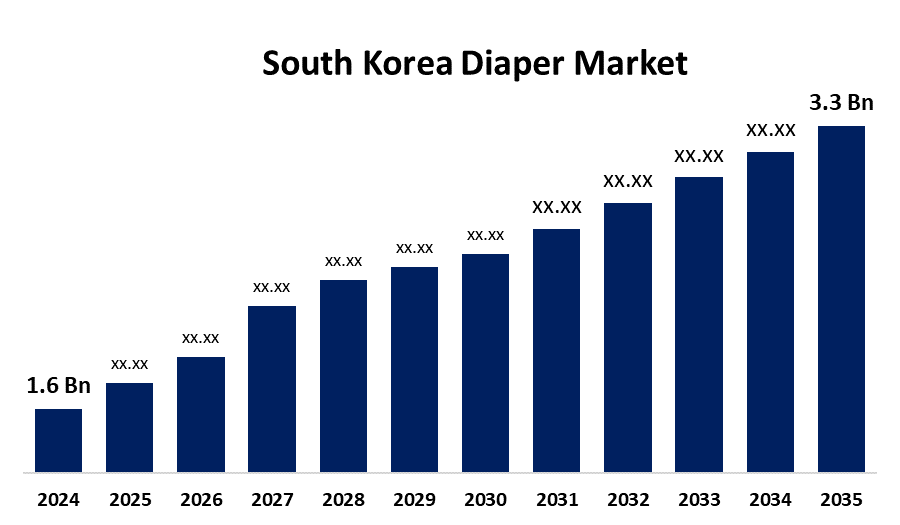

- The South Korea Diaper Market Size was estimated at USD 1.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.80% from 2025 to 2035

- The South Korea Diaper Market Size is Expected to Reach USD 3.3 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Diaper Market is anticipated to reach USD 3.3 billion by 2035, growing at a CAGR of 6.80% from 2025 to 2035. The market is being driven by the ongoing advancements in diaper technology, which have produced diapers with enhanced qualities like increased absorbency, breathability, and skin-friendly materials.

Market Overview

The South Korea diaper market encompasses the production, distribution, and consumption of absorbent clothing for both adults and infants are all included in the South Korean diaper market. These products are crucial for preserving comfort and hygiene, especially for young children or populations with restricted mobility. The market offers a wide variety of goods to meet the needs and tastes of different customers. Additionally, customers who care about the environment are being drawn to the continuous developments in diaper technology, such as the creation of sustainable and eco-friendly options. Another important factor is the accessibility of e-commerce platforms, which offer customers a quick and easy way to buy diapers. In conclusion, the diaper market in South Korea has been growing steadily and remains dynamic due to a number of factors, including changing consumer preferences, demographic shifts, technological advancements, and accessibility through online channels.

Report Coverage

This research report categorizes the market for the South Korea diaper market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea diaper market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea diaper market.

South Korea Diaper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.80% |

| 2035 Value Projection: | USD 3.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | LG Household and Health Care, Yuhan-Kimberly, Unicharm Korea, P and G Korea, KleanNara, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

South Korea's diaper market is expanding rapidly due to a number of important factors. First, the demand for diapers is rising due to the region's growing population and rising birth rates. Additionally, the need for quick and easy childcare options is being fueled by shifting lifestyles, particularly the increasing number of working parents and nuclear families, which is driving the diaper market. Additionally, a preference for high-end, technologically sophisticated diaper products has resulted from increased awareness of proper hygiene and sanitation practices as well as a rise in disposable income.

Restraining Factors

Manufacturers of diapers and other baby care products are subject to strict laws governing product safety, labeling, and environmental impact. It can be difficult and expensive to navigate these regulations, especially for smaller businesses or new entrants. Market dynamics may become even more complicated if non-compliance results in legal repercussions and harm to a brand's reputation.

Market Segmentation

The South Korea diaper market share is classified into product type and distribution channel.

- The baby diapers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea diaper market is segmented by product type into baby diaper and adult diaper. Among these, the baby diapers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Convenience, high absorption capacity, and a strong consumer preference for hassle-free diaper solutions are the reasons this market segment continues to dominate.

- The supermarkets and hypermarkets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea diaper market is segmented by distribution channel into supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others. Among these, the supermarkets and hypermarkets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Supermarkets and hypermarkets are providing a large range of diaper types, sizes, and brands. Customers choose these stores because they are convenient, offer bulk buying options, and run frequent promotions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea diaper market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Household and Health Care

- Yuhan-Kimberly

- Unicharm Korea

- P&G Korea

- KleanNara

- Others

Recent Developments:

- In January 2024, P&G Korea, the local subsidiary of Procter & Gamble, announced on Wednesday that it had launched the newest addition to its product lineup Pampers Baby-Dry Pants, a baby diaper designed to provide improved absorbency.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Diaper Market based on the below-mentioned segments:

South Korea Diaper Market, By Product Type

- Baby Diaper

- Disposable Diapers

- Training Diapers

- Cloth Diapers

- Swim Pants

- Biodegradable Diapers

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

South Korea Diaper Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Need help to buy this report?