South Korea Diabetes Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Insulins, Injectable drugs, Oral anti-diabetic drugs, Others), By Diabetes Type (Type1, Type 2), By Distribution Channel (Online pharmacies, Hospital Pharmacies, Retail pharmacies), and South Korea Diabetes Drugs Market Insights Forecasts 2022 - 2032

Industry: HealthcareSouth Korea Diabetes Drugs Market Insights Forecasts to 2032

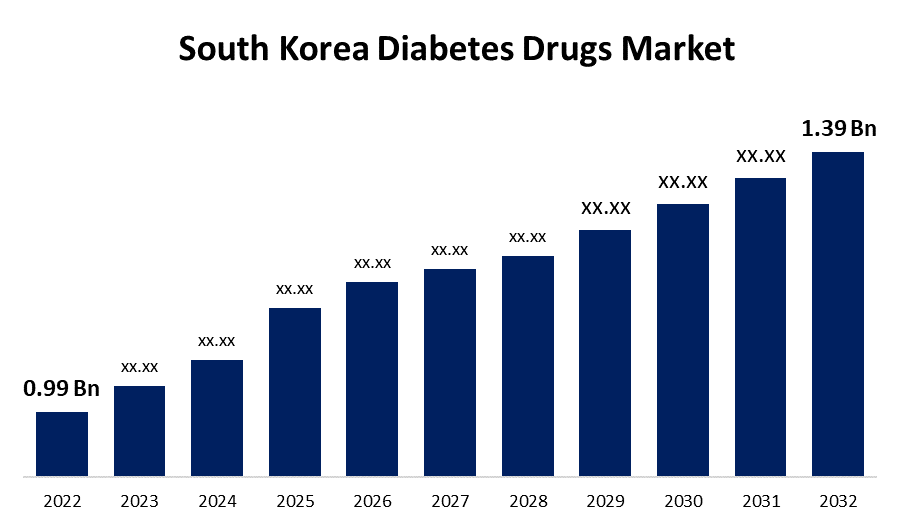

- The South Korea Diabetes Drugs Market Size was valued at USD 0.99 Billion in 2022.

- The Market is Growing at a CAGR of 3.4 % from 2022 to 2032.

- The South Korea Diabetes Drugs Market Size is Expected To Reach 1.39 Billion by 2032.

Get more details on this report -

The South Korea Diabetes Drugs Market Size is Expected To Reach USD 1.39 Billion by 2032, at a CAGR of 3.4 % during the forecast period 2022 to 2032.The South Korean Diabetes Drugs Market has grown substantially over the years, owing to an increasing diabetic population, rising diabetes management awareness, and advances in drug development.

Market Overview

Diabetes is defined by high blood glucose levels, which can harm blood vessels, the heart, kidneys, nerves, and the eyes. Diabetes is also known as hyperglycemia or high blood glucose. Insulin is a hormone that regulates the body's blood glucose levels. Diabetes is caused by an ongoing rise in blood glucose levels. Uncontrolled diabetes can harm the nervous and other body systems. Diabetes drugs are medications used to treat type 1 and type 2 diabetes, and they help the body maintain an average blood glucose level. There are several drug classes available to treat diabetes, and these drugs can be administered orally, intravenously, or subcutaneously. Insulin, metformin, and sulphonylureas are examples of diabetes medications. The South Korean diabetes drugs market refers to the pharmaceutical industry segment dedicated to the production, distribution, and sale of diabetes medications.

Report Coverage

This research report categorizes the market for South Korean diabetes drugs market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean diabetes drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean diabetes drugs market.

South Korea Diabetes Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.99 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.4 % |

| 2032 Value Projection: | USD 1.39 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drug Type, By Diabetes Type, By Distribution Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | AstraZeneca, Boehringer Ingelheim, Eli Lilly and Company, Sanofi Aventis, Novo Nordisk A/S, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Diabetes is becoming more common in South Korea, owing to sedentary lifestyles and unhealthy dietary habits, as well as raising awareness about diabetes management and the importance of early diagnosis and treatment, as well as advancements in drug development technologies, which have resulted in the introduction of novel diabetes drugs. Diabetes and its complications are becoming more prevalent in an aging population. These factors will boost the South Korea market during the forecast period.

Restraining Factors

Diabetes drugs are expensive, especially newer therapies, limiting access for low-income patients. Certain diabetes medications have side effects and complications, limiting their use. In remote areas, healthcare facilities and resources are limited, making timely diabetes management difficult.

Market Segment

- In 2022, the oral anti-diabetic drugs segment accounted for the largest revenue share over the forecast period.

Based on the drug type, the South Korean diabetes drugs market is segmented into insulins, injectable drugs, oral anti-diabetic drugs, and others. Among these, the oral anti-diabetic drugs segment has the largest revenue share over the forecast period. Oral anti-diabetic drugs are available worldwide and are recommended for use when type 2 diabetes treatment must be escalated in conjunction with lifestyle management. due to their wide range of efficacy, safety, and mechanisms of action, oral agents are typically the first medications used in the treatment of type 2 diabetes. Anti-diabetic medications assist diabetic patients in controlling their condition and lowering the risk of diabetes complications.

- In 2022, the type 2 segment accounted for the largest revenue share over the forecast period.

Based on diabetes type, the South Korean diabetes drugs market is segmented into type 1 and type 2. Among these, the type 2 segment has the largest revenue share over the forecast period. Type 2 diabetes accounts for a largest share of the South Korean market. The current situation is attributed to the high prevalence of type 2 diabetes in all age groups due to sedentary lifestyles and obesity. As the result, the South Korean diabetes drug market is expected to grow during the forecast period.

- In 2022, the hospital pharmacies segment is expected to hold the largest share of the South Korean diabetes drugs market during the forecast period.

Based on the distribution channel, the South Korean diabetes drugs market is classified into Online pharmacies, hospital pharmacies, and retail pharmacies. Among these, the hospital pharmacies segment is expected to hold the largest share of the South Korean diabetes drugs market during the forecast period. Considering the presence of trained medical personnel for medicine sales. As an outcome of segment growth, the majority of the population also visits hospitals for primary care. There are two types of pharmacies on a hospital campus: inpatient and outpatient. An inpatient pharmacy within the hospital is only accessible to authorized personnel serving operation rooms, ICU, inpatient wards, and special service areas. Outpatient pharmacies, on the other hand, are typically found in hospital lobbies and customer entrances.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korean diabetes drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- Boehringer Ingelheim

- Eli Lilly and Company

- Sanofi Aventis

- Novo Nordisk A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, AstraZeneca announced new findings from a pre-specified analysis of DELIVER Phase III trial data demonstrating that Farxiga (dapagliflozin) improved symptom burden and health-related quality of life in patients with heart failure while mildly reducing or maintaining ejection fraction compared to placebo.

- In June 2022, Daewoong Pharmaceutical confirmed promising phase 3 topline results focusing on Enavogliflozin monotherapy and combination therapy with Metformin. Enavogliflozin by Daewoong is an SGLT-2 inhibitor in development for the first time in Korea.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea Diabetes Drugs Market based on the below-mentioned segments:

South Korea Diabetes Drugs Market, By Drug Type

- Insulins

- Injectable drugs

- Oral anti-diabetic drugs

- Others

South Korea Diabetes Drugs Market, By Diabetes Type

- Type1

- Type 2

South Korea Diabetes Drugs Market, By Distribution Channel

- Online pharmacies

- Hospital Pharmacies

- Retail pharmacies

Need help to buy this report?