South Korea Data Center Physical Security Market Size, Share, and COVID-19 Impact Analysis, By Solution Type (Video Surveillance and Access Control Solution), By Service Type (Consulting Services and Professional Services), and South Korea Data Center Physical Security Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologySouth Korea Data Center Physical Security Market Insights Forecasts to 2035

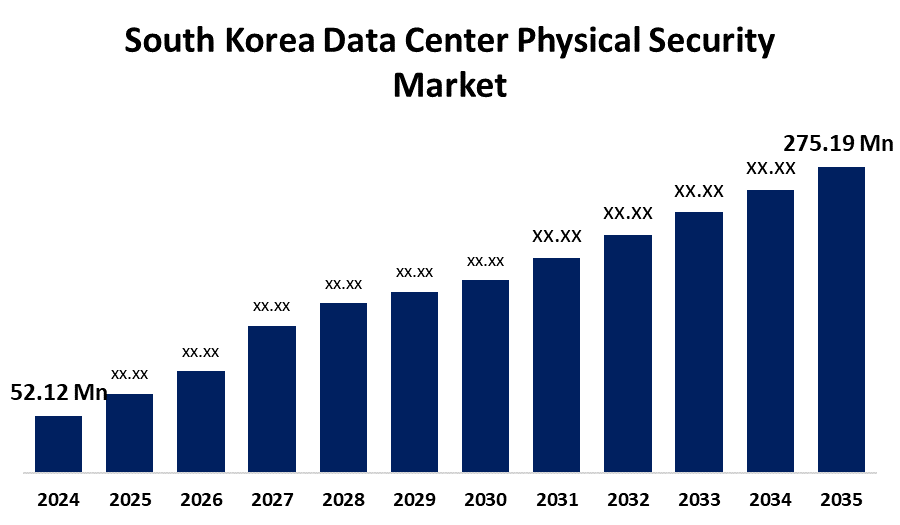

- The South Korea Data Center Physical Security Market Size was estimated at USD 52.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.33% from 2025 to 2035

- The South Korea Data Center Physical Security Market Size is Expected to Reach USD 275.19 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Data Center Physical Security Market Size is Anticipated to reach USD 275.19 Million By 2035, Growing at a CAGR of 16.33 % from 2025 to 2035. South Korea's fast-paced digitalization and mass cloudification are fueling the market for safe data centers. With industries like finance, healthcare, and e-commerce going digital, there is a greater need for comprehensive physical security solutions to guard against sensitive information.

Market Overview

Data center physical security is the process and systems put in place to protect data centers against physical threats, ensuring the integrity and safety of the facility and the data contained within. This involves a multilayer security with perimeter security, access control systems, surveillance systems, and intrusion detection systems. Additionally, physical security applications within data centers play a crucial role in avoiding unauthorized entry, theft, and damage to mission-critical infrastructure, which safeguards sensitive information and guarantees business continuity. Additionally, the government made the decision to reduce the entry restrictions on cloud computing services in the nation. The initiative is likely to pose a threat to local firms by making foreign technology giants like Amazon and Microsoft competitive. US and Chinese technology companies embrace mooted deregulation even as there are increasing worries from KT, Naver, NHN, and other local cloud service providers regarding the threat of domination by foreign companies in domestic markets, and experts indicated that they are starting to pursue options. Cloud computing services for the public sector. These innovations have raised the demand for data centers from the local cloud market, hence the demand for data center security in the nation.

Report Coverage

This research report categorizes the market for the South Korea data center physical security market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea data center physical security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea data center physical security market.

South Korea Data Center Physical Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.12 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.33% |

| 2035 Value Projection: | USD 275.19 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Solution Type, By Service Type and COVID-19 Impact Analysis |

| Companies covered:: | Samsung SDS, LG CNS, Hanwha Techwin, KT Corporation, SK C&C, IDIS, Hikvision, Dahua Technology, Bosch Security Systems, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Stringent regulations and data privacy laws in South Korea are driving the need for sophisticated physical security solutions for data centers. The Personal Information Protection Act (PIPA) requires stringent measures to protect personal and sensitive information inside storage facilities. Failure to comply can attract hefty penalties and damage to reputation for organizations. For instance, in March 2024, amendments to PIPA introduced new rights for individuals, including the ability to request explanations or reviews of automated decisions. Moreover, Ongoing advances in physical security technologies have played a major role in influencing South Korea's Data Center Physical Security Market. The incorporation of smart technologies like artificial intelligence (AI) and machine learning (ML) has optimized threat detection in data centers.

Restraining Factors

Enhancing physical security in existing data center infrastructure calls for a lot of capital expenditure. This involves expenditure on new hardware, power-efficient cooling systems, and top-of-the-line security solutions. In small and medium-sized firms, it's not always easy to budget enough for large-scale renovations. Moreover, implementing new technologies with continuous operations can be complicated. Renovation activities can cause short-term disruptions, raising downtime risks and impacting service reliability. Gradual upgrades and planning carefully are necessary to mitigate these effects.

Market Segmentation

The South Korea data center physical security market share is classified into solution type and service type.

- The video surveillance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea data center physical security market is segmented by solution type into video surveillance and access control solution. Among these, the video surveillance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This category accounts for a significant portion owing to the imperative need to monitor and protect data centers from unauthorized access and potential attacks. Video surveillance systems, such as high-definition cameras and artificial intelligence-enabled surveillance, are critical in ensuring compliance with data protection legislation and safeguarding the integrity of sensitive data held within data centers.

- The professional services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea data center physical security market is segmented by service type into consulting services and professional services. Among these, the professional services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This category includes tasks like system integration, installation, and maintenance, which are of essence for deploying and running physical security systems in data centers. Professional services guarantee that security solutions are suitably deployed and maintained to suit the unique requirements of data centers. Though consulting services are of crucial importance in initial planning and design processes, professional services are of paramount importance to the execution process and functioning over a long period of time for security systems. This is in line with the general industry emphasis on full-service offerings that complement the intricate infrastructure of data centers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea data center physical security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung SDS

- LG CNS

- Hanwha Techwin

- KT Corporation

- SK C&C

- IDIS

- Hikvision

- Dahua Technology

- Bosch Security Systems

- Others

Recent Developments:

- In August 2023, Securitas expanded a 5-year contract to deliver data center security for Microsoft across 31 countries, establishing a solid partnership. The worldwide agreement covered risk management, overall security technology as a system integrator, specialized security and safety resources, guarding services, and digital interfaces. Securitas kept the data center's physical security program innovative, strong, and powerful. This showed stability as a partner, helping address the challenges of Microsoft's growing business.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Data center physical security market based on the below-mentioned segments:

South Korea Data Center Physical Security Market, By Solution Type

- Video Surveillance

- Access Control Solution

South Korea Data Center Physical Security Market, By Service Type

- Consulting Services

- Professional Services

Need help to buy this report?