South Korea Cryptocurrency Market Size, Share, and COVID-19 Impact Analysis, By Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, and Others), By Component (Hardware and Software), and South Korea Cryptocurrency Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Cryptocurrency Market Insights Forecasts to 2035

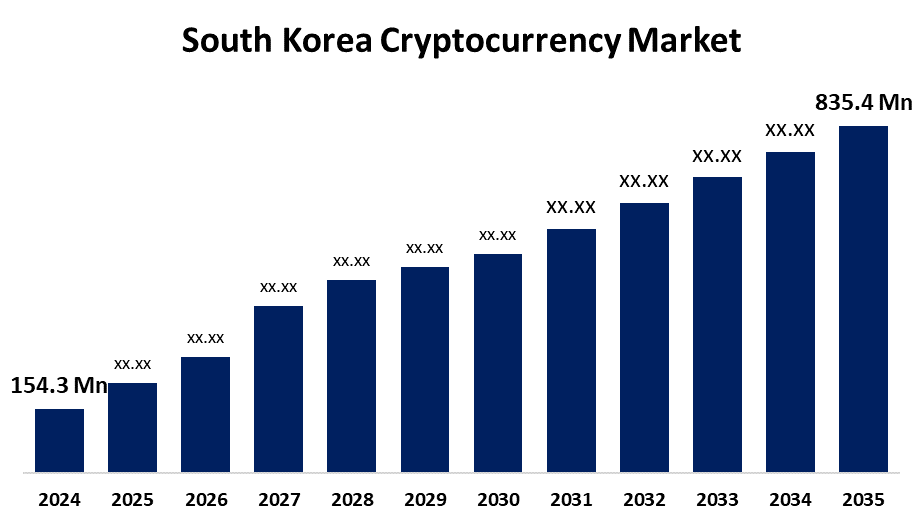

- The South Korea Cryptocurrency Market Size was Estimated at USD 154.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.60% from 2025 to 2035

- The South Korea Cryptocurrency Market Size is Expected to Reach USD 835.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Cryptocurrency Market Size is anticipated to reach USD 835.4 Million by 2035, growing at a CAGR of 16.60% from 2025 to 2035. The market is being driven by the growing use and expansion of decentralized finance platforms and applications, which can affect the demand for particular cryptocurrencies.

Market Overview

The South Korean cryptocurrency market the digital asset ecosystem in South Korea, which includes cryptocurrency exchanges, laws, trading, and blockchain-based financial services, is referred to as the South Korean cryptocurrency market. The Financial Services Commission (FSC) is the main regulator of South Korea's stringent cryptocurrency laws. To ensure compliance among cryptocurrency exchanges, the nation enforces Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Additionally, Numerous factors collectively shape the dynamics of the cryptocurrency market in South Korea. First and foremost, technological developments are crucial since breakthroughs like blockchain technology are constantly changing the game. By ensuring decentralization, security, and transparency, this distributed ledger system boosts trust in virtual currencies. Furthermore, as South Korean governments struggle to create frameworks that strike a balance between innovation and investor protection, regulatory developments have a big impact on the market. An element of unpredictability is introduced by the changing regulatory environment, which affects investment decisions and market sentiment.

Report Coverage

This research report categorizes the market for the South Korea cryptocurrency market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea cryptocurrency market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea cryptocurrency market.

South Korea Cryptocurrency Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 154.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 16.60% |

| 2035 Value Projection: | USD 835.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type and By Component |

| Companies covered:: | D’CENT, VegaX Holding, Alightpay, NFTBank.ai, CoinPlug, Kokoa Finance, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market fluctuates due to macroeconomic factors. People and organizations may turn to cryptocurrencies as a hedge against inflation as a result of economic instability and currency devaluation in established financial systems. Additionally, market activity is increased by companies and financial institutions embracing cryptocurrencies on a large scale. Prominent endorsements, like businesses that take cryptocurrency as payment, confirm the legitimacy of cryptocurrencies and encourage a larger user base. The market is also shaped by social sentiment, with influencers and online communities having a significant impact on investor behavior. The way the South Korean cryptocurrency market develops is shaped by a complex and dynamic ecosystem that is created by the interconnection of these drivers. This ecosystem includes technological advancements, regulatory developments, macroeconomic trends, and social influence.

Restraining Factors

The crypto exchanges operating in South Korea are required to link their accounts to verified bank accounts in order to comply with real-name account policies. For exchanges to function lawfully, they also need to form banking alliances with nearby financial institutions. Although these rules are intended to increase openness and guard against fraud, they also put up obstacles for new platforms looking to join the market.

Market Segmentation

The South Korea cryptocurrency market share is classified into type and component.

- The ripple segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cryptocurrency market is segmented by type into bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others. Among these, the ripple segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. driven by high trading volumes on regional exchanges and robust demand from retail investors. Due to the growing use of XRP for payments and remittances as well as regulatory clarity boosting investor confidence, the segment is anticipated to expand at a substantial compound annual growth rate (CAGR).

- The hardware segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cryptocurrency market is segmented by component into hardware and software. Among these, the hardware segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. driven by the strong demand for mining hardware, including FPGAs, CPUs, GPUs, and ASICs. This market is anticipated to expand at a robust compound annual growth rate (CAGR) over the course of the forecast period as a result of growing mining activity, institutional investments in crypto infrastructure, and blockchain technology advancements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea cryptocurrency market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- D'CENT

- VegaX Holding

- Alightpay

- NFTBank.ai

- CoinPlug

- Kokoa Finance

- Others

Recent Developments:

- In May 2025, The Financial Services Commission announced that nonprofit organizations were allowed to sell digital currencies they had received as donations or through sponsors. However, they had to adhere to the new regulations set by the commission.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea cryptocurrency market based on the below-mentioned segments:

South Korea Cryptocurrency Market, By Type

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

South Korea Cryptocurrency Market, By Component

- Hardware

- Software

Need help to buy this report?