South Korea Cross-Border E-Commerce Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service (Transportation, Warehousing and Inventory Management and Value-Added Services (Labeling, Packaging)), By Product (Fashion and Apparel, Consumer Electronics, Home Appliances, Furniture, Beauty and Personal Care Products and Other Products), and South Korea Cross-Border E-Commerce Logistics Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationSouth Korea Cross-Border E-Commerce Logistics Market Insights Forecasts to 2035

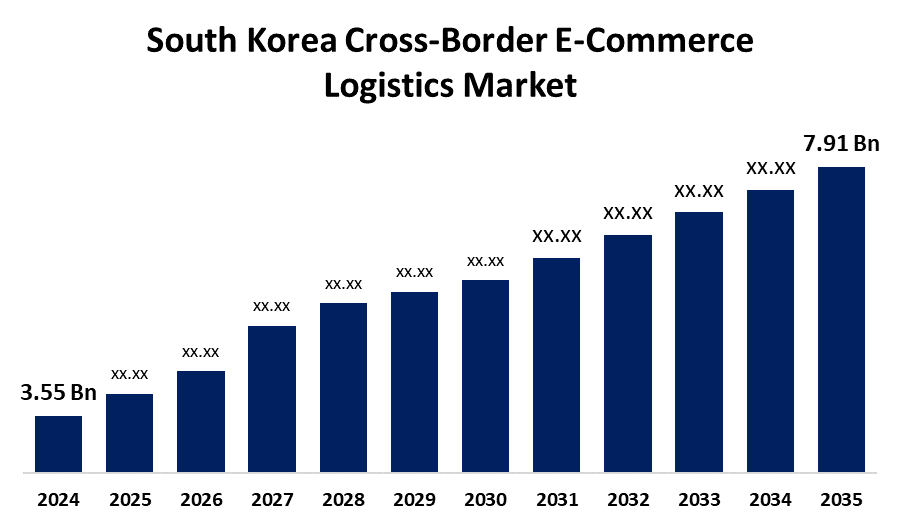

- The South Korea Cross-Border E-Commerce Logistics Market Size Was Estimated at USD 3.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.56% from 2025 to 2035

- The South Korea Cross-Border E-Commerce Logistics Market Size is Expected to Reach USD 7.91 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Cross-Border E-Commerce Logistics Market Size is anticipated to reach USD 7.91 billion by 2035, growing at a CAGR of 7.56% from 2025 to 2035. The cross-border e-commerce logistics market in South Korea is experiencing strong growth due to the growing need for foreign goods and the growth of international e-commerce platforms. Logistics players are concentrating on improving infrastructure, de-layering operations, and implementing cutting-edge technologies to provide smooth and efficient delivery services. All this is making South Korea a prime location for cross-border logistics for the region.

Market Overview

The South Korea cross-border E-commerce logistics market is the wide range of services and infrastructure needed to enable the physical delivery of goods bought online from foreign sellers to South Korean consumers. The market is crucial in bringing e-commerce platforms around the world to South Korean buyers, enabling seamless and timely delivery of products across borders. Additionally, the market is also being aided by innovative tactics, including the adoption of automation and digital technology, which are enhancing supply chain efficiency. Support from the government for digital transformation and logistics modernization further solidifies the market's potential. With companies still innovating and investing, the South Korean cross-border logistics industry is poised to respond to increasing consumer expectations and maintain its positive momentum.

Report Coverage

This research report categorizes the market for the South Korea cross-border E-commerce logistics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea cross-border E-commerce logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea cross-border E-commerce logistics market.

South Korea Cross-Border E-Commerce Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.55 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.56% |

| 2035 Value Projection: | USD 7.91 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Service, By Product and COVID-19 Impact Analysis |

| Companies covered:: | CJ Logistics, Hanjin, Hyundai Glovis, Pantos Logistics, DHL Group Logistics, Mesh Korea*, Barogo and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean cross-border e-commerce logistics sector is undergoing extraordinary change, drievn by the extraordinary growth of cross-border e-commerce. As global shopping platforms become more dominant, top logistics companies like CJ Logistics and Hanjin are expanding their Global Distribution Centers (GDC) in Incheon to handle growing demand for cross-border services. These expansions will help improve the processing capacity of self-clearance facilities, ensuring smooth and efficient delivery solutions. Moreover, Technological innovations are transforming the cross-border logistics industry. South Korean businesses are embracing cutting-edge technologies like blockchain to improve transparency and security, and artificial intelligence (AI) to streamline routes and predict demand. The emergence of "smart" logistics hubs, with automated sorting facilities and AI-based inventory control, is making cross-border operations faster and more economical.

Restraining Factors

Cross-border e-commerce is governed by a convoluted nexus of overseas regulations, covering customs guidelines, tax legislation, and product safety measures. It can be time-consuming and expense-intensive for logistics companies to navigate these different regulations, particularly if they deal with merchandise from more than one country.

Market Segmentation

The South Korea cross-border E-commerce logistics market share is classified into service and product.

- The transportation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cross-border E-commerce logistics market is segmented by Service into transportation, warehousing and inventory management and value-added services (labeling, packaging). Among these, the transportation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The use of e-commerce logistics with transportation management software (TMS) has increased the growth of the e-commerce logistics market. TMS supports delivery planning along the supply chain, increasing efficiency and customer satisfaction.

- The fashion and apparel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cross-border E-commerce logistics market is segmented by product into fashion and apparel, consumer electronics, home appliances, furniture, beauty and personal care products and other products. Among these, the fashion and apparel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is supported by high demand from consumers, aggressive brand pricing, and efficient networks of logistics for cross-border exports. Demand for this segment is also supported by Korean consumers' affinity for global fashion trends, which drives this segment's constant growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea cross-border E-commerce logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ Logistics

- Hanjin

- Hyundai Glovis

- Pantos Logistics

- DHL Group Logistics

- Mesh Korea*

- Barogo

- Others

Recent Developments:

In April 2024, Hanjin boosted its air express delivery business by investing in the customs clearance center at Incheon International Airport's International Logistics Center (GDC). The strategic investment enabled Hanjin to double its customs clearance capacity from 1.1 million boxes per month to 2.2 million boxes. The facility upgrade was valued at approximately KRW 10 billion (USD 7.41 million).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea cross-border E-commerce logistics market based on the below-mentioned segments:

South Korea Cross-Border E-Commerce Logistics Market, By Service

- Transportation

- Warehousing and Inventory Management

- Value-Added Services (Labeling, Packaging)

South Korea Cross-Border E-Commerce Logistics Market, By Product

- Fashion and Apparel

- Consumer Electronics

- Home Appliances

- Furniture

- Beauty and Personal

- Care Products

- Other Products

Need help to buy this report?