South Korea Crocin Market Size, Share, and COVID-19 Impact Analysis, By Purity (Purity >98% and Purity <98%), Indication (Pain), By Application (Food and Drug), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, And Others), and South Korea Crocin Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSouth Korea Crocin Market Insights Forecasts to 2035

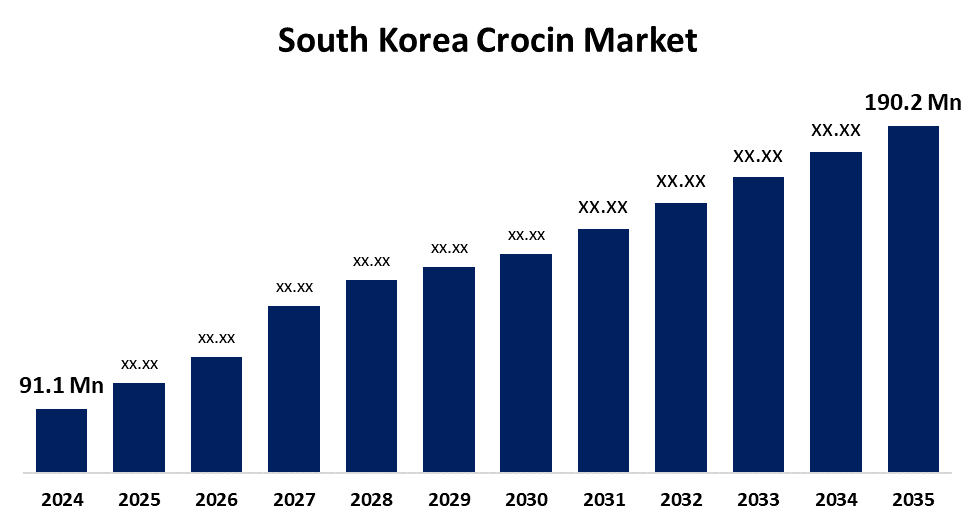

- The South Korea Crocin Market Size Was Estimated at USD 91.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.92% from 2025 to 2035

- The South Korea Crocin Market Size is Expected to Reach USD 190.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Crocin Market Size is anticipated to reach USD 190.2 Million by 2035, growing at a CAGR of 6.92% from 2025 to 2035. The market is the growing incidence of ailments including the flu, headaches, and other symptoms, the growing need for medications to treat pain, and the rise in paracetamol manufacturing.

Market Overview

The "Crocin Market" is the market for the medication Crocin, which is mostly used to treat fever and pain. It is a brand name for the widely accessible over-the-counter drug paracetamol (acetaminophen) tablets. Crocin tablet manufacturing, distribution, and sales, together with other goods and services, are all included in the market. The paracetamol content, Crocin offers momentary relief from a variety of pains, including headaches, toothaches, and muscle aches. Because Crocin Advance tablets with Optizorb technology dissolve more quickly in the stomach, pain may be relieved more quickly. The painkillers like Crocin is fueled by the rising prevalence of fever, headaches, and other pain-related ailments as well as the expanding tendency of self-medication. To lower the cost of healthcare, the government also encourages people to utilize generic medications (like paracetamol) rather than name-brand ones (like Crocin). Customers may choose less expensive generic alternatives as a result of this endeavor, which has an indirect impact on the Crocin market.

Report Coverage

This research report categorizes the market for South Korea crocin market based on various segments and regions forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea crocin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea crocin market.

South Korea Crocin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 91.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.92% |

| 2035 Value Projection: | USD 190.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Purity, By Application |

| Companies covered:: | Yuhan Corporation, Hanmi Pharm Co., Ltd., GC Biopharma (Green Cross Corporation), Daewoong Pharmaceutical Co., Ltd., Kolmar Korea, Chong Kun Dang Pharmaceutical Corporation, Celltrion Inc., SK Biopharmaceuticals Co., Ltd., Samsung Biologics Co., Ltd., Teva Pharmaceutical Industries Ltd., Kyongbo Pharm, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for natural antioxidants and colorants in food, pharmaceutical, and cosmetic industries. Increased awareness of crocin’s health benefits, including its anti-inflammatory, neuroprotective, and anticancer properties, boosts its use in nutraceuticals and functional foods. Growing consumer preference for clean-label and plant-based ingredients further supports market expansion.

Restraining Factors

The high cost of extraction due to labor-intensive saffron harvesting and low crocin yield. Limited availability of raw materials and dependence on specific climatic conditions hinder large-scale production. Additionally, the presence of synthetic alternatives and regulatory challenges regarding purity and standardization affect market growth.

Market Segmentation

The South Korea crocin market share is classified into purity, application, and distribution channel.

- The purity >98% segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea crocin market is segmented by purity into purity >98% and purity <98%. Among these, the purity >98% segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its superior quality, effectiveness, and safety in pharmaceutical and nutraceutical applications. High-purity crocin is preferred for research, clinical use, and premium health supplements.

- The food segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea crocin market is segmented by application into food and drug. Among these, the food segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising demand for natural colorants and health-enhancing ingredients. Crocin's antioxidant properties and vibrant color make it ideal for functional foods and beverages. Growing consumer preference for clean-label, plant-based additives is driving continued growth in this segment.

- The hospital pharmacy segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea crocin market is segmented by distribution channel into hospital pharmacy, retail pharmacy, and others. Among these, the hospital pharmacy segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increased use of crocin in clinical settings for its antioxidant and neuroprotective properties. Hospitals prefer high-quality, standardized formulations for patient care, and rising health awareness and prescription rates are expected to sustain strong growth in this channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea crocin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yuhan Corporation

- Hanmi Pharm Co., Ltd.

- GC Biopharma (Green Cross Corporation)

- Daewoong Pharmaceutical Co., Ltd.

- Kolmar Korea

- Chong Kun Dang Pharmaceutical Corporation

- Celltrion Inc.

- SK Biopharmaceuticals Co., Ltd.

- Samsung Biologics Co., Ltd.

- Teva Pharmaceutical Industries Ltd.

- Kyongbo Pharm

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea crocin market based on the below-mentioned segments:

South Korea Crocin Market, By Purity

- Purity >98%

- Purity <98%.

South Korea Crocin Market, By Application

- Food

- Drug

South Korea Crocin Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

Need help to buy this report?