South Korea Cosmetic Surgery Market Size, Share, and COVID-19 Impact Analysis, By Procedure (Surgical Procedures (Breast Augmentation, Liposuction, Eyelid Surgery, Abdominoplasty, Rhinoplasty, and Others), Non-Surgical Procedures (Botulinum Toxin, Hyaluronic Acid, Hair Removal, Nonsurgical Fat Reduction, Photo Rejuvenation, and Others)), By Gender (Female, Male), and South Korea Cosmetic Surgery Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Cosmetic Surgery Market Insights Forecasts to 2035

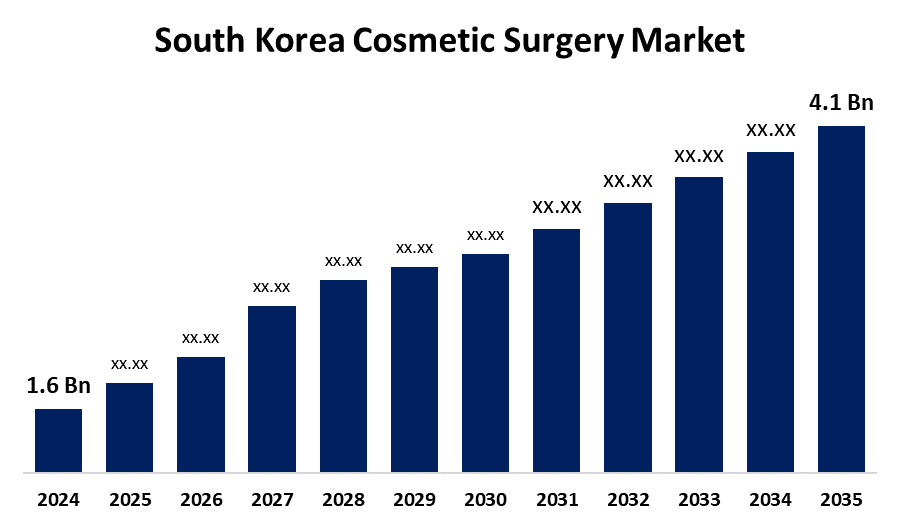

- The South Korea Cosmetic Surgery Market Size was Estimated at USD 1.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.93% from 2025 to 2035

- The South Korea Cosmetic Surgery Market Size is Expected to Reach USD 4.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Cosmetic Surgery Market Size is anticipated to reach USD 4.1 Billion by 2035, growing at a CAGR of 8.93% from 2025 to 2035. The market is expanding as a result of the growing cultural emphasis on personal development.

Market Overview

The market for cosmetic surgery in South Korea includes a broad range of medical operations meant to improve, change, or revitalize a person's appearance. South Korea leads the world in aesthetic enhancements due to its high per capita rate of cosmetic procedures. Additionally, one of the main factors driving growth is the growing emphasis on minimally invasive procedures and the accessibility of financing options. Moreover, yeongnam specializes in high-volume procedures and draws medical tourists, while the Seoul Capital Area is a hub for cutting-edge cosmetic surgery research and techniques. Additionally, the demand for cosmetic enhancements is largely driven by South Korea's strong emphasis on beauty and aesthetics. Confucian principles, which place a high value on harmony and aesthetic refinement, have a significant influence on the nation's beauty standards. Furthermore, the desire for cosmetic procedures is reinforced by the competitive job market and the media's portrayal of beauty. Historical factors, such as the development of reconstructive surgery after the war, have also influenced South Korea's plastic surgery culture.

Report Coverage

This research report categorizes the market for the South Korea cosmetic surgery market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea cosmetic surgery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea cosmetic surgery market.

South Korea Cosmetic Surgery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.93% |

| 2035 Value Projection: | USD 4.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 241 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Procedure, Non-Surgical Procedures and By Gender |

| Companies covered:: | Hugel Aesthetics, Samsung Biologics, Dae Hwa Pharmaceutical, Croma Pharma, Sientra, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing technological and surgical innovations in South Korea improve safety and efficacy, drawing in foreign patients and enhancing the nation's standing as a top location for cosmetic surgery. Furthermore, AI-assisted diagnostics and minimally invasive procedures are two technological innovations driving demand in South Korea's cosmetic surgery market. Predictive analytics and AI-powered imaging improve accuracy in skin treatments and facial contouring, speeding recovery and enhancing results. Furthermore, smart laser systems and robot-assisted procedures are simplifying surgeries and increasing their safety and effectiveness.

Restraining Factors

The market is being hampered by the high prices and restricted access for certain groups. Furthermore, Concerns about authenticity and transparency have been brought up by the use of celebrities and influencers to advertise cosmetic procedures. Before undergoing procedures, some clinics have been observed to require influencers to create promotional content, which could deceive the public about the efficacy and safety of treatments.

Market Segmentation

The South Korea Cosmetic Surgery Market share is classified into procedure and gender.

- The non-surgical procedures segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cosmetic surgery market is segmented by type into surgical procedures (breast augmentation, liposuction, eyelid surgery, abdominoplasty, rhinoplasty, and others) and non-surgical procedures (botulinum toxin, hyaluronic acid, hair removal, nonsurgical fat reduction, photo rejuvenation, and others). Among these, the non-surgical procedures segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fillers and Botox are examples of non-surgical cosmetic procedures that are growing in popularity because they require less recovery time and are less expensive than surgery. This trend increases demand for cosmetic surgery in South Korea by attracting patients from abroad and domestically who are looking for non-invasive, rapid, and efficient aesthetic improvements.

- The female segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cosmetic surgery market is segmented by gender into female and male. Among these, the female segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by a strong desire for both non-surgical and surgical procedures. Most cosmetic procedures were performed on women, especially those involving eyelid surgery, hyaluronic acid fillers, and botulinum toxin.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea cosmetic surgery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hugel Aesthetics

- Samsung Biologics

- Dae Hwa Pharmaceutical

- Croma Pharma

- Sientra

- Others

Recent Developments:

- In May 2024, South Korean startup MediThinQ introduced its SCOPEYE 3D microsurgery solution, which utilized the latest eyes-display technology to enhance precision across medical specialties.

- In May 2024, according to a report released by the Ministry of Health and Welfare, South Korea recorded over 600,000 international patients, with significant growth in dermatology and plastic surgery services. This surge highlighted the country's expanding role as a leading medical tourism hub, particularly in cosmetic surgery, drawing patients from Japan, Taiwan, and beyond.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Cosmetic Surgery Market based on the below-mentioned segments:

South Korea Cosmetic Surgery Market, By Procedure

- Surgical Procedures

- Breast Augmentation

- Liposuction

- Eyelid Surgery

- Abdominoplasty

- Rhinoplasty

- Others

- Non-Surgical Procedures

- Botulinum Toxin

- Hyaluronic Acid

- Hair Removal

- Nonsurgical Fat Reduction

- Photo Rejuvenation

- Others

South Korea Cosmetic Surgery Market, By Gender

- Female

- Male

Need help to buy this report?