South Korea Copper Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rods and Wires, Plates and Strips, Tubes, and Others), By Applications (Building & Construction, Electrical & Electronics, Industrial Machinery & Equipment, Transportation, Consumer & General Products), and South Korea Copper Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Copper Foils Market Size Insights Forecasts to 2035

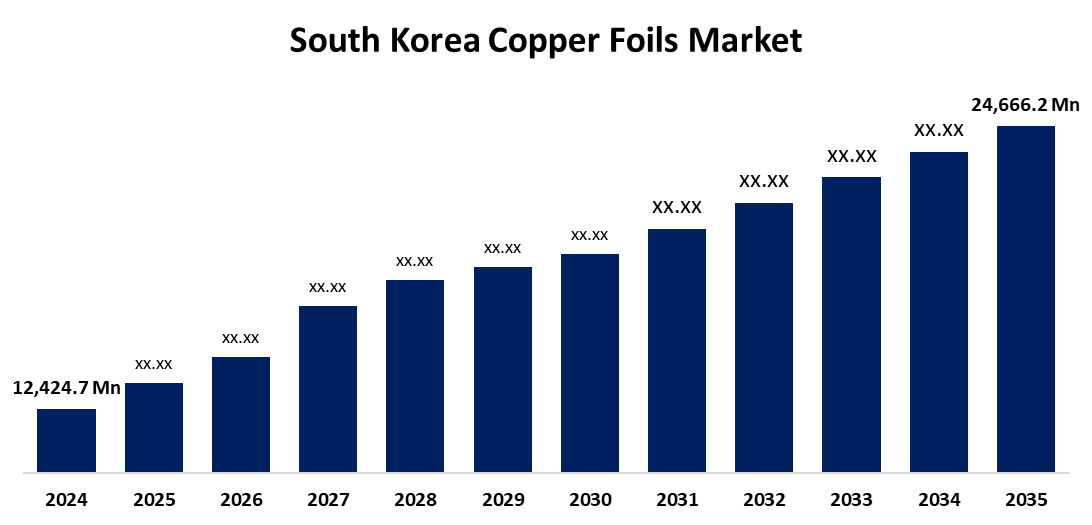

- The South Korea Copper Market Size was estimated at USD 12,424.7Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.43% from 2025 to 2035

- The South Korea Copper Market Size is Expected to Reach USD 24,666.2Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Copper Market Size is anticipated to reach USD 24,666.2 million by 2035, growing at a CAGR of 6.43% from 2025 to 2035. Exports of refined copper and copper-based products are being driven by strong trade relations, particularly with China, the United States, and Vietnam.

Market Overview

The South Korea copper market refers to the production, import, export, processing, and domestic consumption of copper and copper-based products are all included in the South Korean copper market. It includes a broad range of operations in various industries, including electronics, construction, power generation, transportation, and industrial machinery. Additionally, to increase investment in building projects, the South Korean government has put in place a number of laws and programs. Among these are more public-private partnerships (PPPs), tax breaks for companies that invest in new technology, loans for creative projects, and funding for R&D for smart city projects. Furthermore, the demand for green building materials, which use a lot of copper in their production processes (such as pipe wiring), has increased due to growing environmental concerns worldwide. This has greatly increased the overall consumption trend within this industry segment over the forecast period.

Report Coverage

This research report categorizes the market for the South Korea copper market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea copper market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea copper market.

South Korea Copper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12,424.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.43% |

| 2035 Value Projection: | USD 24,666.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 123 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By Applications and COVID-19 Impact Analysis |

| Companies covered:: | LS Cable & System, Poongsan Corporation, Korea Zinc Co., Ltd., Iljin Materials Co., Ltd., LS-Nikko Copper Inc., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Strong demand for copper is being driven by South Korea's infrastructure boom, which includes projects like smart cities, improved transit, and energy-efficient buildings. This is due to the fact that copper is a crucial component of HVAC, plumbing, and electrical wiring all of which are vital parts of contemporary infrastructure. Copper continues to be a vital resource for safe, effective, and environmentally friendly building as these advancements proceed.

Restraining Factors

South Korea's stricter environmental laws mandate that copper producers, especially those operating smelting and refining facilities, lower emissions, enhance waste management, and implement greener technologies. Companies are under financial pressure to meet both domestic and international sustainability expectations because complying with these standards frequently necessitates expensive upgrades to equipment, monitoring systems, and operational procedures.

Market Segmentation

The South Korea copper market share is classified into product type and application.

- The rods and wires segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea copper market is segmented by product type into rods and wires, plates and strips, tubes, and others. Among these, the rods and wires segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by a high demand from the electrical and electronics sector, where copper is essential for power cables, wiring, and electronic components due to its exceptional conductivity. Rods and wires continue to lead because of their widespread use in energy and infrastructure systems, even though plates, strips, and tubes are also important in industrial, automotive, and construction applications.

- The building and construction segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea copper market is segmented by application into building & construction, electrical & electronics, industrial machinery & equipment, transportation, consumer & general products. Among these, the building and construction segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is driven by ongoing investments in smart cities, green buildings, and infrastructure all of which heavily rely on copper for HVAC, plumbing, roofing, and wiring.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea copper market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LS Cable & System

- Poongsan Corporation

- Korea Zinc Co., Ltd.

- Iljin Materials Co., Ltd.

- LS-Nikko Copper Inc.

- Others

Recent Developments:

- In April 2025, The Korea International Trade Association (KITA) had expressed concern on Tuesday over a potential move by the U.S. to impose tariffs on copper imports, as the U.S. Department of Commerce (DOC) had launched an investigation on March 10 under Section 232 of the 1962 Trade Expansion Act to evaluate the national security implications of copper and copper derivative imports, with public comments having been accepted through April 1.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Copper Market based on the below-mentioned segments:

South Korea Copper Market, By Product Type

- Rods and Wires

- Plates and Strips

- Tubes

- Others

South Korea Copper Market, By Applications

- Building & Construction

- Electrical & Electronics

- Industrial Machinery & Equipment

- Transportation

- Consumer & General Products

Need help to buy this report?