South Korea Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Solution Type (Products and Services), By Equipment Type (Heavy Construction Equipment and Compact Construction Equipment), and South Korea Construction Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingSouth Korea Construction Equipment Market Insights Forecasts to 2035

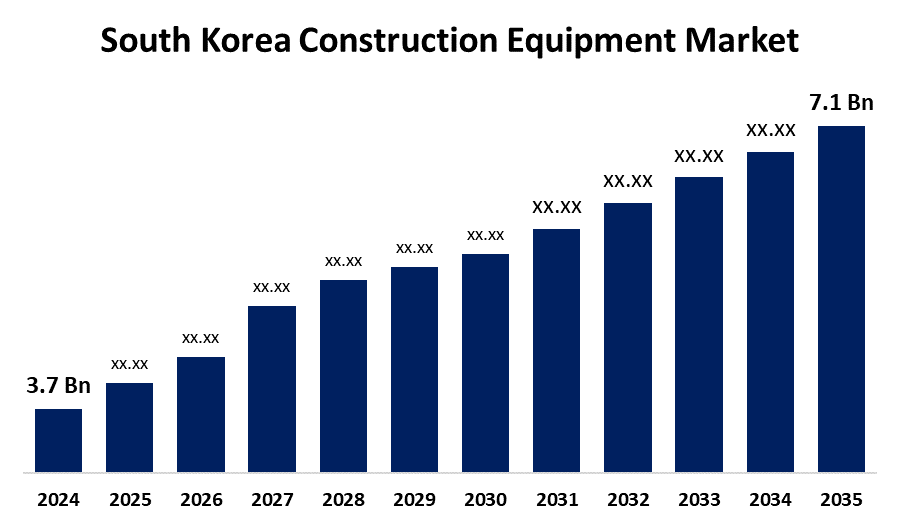

- The South Korea Construction Equipment Market Size was Estimated at USD 3.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.10% from 2025 to 2035

- The South Korea Construction Equipment Market Size is Expected to Reach USD 7.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Construction Equipment Market Size is anticipated to reach USD 7.1 Billion by 2035, growing at a CAGR of 6.10% from 2025 to 2035. The market is driven by a number of important factors, including a thriving manufacturing sector, real estate development, the adoption of eco-friendly practices, the growth of smart city projects, favorable government infrastructure initiatives, rapid urbanization, and international collaborations.

Market Overview

The South Korea Construction Equipment Market The industry that includes machinery and equipment used for infrastructure development, construction, and associated activities in South Korea is known as the South Korea Construction Equipment Market. Road construction machinery, excavators, loaders, cranes, forklifts, and dozers are examples of both heavy and small construction equipment. Urbanization, government infrastructure projects, and technological developments such as intelligent and environmentally friendly equipment are the main factors propelling the market. Additionally, Rapid urbanization in South Korea is fueling the country's need for construction equipment. Through a number of significant development initiatives, such as the building of smart cities and transportation infrastructure, the government is aggressively fostering the expansion of infrastructure. By 2030, 90% of South Koreans are predicted to live in cities, according to the Ministry of Land, Infrastructure, and Transportation. This change encourages investment in the South Korean construction equipment market in addition to raising demand for sophisticated construction equipment. As they deploy cutting-edge equipment designed to satisfy the demands of urban development, major players like Hyundai Construction Equipment should profit from this trend and strengthen their position in the expanding market.

Report Coverage

This research report categorizes the market for the South Korea construction equipment market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea construction equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea construction equipment market.

South Korea Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.10% |

| 2035 Value Projection: | USD 7.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Solution Type and By Equipment Type |

| Companies covered:: | AB Volvo, HD Hyundai Construction Equipment Co. Ltd., Komatsu Ltd., Xuzhou Construction Machinery Group Co. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The future of the South Korean construction equipment market is being shaped by technological innovation. The industry is undergoing a revolution thanks to the growing use of smart construction equipment with automation and Internet of Things capabilities. Government reports indicate that investments in research and development have increased significantly, which has aided in the development of new technologies for construction. Leading equipment producers, such as Doosan Infracore, are leading this change by making sure their machines have state-of-the-art features. As businesses look for effective, automated solutions to satisfy the expanding demands of infrastructure projects, this push for innovation is anticipated to propel growth in the South Korean construction equipment market.

Restraining Factors

Hiring experienced workers is difficult for construction companies in South Korea due to the country's strict labor laws and high wages. The nation is also facing a labor shortage in industries like mining, manufacturing, and construction. Due to this scarcity, there is now a greater need for intelligent and automated construction equipment, which can be expensive to install.

Market Segmentation

The South Korea Construction Equipment Market share is classified into solution type and equipment type.

- The services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea construction equipment market is segmented by solution type into products and services. Among these, the services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the products segment is driven by the demand for construction equipment, such as loaders, cranes, excavators, and forklifts. Cost-cutting preferences among construction companies have led to an increase in services like equipment rental and maintenance.

- The heavy construction equipment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea construction equipment market is segmented by equipment type into heavy construction equipment and compact construction equipment. Among these, the heavy construction equipment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The high demand for excavators, loaders, cranes, and dozers in major infrastructure projects, urban development, and industrial expansion is the reason this segment is dominant. Although compact construction equipment is becoming more and more popular, especially in cities with limited space, heavy machinery continues to be the main factor propelling market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea construction equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AB Volvo

- HD Hyundai Construction Equipment Co. Ltd.

- Komatsu Ltd.

- Xuzhou Construction Machinery Group Co. Ltd.

- Others

Recent Developments:

- In December 2023, At its Ulsan Campus, South Korea's HD Hyundai Construction Equipment Co., Ltd. introduced seven new mini excavators. The excavators were available in seven different models: 1.7-ton, 1.9-ton, 3-ton, 3.5-ton, 4-ton, 4.8-ton, and 5.5-ton.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Construction Equipment Market based on the below-mentioned segments:

South Korea Construction Equipment Market, By Type

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

South Korea Construction Equipment Market, By Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

Need help to buy this report?