South Korea Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Type (Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Age Group (Children, Adult, Geriatric), and South Korea Confectionery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesSouth Korea Confectionery Market Insights Forecasts to 2035

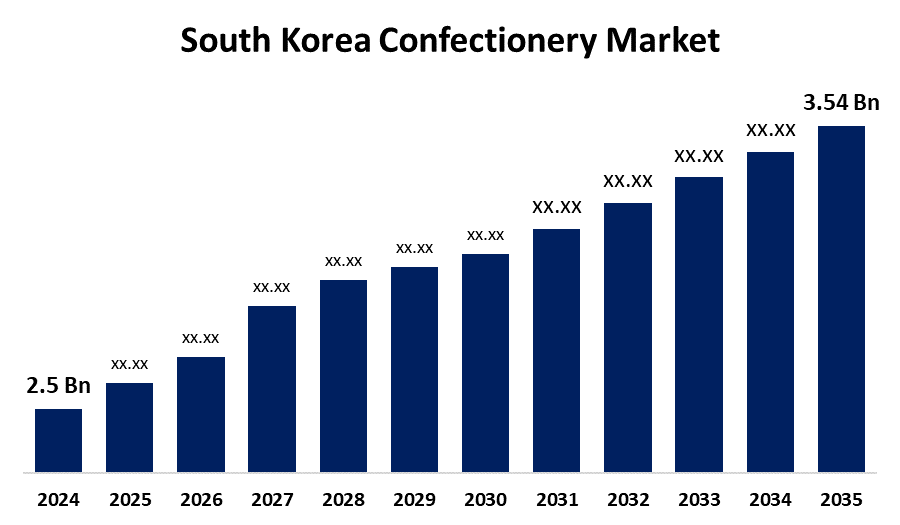

- The South Korea Confectionery Market Size was estimated at USD 2.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.21% from 2025 to 2035

- The South Korea Confectionery Market Size is Expected to Reach USD 3.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Confectionery Market Size is anticipated to reach USD 3.54 Billion by 2035, growing at a CAGR of 3.21% from 2025 to 2035. The ongoing product innovation, such as the development of new shapes, flavors, and packaging, that can appeal to various consumers, is impelling the market.

Market Overview

The South Korean confectionery market is a broad spectrum of sweet foods such as chocolates, candies, gums, and traditional sweets to suit different consumer lifestyles and tastes. Additionally, Customers are increasingly looking for sweets that provide health benefits. Products with vitamins, probiotics, collagen, and adaptogens are becoming popular. This trend is especially prevalent among millennials and Gen Z consumers, who place a high value on health in their everyday decisions. Manufacturers are reacting by launching healthier options and highlighting the nutritional content of their products. Also, the Producers are launching new flavors, textures, and package forms to grab consumers' attention and set their products apart from other brands. Limited batches, seasonal sales, and brand collaborations are typical tactics used to generate buzz and drive sales.

Report Coverage

This research report categorizes the market for the South Korea confectionery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea confectionery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea confectionery market.

South Korea Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.21% |

| 2035 Value Projection: | USD 3.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Age Group (Children, Adult, Geriatric) |

| Companies covered:: | Lotte Confectionery Co., Ltd., Orion Corporation, SPC Group, Crown Confectionery Co., Ltd, Binggrae Co., Ltd., Haitai Confectionery & Foods Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is increasing interest in healthier versions of confectionery, in the form of low-sugar, organic, and functional ones. The market is reacting with the launch of products enriched with vitamins, minerals, and other health-enhancing ingredients to serve health-aware customers. Furthermore, the rising disposable income of regional consumers has been driving an increase in discretionary spending on confectionery products, supporting market growth.

Restraining Factors

The production costs may be impacted by changes in the price of raw materials like sugar and cocoa. Furthermore, consumer purchasing patterns may be influenced by inflationary pressures and economic concerns, which could have an effect on the demand for non-essential goods like confections.

Market Segmentation

The South Korea confectionery market share is classified into type and age group.

- The chocolate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea confectionery market is segmented by type into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. While chocolate is number one in value terms, the sugar confectionery segment, including hard-boiled sweets, mints, gums and jellies, caramels and toffees, and medicated confectionery, also occupies an important part of the market. The segment has appeal among consumers that are looking for a broad assortment of sweet and functional products.

- The adult segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea confectionery market is segmented by age group into children, adult, and geriatric. Among these, the adult segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is further attracted to confectionery products as a result of indulgence, nostalgia, and stress relief, among other factors. Also, the availability of healthier products, such as reduced-sugar and functional sweets, has expanded the appeal of confectionery across adults.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea confectionery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lotte Confectionery Co., Ltd.

- Orion Corporation

- SPC Group

- Crown Confectionery Co., Ltd

- Binggrae Co., Ltd.

- Haitai Confectionery & Foods Co., Ltd.

- Others

Recent Developments:

- In April 2025, Orion, which was famous for its Choco Pie, had announced a $580 million investment to expand snack manufacturing facilities in South Korea, Russia, and Vietnam. The firm plans to construct an integrated manufacturing-to-logistics complex in Jincheon, Korea, scheduled for completion by 2027.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea confectionery Market based on the below-mentioned segments:

South Korea Confectionery Market, By Type

- Hard-Boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

South Korea Confectionery Market, By Age Group

- Children

- Adult

- Geriatric

Need help to buy this report?