South Korea Concentrated Feed Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Protein Concentrates, Energy Concentrates, Mineral Concentrates, Vitamin Concentrates, and Others), By Livestock (Ruminants, Poultry, Swine, Aquaculture, and Others), and South Korea Concentrated Feed Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Concentrated Feed Market Insights Forecasts to 2035

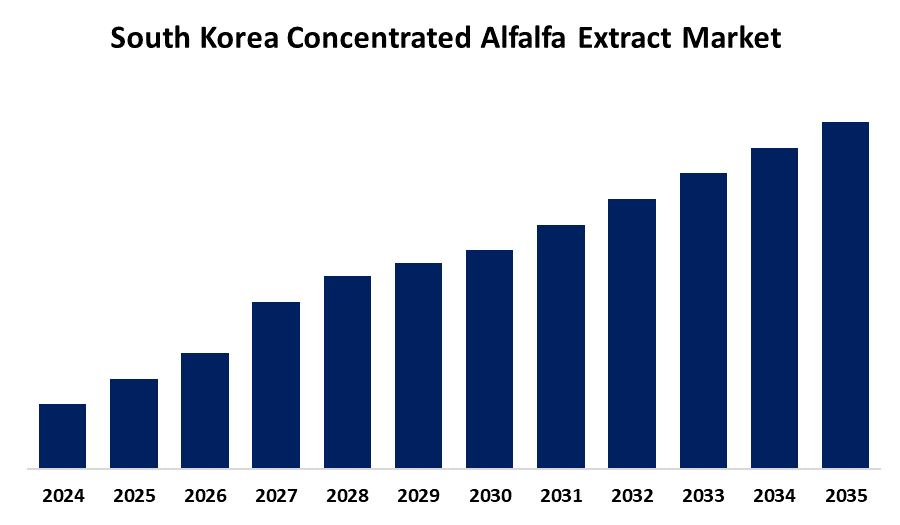

- The South Korea Concentrated Feed Market size is Expected to Grow at a CAGR of around 4.2% from 2025 to 2035

- The South Korea Concentrated Feed Market size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Concentrated Feed Market Size is Anticipated to Grow at a CAGR of 4.2% from 2025 to 2035. The market is driven by technological advancements, increasing consumer demand for quality livestock products, and a focus on sustainability.

Market Overview

The concentrated feed market in South Korea is critical for providing feed for livestock nutrition, especially high-performing animals (poultry, swine, and ruminants). Concentrated feeds are an animal's primary source of nutrients, including proteins, vitamins, and trace minerals. They usually are much higher in nutrients than just grains or by-products, and they have a significant effect on the animal’s improvement in weight gain, production level, and overall health. The concentrated feed product has grown steadily as a result of the basis of sustained meat consumption, an increasing concern surrounding animal health, and commercial raising and intensifying farming models. Government interests on food security and lower imported meat have also played a role in boosting the quality of livestock feed. Leading markets in feed manufacturers are focusing on new and dynamic formulations and precision nutrition technologies to diversify animal diets while limiting feed losses.

Report Coverage

This research report categorizes the market for the South Korea concentrated feed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea concentrated feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea concentrated feed market.

South Korea Concentrated Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product Type, By Livestock and COVID-19 Impact Analysis. |

| Companies covered:: | CP Group, Cargill, Tyson Foods, Purina Animal Nutrition, BRF, Nutreco, JA Zen-Noh and Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The need for high-quality animal protein sources, such as eggs, pigs, and chicken meat, is increasing. Urbanisation, changing dietary habits, and rising disposable income are all contributing factors to the increased demand for protein sources. As a consequence, livestock producers are attempting to incorporate feeding and feed management techniques into their producer-farming practices in order to effectively generate maximum productivity. Concentrated feeds composed of natural protein sources and powders, and/or premixed feeds are a large part of productivity and efficiency and represent one option for livestock producers to optimize their animal growth cycles, reduce mortality and maximize outputs. South Korea feed manufacturers are increasingly adopting data-driven formulation tools and adding value to their products through customization of micronutrient premixes.

Restraining Factors

The reliance on imported raw materials, specifically corn, soymeal, and some feed-grade additives. The vast majority of these components must be imported, and South Korea sources them from other countries, primarily the U.S., Brazil, and China. Market volatility and supply chain issues (e.g., price fluctuation of commodity prices globally and the tensions between countries) leave the local market as vulnerable as possible to price fluctuations and shortages.

Market Segmentation

The South Korea concentrated feed market share is classified into product type and livestock.

- The protein concentrates segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea concentrated feed market is segmented by product type into protein concentrates, energy concentrates, mineral concentrates, vitamin concentrates, and others. Among these, the protein concentrates segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to these are crucial in meeting the high protein demands of animals, especially in poultry and swine feed. Protein concentrates are helpful for muscle development, weight gain, and feed efficiency, making them essential in intensive livestock farming. Given the increasing demand for quality lean meat and production, protein concentrates are playing an ever-increasing role in feed formulations all across South Korea.

- The poultry segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea concentrated feed market is segmented by livestock into ruminants, poultry, swine, aquaculture, and others. Among these, the poultry segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can lead to faster growth rates and improved feed conversion ratios, and disease resistance has increased demand for concentrated feed that is high in nutrients but lower in volume. This sector is likely to remain focused, with an ever-increasing consumption of poultry and feed manufacturers continuing to create targeted solutions for this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea concentrated feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CP Group

- Cargill

- Tyson Foods

- Purina Animal Nutrition

- BRF

- Nutreco

- JA Zen-Noh

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea concentrated feed market based on the below-mentioned segments:

South Korea Concentrated Feed Market, By Product Type

- Protein Concentrates

- Energy Concentrates

- Mineral Concentrates

- Vitamin Concentrates

- Others

South Korea Concentrated Feed Market, By Livestock

- Ruminants

- Poultry

- Swine

- Aquaculture

- Others

Need help to buy this report?