South Korea Coffee Market Size, Share, and COVID-19 Impact Analysis, By Type (Robusta, Arabica, Others), By product (Whole-Bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsule), and South Korea Coffee Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesSouth Korea Coffee Market Insights Forecasts to 2035

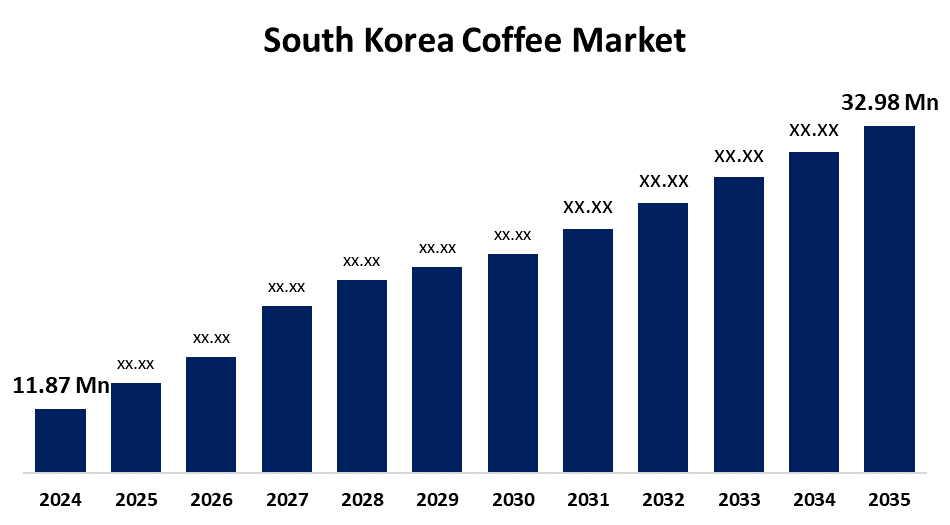

- The South Korea Coffee Market Size was estimated at USD 11.87 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.74% from 2025 to 2035

- The South Korea Coffee Market Size is Expected to Reach USD 32.98 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Coffee Market Size is Anticipated to reach USD 32.98 Million By 2035, Growing at a CAGR of 9.74% from 2025 to 2035. The intersection of cultural integration, technological progress, health trends, popular culture impact, premiumization, coffee chain expansion, RTD segment growth, and the emergence of e-commerce and subscription models together result in the projected growth of the South Korean coffee market.

Market Overview

The South Korea coffee market refers to the production, import, distribution, and domestic consumption of coffee in South Korea. It entails different coffee products like whole beans, ground coffee, instant coffee, ready-to-drink (RTD) beverages, and coffee capsules or pods. The market covers several channels of distribution like coffee shops, convenience stores, supermarkets, e-commerce platforms, and vending machines. Additionally, demand is driven by hectic lifestyles and the need for quick, convenient beverage solutions such as pods and instant coffee. Coffee drinking is linked with productivity and creativity and is attractive to Millennials and Gen Z. Speciality coffee tastes are driven by award-winning baristas and encourage premium coffee experience demand and drive the popularity of local and global coffee shop chains such as Starbucks and Costa. Moreover, technology growth and innovation in products are accelerating growth in the nation's coffee market, facilitating payment and ordering processes. Consistency and quality are guaranteed across coffee chains due to new technologies, which further improve customer experience. Self-service kiosks and mobile ordering enhance efficiency, while innovative techniques such as latte art printing draw consumers. These technologies drive South Korea's growth in coffee culture.

Report Coverage

This research report categorizes the market for the South Korea coffee market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea coffee market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea coffee market.

South Korea Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.87 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 9.74% |

| 2035 Value Projection: | USD 32.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By product and COVID-19 Impact Analysis |

| Companies covered:: | Dong Suh Companies Inc., Namyang Dairy Products Co., Ltd, LOTTE-Nestlé Korea Co., Ltd, Starbucks Corporation, Ediya Co., Ltd., LUIGI LAVAZZA SPA, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing market for ready-to-drink and organic coffee is driven by health-conscious consumers seeking alternatives to carbonated beverages. Regular coffee consumption, in moderation, is associated with potential health benefits including heart health and liver function improvement. Additionally, antioxidants in dark roast coffee may contribute to reducing DNA damage. These health advantages contribute to the increasing popularity of coffee in South Korea.

Restraining Factors

Despite its affordability and convenience, instant coffee in South Korea faces a significant image challenge, as it is widely perceived as inferior to freshly brewed alternatives. This perception hinders market growth, with increasingly quality-conscious consumers shifting toward premium coffee options and higher-end substitutes, thereby limiting the potential of the instant coffee segment.

Market Segmentation

The South Korea coffee market share is classified into type and product.

- The arabica coffee segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea coffee market is segmented by type into robusta, arabica, and others. Among these, the arabica coffee segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increasing numbers of South Korean consumers are choosing premium coffee experiences, and they prefer using Arabica beans for their rich, less bitter taste and lower caffeine levels than Robusta beans. The trend mirrors that around the world in pursuing premium coffee with Arabica beans leading in the specialty coffee segment.

- The instant coffee segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea coffee market is segmented by type into Whole-bean, ground coffee, instant coffee, coffee pods and capsule. Among these, the instant coffee segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This supremacy is caused by its convenience, affordability, and extended shelf life, and thus it occupies the shelf space of many households. Nevertheless, recent trends have caused a movement towards more premium and convenient coffee products, which has resulted in high growth in other product segments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea coffee market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dong Suh Companies Inc.

- Namyang Dairy Products Co., Ltd

- LOTTE-Nestlé Korea Co., Ltd

- Starbucks Corporation

- Ediya Co., Ltd.

- LUIGI LAVAZZA SPA

- Others

Recent Developments:

- In April 2025, Canadian coffee operator Tim Hortons reinforced its presence in Asia by introducing its first retail packaged coffee line in South Korea. The introduction was designed to increase stronger brand connection among South Korean consumers as well as access the country's high-value in-home coffee market. The introduction represented an important strategic move in the company's global retail expansion strategy.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea coffee market based on the below-mentioned segments:

South Korea Coffee Market, By Type

- Robusta

- Arabica

- Others

South Korea Coffee Market, By product

- Whole-Bean

- Ground Coffee

- Instant Coffee

- Coffee Pods and Capsule

Need help to buy this report?