South Korea Cocoa Powder Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Cocoa Powder, Alkalized Cocoa Powder), By Application (Bakery, Beverages, Confectionery, Dairy, Nutraceuticals), and South Korea Cocoa Powder Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Cocoa Powder Market Insights Forecasts to 2035

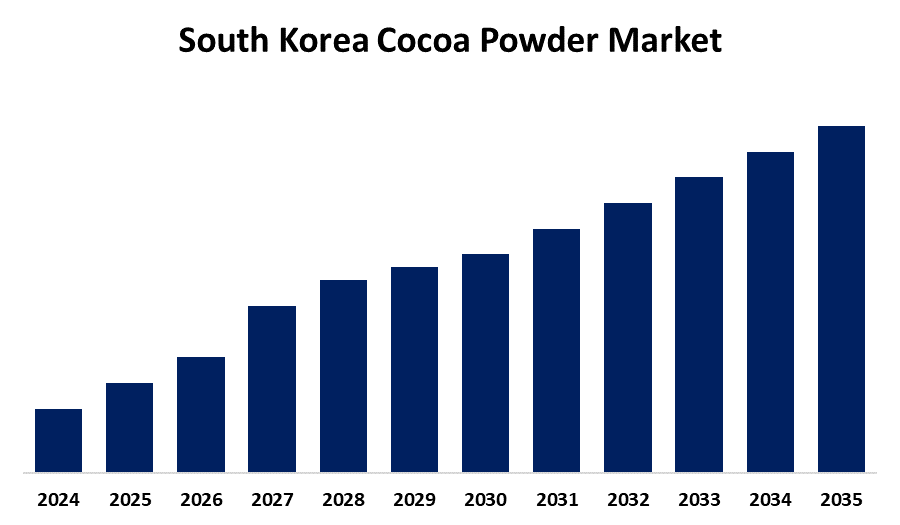

- The South Korea Cocoa Powder Market size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035

- The South Korea Cocoa Powder Market size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Cocoa Powder Market Size is Anticipated to Grow at a CAGR of 4.1% from 2025 to 2035. The market is driven by increasing demand for chocolate-flavored bakery, beverage, and dairy products. Growing health awareness and interest in antioxidant-rich, clean-label ingredients also support market expansion.

Market Overview

South Korean cocoa powder market is growing steadily with increasing demand for chocolate-flavored food and beverages in bakery, beverage, confectionery, and dairy. Cocoa powder, being rich in chocolaty taste and antioxidant property, has increased application in home and commercial food preparation. Growing home baking popularity, dessert specialty trends, and healthier nutrition formulation is also increasingly fueling its application in cakes, muffins, hot chocolate beverages, and flavored milk. Alkalized cocoa powder is also gaining momentum for its better solubility and less bitter taste, particularly in beverage and food-pouch formats. Natural cocoa powder, however, gains traction with the clean-label and low-processing product lines. Increased demand for superfoods and functional food ingredients is backing cocoa powder's role in nutraceuticals and health foods. The challenges are import reliance and market price volatility, but the market still grows due to robust consumer demand, increased online penetration, and enhanced cocoa sourcing, flavor offerings, and foodservice channels in South Korea.

Report Coverage

This research report categorizes the market for the South Korea cocoa powder market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea cocoa powder market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea cocoa powder market.

South Korea Cocoa Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Barry Callebaut AG, Cargill, Incorporated, Olam International, Nestle S.A., The Hershey Company, Ghirardelli Chocolate Company, Blommer Chocolate Company and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

South Korean demand for cocoa powder is being fueled by increasing demand for chocolate-based bakery, beverage, and dairy foods owing to shifting consumer trend toward indulgent but healthier foods. Cocoa powder is preferred due to its strong flavor, antioxidant nature, and clean-label status and is applied as a principal ingredient in traditional and functional food applications. The trend for home baking, well-being, and premium dessert consumption combined with innovation in alkalized and organic cocoa types drives market adoption in many different food applications.

Restraining Factors

The South Korean cocoa powder industry is restrained by its high dependence on imported cocoa, making it exposed to global price shocks and supply risks. Indigenous processing capacity shortages and competition from artificial flavoring products are also threats to growth. Furthermore, emerging health concerns regarding the use of sugar in chocolate foods may impact demand.

Market Segmentation

The South Korea cocoa powder market share is classified into type and application.

- The alkalized cocoa powder segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cocoa powder market is segmented by type into natural cocoa powder and alkalized cocoa powder. Among these, the alkalized cocoa powder segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This type is commonly utilized in processed food due to its less bitter taste, darker color, and greater solubility, favored by drinks, cake, and instant food.

- The bakery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cocoa powder market is segmented by application into bakery, beverages, confectionery, dairy, and nutraceuticals. Among these, the bakery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cocoa powder is extensively applied in baked food products such as cakes, muffins, brownies, and cookies and is thus a staple ingredient in domestic as well as industrial bakery products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea cocoa powder market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barry Callebaut AG

- Cargill, Incorporated

- Olam International

- Nestle S.A.

- The Hershey Company

- Ghirardelli Chocolate Company

- Blommer Chocolate Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea cocoa powder market based on the below-mentioned segments:

South Korea Cocoa Powder Market, By Type

- Natural Cocoa Powder

- Alkalized Cocoa Powder

South Korea Cocoa Powder Market, By Application

- Bakery

- Beverages

- Confectionery

- Dairy

- Nutraceuticals

Need help to buy this report?