South Korea Cocoa Butter Equivalent (CBE) Market Size, Share, and COVID-19 Impact Analysis, By Source (Palm Oil, Shea Butter, Sal Fat, Kokum Butter, Mango Butter, and Others), By Application (Confectionery, Bakery, Cosmetics, Pharmaceuticals, and Others), and South Korea Cocoa Butter Equivalent (CBE) Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Cocoa Butter Equivalent (CBE) Market Insights Forecasts to 2035

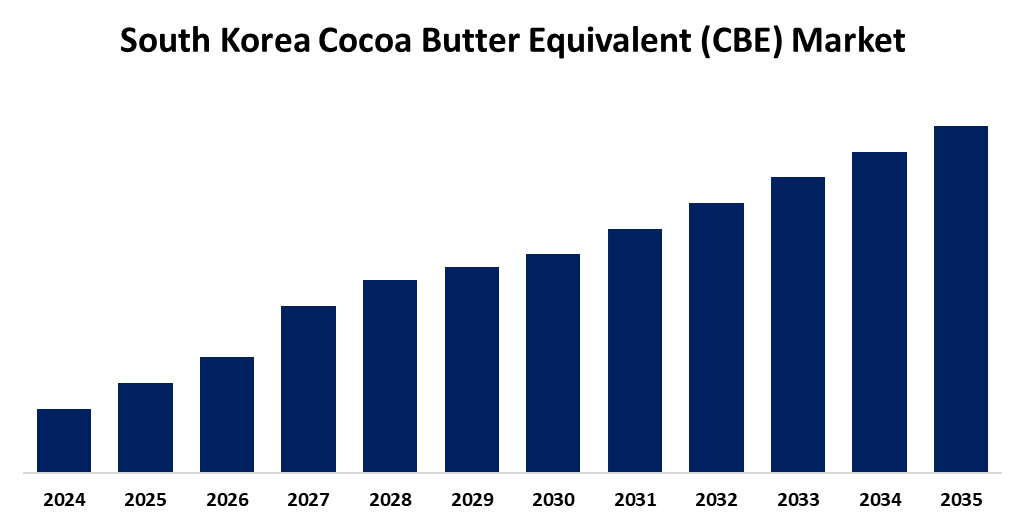

- The South Korea Cocoa Butter Equivalent (CBE) Market Size is Expected to Grow at a CAGR of around 4.8% from 2025 to 2035

- The South Korea Cocoa Butter Equivalent (CBE) Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Cocoa Butter Equivalent (CBE) Market Size is anticipated to Grow at a CAGR of 4.8% from 2025 to 2035. The market is driven by rising cocoa butter prices and growing demand for cost-effective, plant-based fat alternatives. Manufacturers favor CBEs for their functional benefits in texture, shelf life, and stability across confectionery, bakery, and cosmetic applications.

Market Overview

The South Korea Market Size for Cocoa Butter Equivalent (CBE) is witnessing steady growth on account of the rising demand for cost-efficient and functionally equivalent substitutes for cocoa butter across various industries. CBEs are employed widely in chocolate, confectionery, and bakery foods because they have a comparable melting profile, improved heat stability, and longer shelf life. Produced from palm oil, shea butter, sal fat, kokum butter, and mango butter, CBEs are increasing in appeal to Korean manufacturers seeking to cut down on costs of production as well as cope with cocoa supply fluctuations. As consumers demand increasingly more plant-based, sustainable, and clean-label goods, the market is witnessing growth in the application of CBEs for food as well as non-food uses. While high-end chocolate companies still demand real cocoa butter for its superior taste and texture, CBEs are in heavy use in mass market. The industry is also underpinned by the creation of cosmetic and pharma formulations, further solidifying CBEs as a strategic part of Koreas shifting ingredient scene.

Report Coverage

This research report categorizes the market for the South Korea cocoa butter equivalent (CBE) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea cocoa butter equivalent (CBE) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the south korea cocoa butter equivalent (CBE) market.

South Korea Cocoa Butter Equivalent (CBE) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Cargill, Incorporated, Wilmar International Limited, Barry Callebaut AG, Olam International, The Hershey Company, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean CBE market is driven by the rising price of cocoa butter, which compels manufacturers to use low-cost, stable sources. CBEs are satisfactory with regard to melting characteristics, shelf life, and texture and find applications in confectionery and bakery sectors. Growing demand for plant-based, eco-friendly ingredients also drives the consumption of palm, shea, and mango butter-derived CBEs. In addition, rising usage in pharmaceuticals and cosmetics drives growth, as natural, functional fats become more highly demanded within food and personal care products.

Restraining Factors

South Korean CBE market is re by strict regulation of CBEs, restricting the use of CBE in high-end chocolate products, and labeling regulations. Misconception that CBEs lack taste and quality compared to genuine cocoa butter also discourages adoption, particularly in upscale confectionery and personal care use.

Market Segmentation

The South Korea Cocoa Butter Equivalent (CBE) Market share is classified into source and application.

- The palm oil segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cocoa butter equivalent (CBE) market is segmented by source into palm oil, shea butter, sal fat, kokum butter, mango butter, and others. Among these, the palm oil segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its cheap, readily available, and chocolate and bakery recipe compatible, thus the base of choice for most commercial CBEs.

- The confectionery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cocoa butter equivalent (CBE) market is segmented by application into confectionery, bakery, cosmetics, pharmaceuticals, and others. Among these, the confectionery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. CBEs are used in chocolate bars, coatings, and compound chocolates due to their strong textural and thermal properties for stable production in Koreas hot and humid climate.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea cocoa butter equivalent (CBE) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Wilmar International Limited

- Barry Callebaut AG

- Olam International

- The Hershey Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea cocoa butter equivalent (CBE) market based on the below-mentioned segments:

South Korea Cocoa Butter Equivalent (CBE) Market, By Source

- Palm Oil

- Shea Butter

- Sal Fat

- Kokum Butter

- Mango Butter

- Others

South Korea Cocoa Butter Equivalent (CBE) Market, By Application

- Confectionery

- Bakery

- Cosmetics

- Pharmaceuticals

- Others

Need help to buy this report?