South Korea Clodinafop Propargyl Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Herbicide Formulations and Technical Grade), By Application (Agriculture, Horticulture, and Others), By Crop Type (Cereals, Grains, and Others), and South Korea Clodinafop Propargyl Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureSouth Korea Clodinafop Propargyl Market Insights Forecasts to 2035

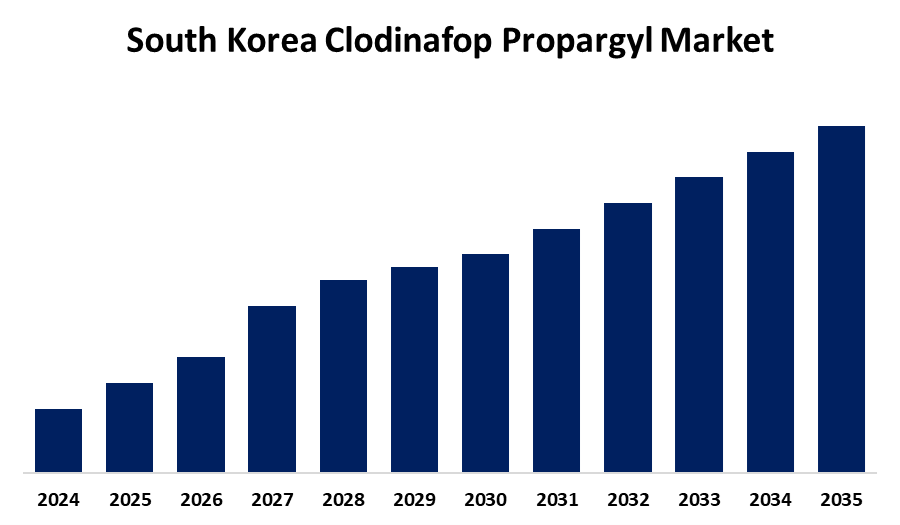

- The South Korea Clodinafop Propargyl Market Size is Expected to Grow at a CAGR of around 5.6% from 2025 to 2035

- The South Korea Clodinafop Propargyl Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Clodinafop Propargyl Market Size is anticipated to Grow at a CAGR of 5.6% from 2025 to 2035. The market is driven by increasing demand for selective grass weed control in cereal crops like wheat and barley. Rising adoption of modern farming practices and government focus on improving crop yields further support market growth.

Market Overview

South Korean Clodinafop Propargyl Market Size is slowly growing in the crop protection sector as the demand for effective post-emergence herbicides in cereal farming is growing steadily. Clodinafop propargyl is highly used in the management of weeds in wheat and barley fields with high selectivity and effectiveness. As more sophisticated farming activities are carried out in South Korea, more stress is placed on the effectiveness of herbicides, minimizing labor usage, and enhancing the quality of crop yields. While remaining a specialty in total herbicide application, clodinafop propargyl boasts potential agricultural policy support, availability for importation, and increasing popularity among cereal producers. Regulatory concern, though especially regarding residues and groundwater effects, constitutes limits for general acceptance. Despite all these challenges, the product continues to attract interest as a tool for integrated weed management practices, especially in grain-dominant farming regions.

Report Coverage

This research report categorizes the market for the South Korea clodinafop propargyl market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea clodinafop propargyl market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea clodinafop propargyl market.

South Korea Clodinafop Propargyl Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.6% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Bayer CropScience AG, Syngenta AG, BASF SE, Nufarm Limited, Adama Agricultural Solutions Ltd., UPL Limited, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing demand for post-emergent herbicides in cereal crops like wheat and barley is driving the market. Farmers want selective products to keep control of resistant grass weeds without affecting the crop or its yield. Increasing adoption of mechanized and improved agriculture practices, combined with government programs to increase agricultural productivity, fuels the markets growth. In addition, the continuous need for clodinafop propargyl in agricultural belts is sustained by increased responsiveness to herbicide rotation and integrated weed management.

Restraining Factors

Environmental regulations for herbicide residues in the environment and contamination of groundwater are restraining the market. Low levels of awareness among small-scale farmers, reliance on foreign technical-grade material, and the competitive market presence of other herbicides are constraints against wider market use and multiple product use.

Market Segmentation

The South Korea Clodinafop Propargyl Market share is classified into product type and application.

- The herbicide formulations segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea clodinafop propargyl market is segmented by product type into herbicide formulations and technical grade. Among these, the herbicide formulations segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to ready-to-use products are well accepted by consumers based on ease of application, consistent performance, and retail coverage availability. Examples include emulsifiable concentrates and other commercial products developed to handle local weed issues. Formulated products provide higher convenience and availability from agri-input shops and cooperatives.

- The agriculture segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea clodinafop propargyl market is segmented by application into agriculture, horticulture, and others. Among these, the agriculture segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because clodinafop propargyl is used extensively in the development of barley and wheat. The efficiency and selectivity of the herbicide towards graminoid weeds make it ideal for use in the field where yield and efficiency of weed control are of high priority. Its application in horticulture is still constrained by crop susceptibility as well as other weed control methods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea clodinafop propargyl market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer CropScience AG

- Syngenta AG

- BASF SE

- Nufarm Limited

- Adama Agricultural Solutions Ltd.

- UPL Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea clodinafop propargyl market based on the below-mentioned segments:

South Korea Clodinafop Propargyl Market, By Product Type

- Herbicide Formulations

- Technical Grade

South Korea Clodinafop Propargyl Market, By Application

- Agriculture

- Horticulture

- Others

Need help to buy this report?