South Korea Cling Films Market Size, Share, and COVID-19 Impact Analysis, By Material (Polyvinyl Chloride, Polyethylene, Polypropylene, and Polyvinylidene Chloride), By End-use (Food & Beverage, Automotive, and Healthcare), and South Korea Cling Films Market Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Cling Films Market Insights Forecasts to 2035

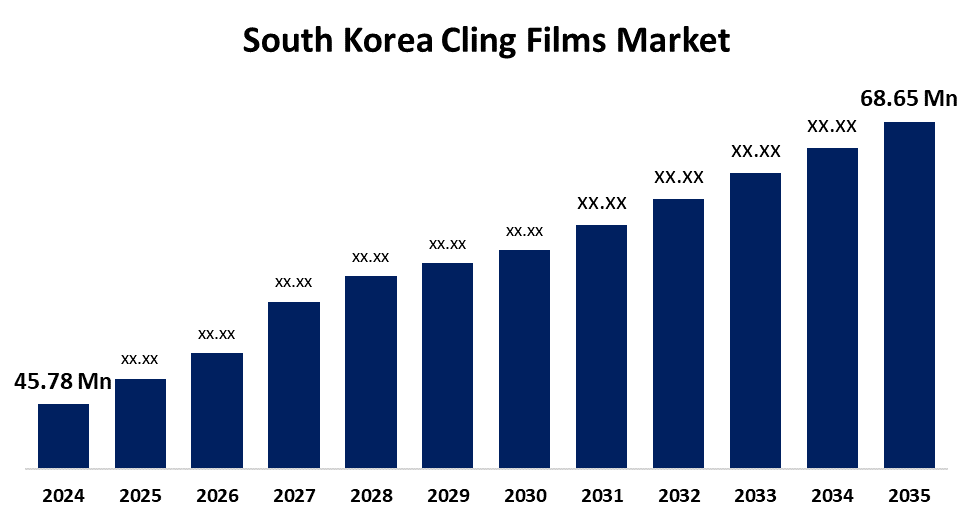

- The South Korea Cling Films Market Size Was Estimated at USD 45.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.75% from 2025 to 2035

- The South Korea Cling Films Market Size is Expected to Reach USD 68.65 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Cling Films Market Size is Anticipated to Reach USD 68.65 Million by 2035, Growing at a CAGR of 3.75% from 2025 to 2035. The increased need for clean and easy food packaging, particularly in homes and the foodservice sector, is fueling the cling film market.

Market Overview

The cling films market refers to the industry focused on the production and distribution of thin plastic films, typically made from polyethylene or PVC, used for wrapping and preserving food and other perishable items. Cling films offer benefits such as extending shelf life, preventing contamination, and maintaining food freshness. Growing awareness of hygiene, rising demand for food packaging, and increasing use in households and commercial kitchens present significant opportunities for market expansion. Moreover, advancements in biodegradable and recyclable cling films align with sustainability trends. Government initiatives promoting eco-friendly packaging, waste reduction, and food safety standards, such as subsidies for biodegradable alternatives and stricter plastic regulations, are encouraging manufacturers to innovate and shift toward sustainable solutions, driving growth and transformation in the cling films market.

Report Coverage

This research report categorizes the market for South Korea cling films market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea cling films market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea cling films market.

South Korea Cling Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 45.78 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.75% |

| 2035 Value Projection: | USD 68.65 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Material, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | Hyosung Chemical Corporation, Kolon Industries Inc., Kumho Polychem Co., Ltd., HDC Hyundai EP, Lotte Chemical Corporation, J&J Co., Ltd., AllQ Company, POWERWRAP Corporation, Livingcos Co., Ltd., Hosan P&T Co., Ltd., Mapro Co., Ltd., Seokwang TPU Co., Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for convenient and hygienic food packaging, especially in urban households and the foodservice industry. Rising awareness of food safety and shelf-life extension boosts usage in both residential and commercial sectors. The growth of the retail and e-commerce food sectors further fuels demand for protective packaging. Additionally, innovations in biodegradable and eco-friendly cling films, supported by government regulations on single-use plastics, are encouraging manufacturers to adopt sustainable materials, accelerating market growth.

Restraining Factors

The market faces mounting environmental concerns, as traditional cling films, typically made of non-biodegradable PVC or LDPE contribute significantly to plastic pollution and trigger regulatory backlash. Health worries persist around PVC cling films, linked to potential migration of plasticizers into food, especially under heat or contact with fats.

Market Segmentation

The South Korea cling films market share is classified into material and end-use.

- The polyvinyl chloride segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cling films market is segmented by material into polyvinyl chloride, polyethylene, polypropylene, and polyvinylidene chloride. Among these, the polyvinyl chloride segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its excellent stretchability, clarity, and strong cling properties, making it ideal for food packaging. PVC’s cost-effectiveness and ability to preserve freshness and prevent contamination further drive its demand. Widespread use in supermarkets, households, and the foodservice industry supports its growth. Despite environmental concerns, innovations in phthalate-free and recyclable PVC films are expected to sustain a strong CAGR during the forecast period.

- The food & beverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cling films market is segmented by end-use into food & beverage, automotive, and healthcare. Among these, the food & beverage segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The high demand for hygienic, cost-effective food packaging solutions. Cling films are widely used for wrapping fresh produce, meat, and ready-to-eat meals to extend shelf life and maintain quality. The rise in urban lifestyles, growing food delivery services, and increased retail food sales further fuel this demand. Additionally, consumer focus on food safety and freshness continues to drive significant CAGR growth in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea cling films market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyosung Chemical Corporation

- Kolon Industries Inc.

- Kumho Polychem Co., Ltd.

- HDC Hyundai EP

- Lotte Chemical Corporation

- J&J Co., Ltd.

- AllQ Company

- POWERWRAP Corporation

- Livingcos Co., Ltd.

- Hosan P&T Co., Ltd.

- Mapro Co., Ltd.

- Seokwang TPU Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea cling films market based on the below-mentioned segments:

South Korea Cling Films Market, By Material

- Polyvinyl Chloride

- Polyethylene

- Polypropylene

- Polyvinylidene Chloride

South Korea Cling Films Market, By End-use

- Food & Beverage

- Automotive

- Healthcare

Need help to buy this report?