South Korea Chocolate Market Size, Share, and COVID-19 Impact Analysis, South Korea Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Product Variant (Softline/selflines, Boxed Assortments, Seasonal Chocolates, Molded Chocolate), By Product Type (Dark chocolate, Milk chocolate), By Distribution Channel (Supermarkets, Convenience stores, Retailers, Online), and South Korea Chocolate Market Insights Forecasts 2022 - 2032

Industry: Food & BeveragesSouth Korea Chocolate Market Insights Forecasts to 2032

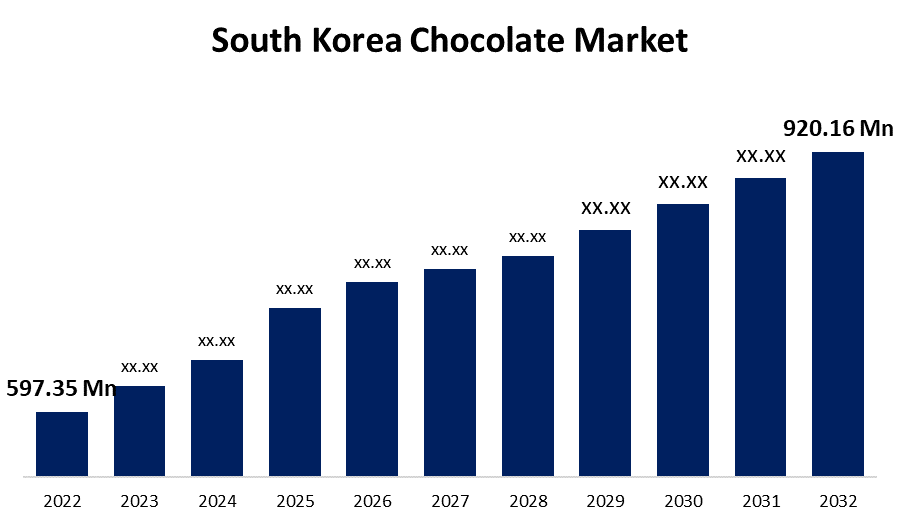

- The South Korea Chocolate Market Size was valued at USD 597.35 Million in 2022.

- The Market Size is Growing at a CAGR of 4.4 % from 2022 to 2032.

- The South Korea Chocolate Market Size is expected to reach USD 920.16 Million by 2032.

Get more details on this report -

The South Korea Chocolate Market Size is expected to reach USD 920.16 Million by 2032, at a CAGR of 4.4% during the forecast period 2022 to 2032.

Chocolate industry, the launch of new flavors, combined with changing consumer tastes, is a significant market driver. The South Korea chocolate market report provides a comprehensive assessment of the market.

Market Overview

Chocolate, made from roasted cacao beans, is widely used in the confectionery and pastry industries. According to health experts, moderate chocolate consumption raises serotonin levels, which calm the brain and have antidepressant properties. It also causes the body to release endorphins, which immediately improve mood. Consuming chocolate also lowers the stress hormone cortisol. Instead of relying on medication, consumers would prefer to incorporate health-promoting ingredients into their regular diet. In general, chocolate accounts for 42% of the South Korean confectionary industry. It outperforms chewing gum and sugar-based confectionery. However, if molten chocolate is required, South Korea has a plethora of options. There are many chocolate flavor options available in Seoul, in particular. French-trained and self-taught, the creators are gaining a reputation in Korea. Chocolate is available in a variety of forms in South Korea, including boxed chocolates, molded chocolate bars, chocolate-covered bars, bite-sized versions, milk chocolate, and so on.

Report Coverage

This research report categorizes the market for the south Korean chocolate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean chocolate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean chocolate market.

South Korea Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 597.35 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.4% |

| 2032 Value Projection: | USD 920.16 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Variant, By Product Type |

| Companies covered:: | Crown Confectionery Co., Ltd., The Hershey Company, Orion Confectionery Co, Ltd., Mars, Incorporated, Ferrero International S.A., Lotte Corporation, Meiji Holdings Co. Ltd, Perfetti Van Melle Group, Mondelez International, Inc., Loacker USA Inc., Others, and others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The decrease in the level of inflation and the increase in the level of Gross Income indicate that people have more money in their hands. People's purchasing power increases as their income rises. That is why people are demanding high-quality goods. This is one of the primary reasons that chocolate consumption in South Korea is increasing and the industry is expanding. Consumers want small premium items and high-quality products.

Restraining Factors

The cocoa and chocolate markets are expanding at a rapid pace. As a result, the shortage of cocoa beans will stymie future growth in the cocoa and chocolate markets. Since chocolate contains saturated fats and has negative health effects, consumer interest is shifting to other alternatives, such as snacks, limiting the growth of the chocolate market in South Korea.

Market Segment

- In 2022, the molded chocolate segment accounted for the largest revenue share over the forecast period.

Based on the product variant, the South Korean chocolate market is segmented into soft lines/selflines, boxed assortments, seasonal chocolates, and molded chocolate. Among these, the molded chocolate segment has the largest revenue share over the forecast period. Molded chocolate is the most popular. This is due to changing tastes and an increase in demand for premium products. Seasonal and boxed items, on the other hand, have grown in popularity over the years.

- In 2022, the dark chocolate segment accounted for the largest revenue share over the forecast period.

Based on product type, the South Korean chocolate market is segmented into dark chocolate and milk chocolate. Among these, the dark chocolate segment has the largest revenue share over the forecast period. Dark chocolate is the most popular. This is due not only to the rich flavor but also to the health benefits it provides.

- In 2022, the supermarket segment is expected to hold the largest share of the South Korean chocolate market during the forecast period.

Based on the distribution channel, the South Korean chocolate market is classified into supermarkets, convenience stores, retailers, and online. Among these, the supermarket segment is expected to hold the largest share of the South Korean chocolate market during the forecast period. Consumers prefer physical stores because they can get immediate access to the product and choose it in person for a better experience. Furthermore, as consumer demand grows, manufacturers are opening stores in malls, which will increase chocolate sales in supermarkets and hypermarkets in the coming years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea chocolate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Crown Confectionery Co., Ltd.

- The Hershey Company

- Orion Confectionery Co, Ltd.

- Mars, Incorporated

- Ferrero International S.A.

- Lotte Corporation

- Meiji Holdings Co. Ltd

- Perfetti Van Melle Group

- Mondelez International, Inc.

- Loacker USA Inc.

- Others

-

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

-

Recent Development

- In March 2023, Lotte Confectionery Co. of South Korea announced its rebranding as Lotte Wellfood as part of its continued global expansion. The company sells sweets, chocolates, biscuits, and snacks, and market expansion will help it grow even more.

-

- In March 2022, Lotte Group announced the merger of its confectionery and foodstuff businesses, Lotte Food in South Korea.

- Market Segment

-

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korean chocolate Market based on the below-mentioned segments:

South Korea Chocolate Market, By Product Variant

- Softline/selflines

- Boxed Assortments

- Seasonal Chocolates

- Molded Chocolate.

-

South Korean Chocolate Market, By Product Type

- Dark chocolate

- Milk chocolate

-

South Korean Chocolate Market, By Distribution Channel

- Supermarkets

- Convenience stores

- Retailers

- Online

Need help to buy this report?