South Korea Cement Market Size, Share, and COVID-19 Impact Analysis, By Type (Blended, Portland, and Others), By End Use (Residential, Commercial, and Infrastructure), and South Korea Cement Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingSouth Korea Cement Market Insights Forecasts to 2035

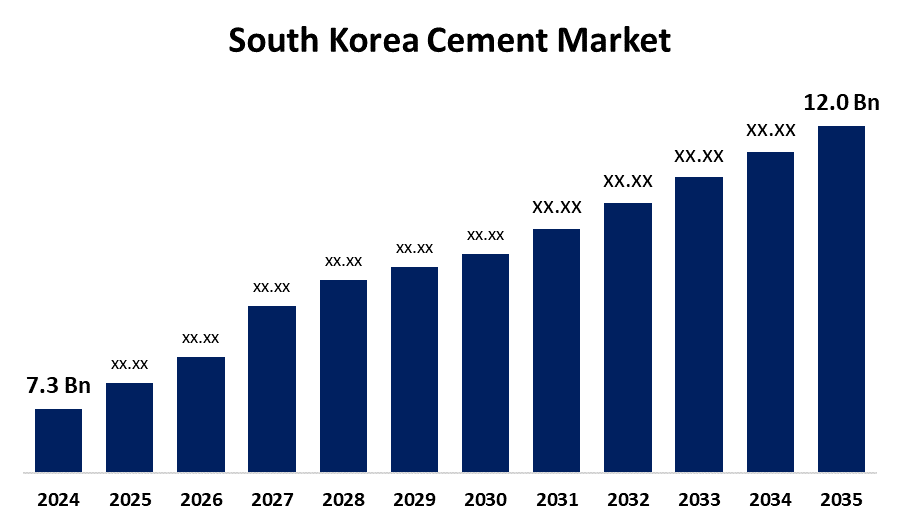

- The South Korea Cement Market Size was Estimated at USD 7.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.62% from 2025 to 2035

- The South Korea Cement Market Size is Expected to Reach USD 12.0 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Cement Market Size is anticipated to reach USD 12.0 Billion by 2035, growing at a CAGR of 4.62% from 2025 to 2035. The market is being driven by the growing innovations and advancements in cement manufacturing technologies that can increase cement's quality, lower costs, and improve efficiency, making it more appealing for a range of construction applications.

Market Overview

The South Korean cement market encompasses the produce, sale, and use of cement products in South Korea are all included in the country's cement market. For the construction of concrete and mortar, which are necessary for infrastructure, commercial, and residential projects, cement acts as a basic binding agent. Domestic demand, production capacity, environmental regulations, and the dynamics of international trade are some of the factors that impact the market. Additionally, with a number of important factors, the cement market in South Korea is expanding rapidly. First, there is a need for significant infrastructure development due to the ongoing regional urbanization boom. The demand for cement as a basic building material is thus driven by an increase in construction activities. Moreover, government initiatives focusing on affordable housing and smart city projects contribute significantly to market expansion. Cement consumption is further increased by South Korea's growing middle class and growing population, which drive infrastructure and building projects.

Report Coverage

This research report categorizes the market for the South Korea cement market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea cement market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea cement market.

South Korea Cement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.62% |

| 2035 Value Projection: | USD 12.0 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 272 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type and By End Use |

| Companies covered:: | Asia Cement Co. Ltd, Hanil Holdings Co Ltd, Sampyo Cement, Ssangyong C&E Co. Ltd., Sungshin Cement Co. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of eco-friendly cement varieties is emphasized by the increased awareness and adoption of sustainable construction practices, opening up a new market opportunity. Concurrently, technological developments in cement manufacturing improve quality and efficiency, supporting the market's upward trend. In conclusion, a confluence of urbanization, government initiatives, population growth, sustainability trends, and technological innovations collectively propel the thriving trajectory of the cement market in South Korea during the forecast period.

Restraining Factors

The Cement manufacturers now face higher compliance costs as a result of South Korea's stricter environmental regulations. These regulations are aimed at lowering carbon emissions, restricting particulate matter, and encouraging the use of environmentally friendly products. To meet new standards, businesses must make investments in alternative fuels, low-carbon cement production techniques, and sophisticated filtration systems, which will increase operating costs.

Market Segmentation

The South Korea Cement Market share is classified into type and end use.

- The portland segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cement market is segmented by type into blended, portland, and others. Among these, the portland segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is explained by its extensive use in a variety of building projects, including high-performance infrastructure like nuclear power plants and high-speed railroads, where its exceptional strength and durability are crucial.

- The infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea cement market is segmented by end use into residential, commercial, and infrastructure. Among these, the infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is a result of continuous government spending on large-scale urban development projects, bridges, and roads, all of which demand a significant amount of cement.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea cement market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asia Cement Co. Ltd

- Hanil Holdings Co Ltd

- Sampyo Cement

- Ssangyong C&E Co. Ltd.

- Sungshin Cement Co. Ltd.

- Others

Recent Developments:

- In September 2024, in response to high domestic cement prices, the South Korean government announced plans to import cement from China, which was reportedly 15% cheaper than locally produced cement. The preparations for importation, including certification and the construction of storage facilities, were estimated to take about two years.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Cement Market based on the below-mentioned segments:

South Korea Cement Market, By Type

- Blended

- Portland

- Others

South Korea Cement Market, By End Use

- Residential

- Commercial

- Infrastructure

Need help to buy this report?