South Korea CBCT Dental Imaging Market Size, Share, and COVID-19 Impact Analysis, By Type of Detector (Flat Panel Detectors and Image Intensifier), By Application (Dental Implants, Endodontics, Orthodontics, and Others), and South Korea CBCT Dental Imaging Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea CBCT Dental Imaging Market Insights Forecasts to 2035

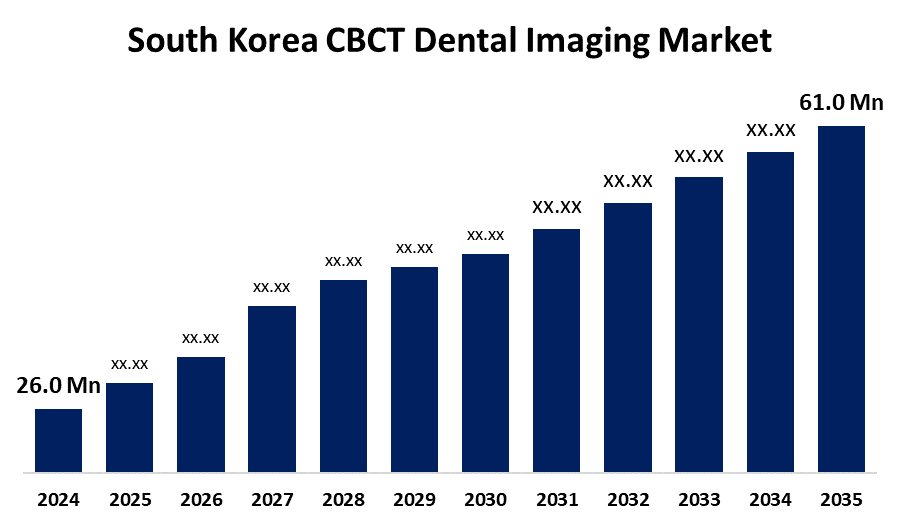

- The South Korea CBCT Dental Imaging Market Size was Estimated at USD 26.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.06% from 2025 to 2035

- The South Korea CBCT Dental Imaging Market Size is Expected to Reach USD 61.0 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea CBCT Dental Imaging Market Size is anticipated to reach USD 61.0 Million by 2035, growing at a CAGR of 8.06% from 2025 to 2035. by the government's support of cutting-edge medical technology, the growing demand for minimally invasive dental procedures, and the growing use of high-resolution 3D imaging.

Market Overview

The market for CBCT (Cone-Beam Computed Tomography) dental imaging in South Korea is the area of the medical imaging sector devoted to the creation, marketing, and application of CBCT systems for dental applications. To procedures like dental implants, endodontics, orthodontics, and oral surgery, these systems offer 3D imaging, facilitating accurate diagnosis and treatment planning. Additionally, with a number of funding initiatives and programs targeted at modernizing healthcare practices, the South Korean government is actively supporting cutting-edge dental technologies. Healthcare providers now have easier access to dental imaging technologies thanks to recent policies that have allocated funds for research and development. More dental offices will probably make CBCT system investments as a result, improving their diagnostic capabilities. These positive government initiatives, which support national health goals centered on enhancing the quality of dental care, are therefore anticipated to contribute to the strong growth of the South Korean CBCT Dental Imaging Market Industry.

Report Coverage

This research report categorizes the market for the South Korea CBCT dental imaging market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea CBCT dental imaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea CBCT dental imaging market.

South Korea CBCT Dental Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26.0 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.06% |

| 2035 Value Projection: | USD 61.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 172 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type of Detector and By Application |

| Companies covered:: | Osstem Implant Co. Ltd., HDXWILL Co. Ltd., Ray Co. Ltd., Genoray Co. Ltd., Vatech Co. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The CBCT dental imaging market in South Korea is expanding significantly as a result of improvements in imaging technology. Dental practitioners are finding CBCT to be a more attractive alternative due to advancements like faster scanning times and higher-resolution images. Recent advances in image processing using artificial intelligence have the potential to improve diagnostic precision and raise the bar for care. This trend of advancing dental imaging technologies is supported by a large number of patents submitted by regional businesses. Dental professionals are consequently spending more money on CBCT systems, which is propelling the South Korean market's expansion.

Restraining Factors

The capital investment needed for CBCT systems is high and typically ranges from tens to hundreds of thousands of dollars. These systems are technologically sophisticated. For independent or small dental practices, particularly those with tight budgets, this hefty upfront expense may be unaffordable. Because of this, many providers choose to use alternative imaging techniques or postpone adoption, which slows market penetration.

Market Segmentation

The South Korea CBCT dental imaging market share is classified into type of detector and application.

- The flat panel detectors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea CBCT dental imaging market is segmented by type of detector into flat panel detectors and image intensifier. Among these, the flat panel detectors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for Flat Panel Detectors is fueled by dentists' increased awareness of patient safety and technological advancements, which greatly influences the dynamics of the market as a whole. Image intensifiers, on the other hand, maintain their market share because of their capacity to improve image quality under a range of lighting conditions, which makes them useful in a variety of clinical settings. Although both kinds of detectors are used in practice, modern dental facilities are more drawn to Flat Panel Detectors because of their reputation for being easier to use and producing consistently high-quality results. The operational preferences of dental facilities and particular use cases frequently influence the selection of these detectors.

- The dental implants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea CBCT dental imaging market is segmented by application into dental implants, endodontics, orthodontics, and others. Among these, the dental implants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Dental implants are extremely important because they allow for accurate measurements of bone structure, which is essential for implant placement success.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea CBCT dental imaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Osstem Implant Co. Ltd.

- HDXWILL Co. Ltd.

- Ray Co. Ltd.

- Genoray Co. Ltd.

- Vatech Co. Ltd.

- Others

Recent Developments:

- In March 2023, Osstem had launched the T2 Plus, an upgraded version of its CBCT machine. The T2 Plus delivered superior image quality and higher resolution, addressing the growing demand for precise diagnostic tools

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea CBCT Dental Imaging Market based on the below-mentioned segments:

South Korea CBCT Dental Imaging Market, By Type of Detector

- Flat Panel Detectors

- Image Intensifier

South Korea CBCT Dental Imaging Market, By Application

- Dental Implants

- Endodontics

- Orthodontics

- Others

Need help to buy this report?