South Korea Carbon Battery Bank Market Size, Share, and COVID-19 Impact Analysis, By Type (Carbon Zinc, Alkaline Carbon, Lithium Carbon, and Others), By Application (Consumer Electronics, Industrial Equipment, Power Utilities, Automotive, and Others), By End-Use (Residential, Commercial, Military, and Others), and South Korea Carbon Battery Bank Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerSouth Korea Carbon Battery Bank Market Insights Forecasts to 2035

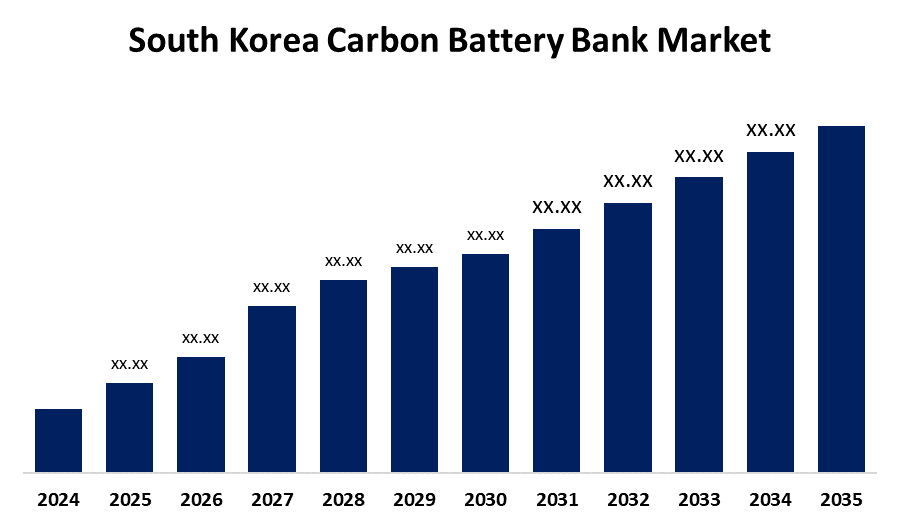

- The South Korea Carbon Battery Bank Market size is Expected to Grow at a CAGR of around 7.3% from 2025 to 2035

- The South Korea Carbon Battery Bank Market size is expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Carbon Battery Bank Market Size is anticipated to grow at a CAGR of 7.3% from 2025 to 2035. The market is driven by rising demand for cost-effective and reliable backup energy storage systems, growing deployment of renewable energy, and advancements in carbon-based battery technologies. The South Korean government’s strategic support for energy storage systems under its “Carbon Neutral Strategy 2050” is also a key growth enabler.

Market Overview

South Korea's carbon battery bank market is primarily increasing, led by the nation's robust energy transition and carbon neutrality targets. These carbon-containing electrodes or carbon-enriched battery banks are becoming increasingly popular based on their ability to increase the energy density of the battery, lower the cost, and promote the sustainability of large-scale energy storage systems. With the growing trend of integration of clean sources like wind and solar, carbon battery banks are under investigation for effective possibilities in grid stabilization, peak shaving, and backup power supply. Smart grids and government policies in favor of energy storage facilities strengthen the market's growth even more. Local authorities are spending heavily in research and pilot-scale production of new battery chemistries such as dual-carbon and solid-state technology. South Korea's performance-based incentive and trading scheme for emissions are also pushing additional demand for energy storage solutions with decarbonization. Generally speaking, the market exhibits a strategic realignment towards cleaner and more efficient energy facilities in the nation.

Report Coverage

This research report categorizes the market for the South Korea carbon battery bank market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea carbon battery bank market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea carbon battery bank market.

South Korea Carbon Battery Bank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 237 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type, By Application and By End-Use |

| Companies covered:: | LG Energy Solution, Samsung SDI, GS Energy, Kokam Co., Ltd., SK Ecoplant, Enertech International, Narada Power, Hitachi Chemical Energy Technology, Toshiba Corporation, Amperex Technology Limited (ATL), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

South Korea carbon battery bank market is propelled by the fast growth of electric vehicle (EV) adoption and renewable energy expansion, requiring effective energy storage technologies. Government policies, such as hefty monetary incentives and carbon credit rewards, also promote growth in the market. Smart grid integration and performance-based compensation schemes increase demand even further. Moreover, the development of battery technologies like solid-state and sodium-ion, as well as the localization and securing of the supply chain for batteries, ensures long-term sustainability. South Korean companies also venture outward globally, driving more innovation and cost advantages, favoring the domestic battery bank market.

Restraining Factors

The South Korean carbon battery bank market is faced with various constraints. Low volume of production in initial years, coupled with high upfront manufacturing costs, reduces cost affordability and scalability. Incentive pressure from established incumbent lithium-ion batteries, being more energy-dense as well as better positioned in supply chains, detains adoption. Raw material supply and uncertainty for activated carbon as well as specialty metals also impact stability. Environmental issues around disposal and recycling inefficiencies present further barriers to market growth as well as long-term sustainability.

Market Segmentation

The South Korea Carbon Battery Bank Market share is classified into type, application, and end-use.

- The lithium carbon segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea carbon battery bank market is segmented by type into carbon zinc, alkaline carbon, lithium carbon, and others. Among these, the lithium carbon segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment benefits from advancements in carbon-lithium electrode integration, offering improved charge-discharge cycles, thermal stability, and environmental performance. Its application is expanding rapidly in grid energy storage and commercial power backup due to its balance of cost, efficiency, and sustainability.

- The industrial equipment segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea carbon battery bank market is segmented by application into consumer electronics, industrial equipment, power utilities, automotive, and others. Among these, the industrial equipment segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased use of battery banks in factory backup storage, factory automation, and uninterruptible power supply (UPS) systems have been the main drivers for this sector's robust demand. Their durability and reliability make it worthy that carbon batteries are suitable for industrial systems' high-load, long-duration power requirements.

- The commercial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea carbon battery bank market is segmented by end-use into residential, commercial, military, and others. Among these, the commercial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is fueled by the increasing application of carbon battery banks in retail stores, hospitals, data centers, and business offices, where there is a need for a clean and reliable power supply. Corporate environmental protection initiatives and energy conservation also drive growth in this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea carbon battery bank market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Energy Solution

- Samsung SDI

- GS Energy

- Kokam Co., Ltd.

- SK Ecoplant

- Enertech International

- Narada Power

- Hitachi Chemical Energy Technology

- Toshiba Corporation

- Amperex Technology Limited (ATL)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea carbon battery bank market based on the below-mentioned segments:

South Korea Carbon Battery Bank Market, By Type

- Carbon Zinc

- Alkaline Carbon

- Lithium Carbon

- Others

South Korea Carbon Battery Bank Market, By Application

- Consumer Electronics

- Industrial Equipment

- Power Utilities

- Automotive

- Others

South Korea Carbon Battery Bank Market, By End-Use

- Residential

- Commercial

- Military

- Others

Need help to buy this report?