South Korea Car Loan Market Size, Share, and COVID-19 Impact Analysis, By Type of Loan (Bank Car Loans and Non-bank Financial Institutions (NBFIs) Loans), By Vehicle Type (Passenger Vehicle and Commercial Vehicle), and South Korea Car Loan Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Car Loan Market Insights Forecasts to 2035

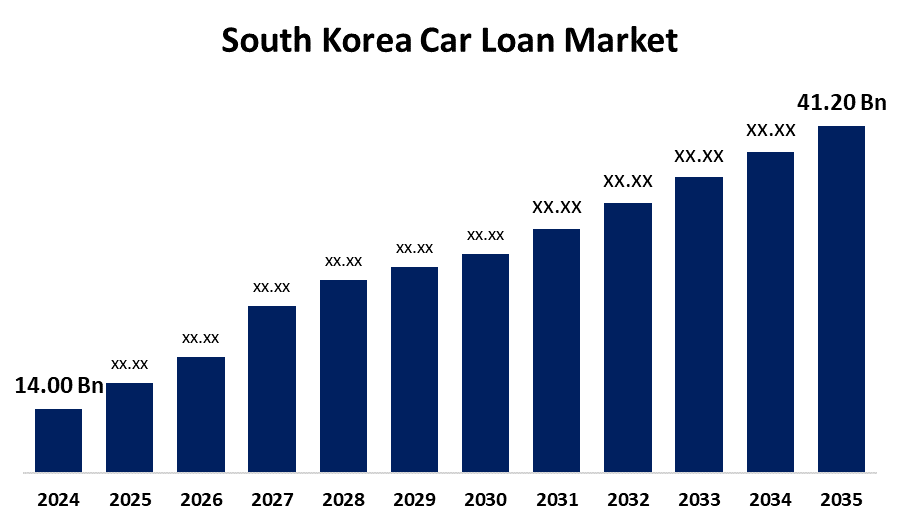

- The South Korea Car Loan Market Size was estimated at USD 14.00 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.31% from 2025 to 2035

- The South Korea Car Loan Market Size is Expected to Reach USD 41.20 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Car Loan Market Size is anticipated to reach USD 41.20 Billion by 2035, growing at a CAGR of 10.31% from 2025 to 2035. Demand for car loans in South Korea is being driven by the likes of rising urbanization, the expanding middle class, and the shift towards personal vehicles rather than public transport. As economic conditions in the nation strengthen and consumers look towards upgrading their mobility solutions, car loans have emerged as a sought-after alternative to enable vehicle ownership.

Market Overview

The South Korea car loan market is the portion of the South Korean financial services sector that offers car financing products to consumers and companies to acquire new and pre-owned vehicles. The market comprises a range of loan products from banks, non-banking financial companies (NBFIs), credit cooperatives, and online lenders, allowing borrowers to purchase cars by paying in installments within a predetermined timeframe, normally bearing interest. Additionally, the growth in sales of electric vehicles is expected to fuel a higher demand for electric vehicle-specific loans. Banks are seeing an uptick in loan requests from customers who want to finance their electric vehicle purchases. Banks launched specialized loan products that cater to the distinct characteristics and requirements of electric vehicles. These items may consist of low interest rates, long terms of repayment, or any other incentives to enhance the use of electric vehicles. The South Korean government provides incentives and support programs for the use of electric vehicles.

Report Coverage

This research report categorizes the market for the South Korea car loan market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea car loan market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea car loan market.

South Korea Car Loan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.00 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.31% |

| 2035 Value Projection: | USD 41.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 272 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type of Loan and By Vehicle Type |

| Companies covered:: | Kookmin Bank, Shinhan Bank, Hyundai Capital, Samsung Life Insurance, KB Kookmin Card, Toyota Financial Services Korea, BMW Group Financial Services Korea, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The policies to encourage local car sales and offer tax concessions or subsidies to car purchasers (particularly EVs and green cars) are motivating buyers to take loans. In addition, the government initiatives aimed at strengthening economic stability and household incomes facilitate this trend by making car ownership more affordable to the average South Korean citizen.

Restraining Factors

High family debt, stringent rules, fluctuating interest rates, economic uncertainty, and a growing preference for ridesharing and public transportation are some of the obstacles facing South Korea's auto loan sector.

Market Segmentation

The South Korea car loan market market share is classified into type of loan, vehicle type.

- The bank car loans segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea car loan market is segmented by type of loan into bank car loans, non-bank financial institutions (NBFIs) loans. Among these, the bank car loans segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Korean bank car loans provide competitive interest rates and trustful procedures, due to the robust regulatory supervision by the Bank of Korea and the Financial Supervisory Service. This provides protection for consumers and financial stability, enhancing consumer confidence. Banks also provide other benefits such as bundled insurance, rewards programs, and reduced rates for loyal customers, which enhance their attractiveness in the competitive market for car loans. Therefore, banks are the most prominent institution with a stable market share and an extensive base of customers.

- The passenger vehicle segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea car loan market is segmented by vehicle type into passenger vehicle and commercial vehicle. Among these, the passenger vehicle segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The popularity of SUVs results in increased demand for car loans as buyers look to have financing available for the bigger, usually more costly vehicles. Banks and other financial institutions have a surge in applications for SUV purchase loans. Banks and other financial institutions implement unique loan products catering to SUV buyers' tastes and demands. Such products might encompass elements like longer repaying terms, and favorable interest rates to lure customers into considering SUV model.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea car loan market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kookmin Bank

- Shinhan Bank

- Hyundai Capital

- Samsung Life Insurance

- KB Kookmin Card

- Toyota Financial Services Korea

- BMW Group Financial Services Korea

- Others

Recent Developments:

- In January 2025, Hyundai Capital had introduced a novel car loan scheme exclusively designed for the purchase of electric cars (EVs). The initiative featured reduced interest rates and convenient repayment terms to encourage the acquisition of environmentally friendly vehicles. The scheme was launched in partnership with prominent EV manufacturers with the aim of boosting electric vehicle adoption in South Korea and supporting the government's environmental agendas.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea car loan market based on the below-mentioned segments:

South Korea Car Loan Market, By Type of Loan

- Bank Car Loans

- Non-bank Financial Institutions (NBFIs) Loans

South Korea Car Loan Market, By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Need help to buy this report?