South Korea Canned Tuna Market Size, Share, and COVID-19 Impact Analysis, By Type (Skipjack Tuna, Yellowfin Tuna, Albacore Tuna, Others), By Distribution Channel (Store-Based, Non-Store-Based), and South Korea Canned Tuna Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Canned Tuna Market Insights Forecasts to 2035

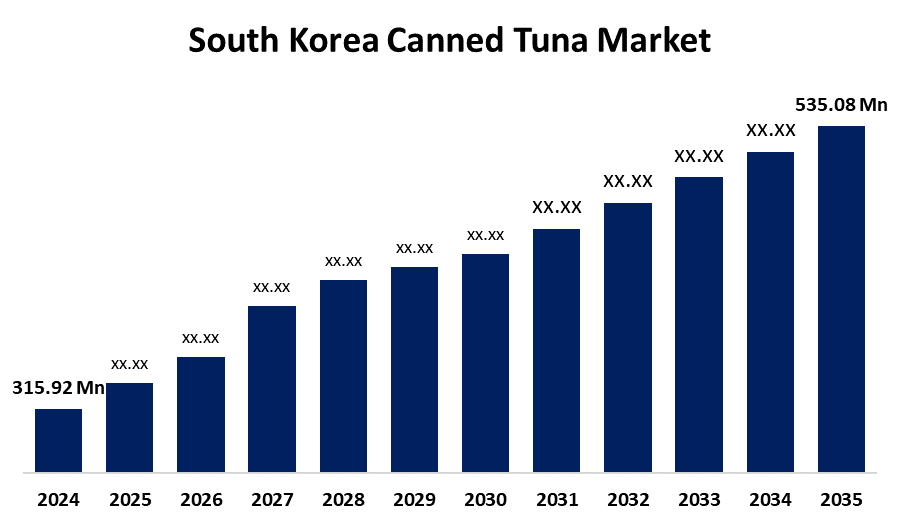

- The South Korea Canned Tuna Market Size was Estimated at USD 315.92 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.91% from 2025 to 2035

- The South Korea Canned Tuna Market Size is Expected to Reach USD 535.08 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Canned Tuna Market Size is anticipated to reach USD 535.08 Million by 2035, growing at a CAGR of 4.91% from 2025 to 2035. Growing demand among urban and health-conscious consumers for quick, high-protein, low-fat food options. Additionally, localized flavor offerings, sustainable packaging innovations, and the growth of e-commerce platforms are increasing consumer interest and propelling long-term market expansion.

Market Overview

The South Korea canned tuna market refers to the industry centered around the production, importation, distribution, and consumption of tuna preserved in cans, mainly for ready-to-eat meals, is known as the South Korean canned tuna market. In response to consumer demand for quick, high-protein, and shelf-stable food options, it features a variety of tuna varieties, including skipjack, yellowfin, and albacore. With a growing focus on sustainability, health trends, and creative packaging, the market is supported by both domestic and imported brands. Additionally, the demand for canned tuna products is also being driven by South Korean consumers who are becoming more health-conscious and looking for low-fat, high-protein food options. As manufacturers experiment with new flavors and packaging, there are chances to gain market share. In an effort to appeal to customers who care about the environment, many brands have created eco-friendly packaging and sourced tuna from sustainable fisheries as a result of the sustainability movement. Furthermore, regional flavors tailored to Korean cuisine are beginning to emerge, exciting consumers looking for new flavors in common canned goods. The public can now purchase canned tuna more easily in Korea due to the rise in food delivery services and e-commerce websites. Social media and cooking programs have contributed to new ideas and a greater understanding of canned tuna, which has increased its popularity among young consumers.

Report Coverage

This research report categorizes the market for the South Korea canned tuna market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea canned tuna market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea canned tuna market.

South Korea Canned Tuna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 315.92 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.91% |

| 2035 Value Projection: | USD 535.08 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Type and By Distribution Channel |

| Companies covered:: | Dongwon Industries, Sajo Industries, Silla Co., Ltd., You Wang Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumer preferences in South Korea have significantly shifted in favor of quick and easy food options, especially for city dwellers. There is a greater demand for prepared meals and snack foods, such as canned tuna, as a result of South Koreans' hectic lifestyles. According to South Korea's Ministry of Food and Drug Safety, the market for convenience foods has grown steadily in recent years, with a valuation of over 6 trillion KRW. Given that canned tuna is readily incorporated into salads, sandwiches, and other prepared foods, this change is probably going to propel the canned tuna market in South Korea. Because of its convenience and nutritional advantages, canned tuna is also becoming more and more popular in the food service industry, which includes cafes and restaurants. This further supports the product's expanding market.

Restraining Factors

Pressures on sustainability are increasing as worries about bycatch and overfishing increase. The increased demand for eco-certified tuna and tighter sourcing regulations have resulted in higher certification and operating costs for South Korean canned tuna producers.

Market Segmentation

The South Korea canned tuna market share is classified into type and distribution channel

- The South Korea canned tuna segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea canned tuna market is segmented by type into skipjack tuna, yellowfin tuna, albacore tuna, and others. Among these, the skipjack tuna segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Skipjack tuna is a popular choice for both consumers and retailers because of its good taste and affordability. Its accessibility and adaptability in different canned goods greatly add to its appeal.

- The store-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea canned tuna market is segmented by distribution channel into store-based and non-store-based. Among these, the store-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Customers can more easily buy canned tuna along with other groceries thanks to store-based distribution, which includes supermarkets and convenience stores. Strong foot traffic and brand awareness boost consumer confidence through this channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea canned tuna market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dongwon Industries

- Sajo Industries

- Silla Co., Ltd.

- You Wang Co., Ltd.

- Others

Recent Developments:

- In March 2024, Dongwon company planned to launch in April the country's first shipyard under complete automation at Busan New Port, positioning Dongwon to become a global terminal operator (GTO). With the project, Dongwon was expected to acquire HMM, the country's only container ship operator a bid the group had failed to achieve the previous year when it had competed with Harim Group.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Canned Tuna Market based on the below-mentioned segments:

South Korea Canned Tuna Market, By Type

- Skipjack Tuna

- Yellowfin Tuna

- Albacore Tuna

- Others

South Korea Canned Tuna Market, By Distribution Channel

- Store-Based

- Non-Store-Based

Need help to buy this report?