South Korea Butane Market Size, Share, and COVID-19 Impact Analysis, By Application (Residential & Commercial, Industrial, Engine Fuel, Refinery, Chemical Feedstock, and Others), and South Korea Butane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Butane Market Insights Forecasts to 2035

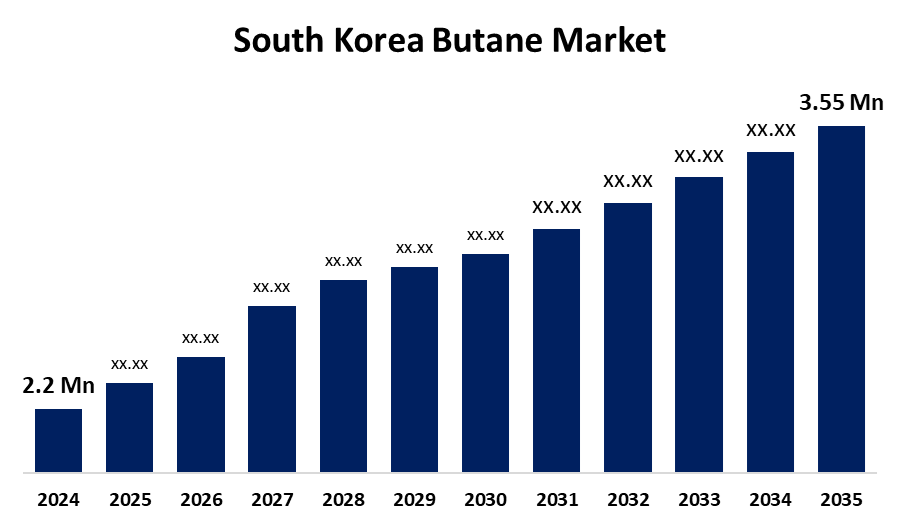

- The South Korea Butane Market Size Was Estimated at USD 2.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.45% from 2025 to 2035

- The South Korea Butane Market Size is Expected to Reach USD 3.55 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Butane Market Size is anticipated to reach USD 3.55 Million by 2035, Growing at a CAGR of 4.45% from 2025 to 2035. In many different applications, butane is typically utilized as a blend of isomers. In this mixture, isobutene makes up the remaining portion, whereas normal butane makes up more than two-thirds.

Market Overview

The butane industry is the trade and consumption of butane, a colorless, highly flammable hydrocarbon gas commonly used in many industries. A major use is as an aerosol product propellant in deodorants and personal care products, providing a cleaner alternative to ozone-depleting agents. Butane is also needed for portable energy storage, especially in gas cartridges for camping and home heating. Its application as a petrochemical feedstock, particularly in the fast-developing Asia-Pacific market, also contributes to market growth. Butane is increasingly being researched as an alternative fuel for vehicles, with a lower carbon footprint compared to gasoline and diesel. Subsidies and government programs favoring LPG, which includes butane, are likely to foster adoption in developing economies.

For instance, in 2023, about 3.2 billion liters of butane gas were needed domestically in South Korea. This is less than it was the year before. In 2018, domestic demand reached a peak of approximately 4.05 billion liters. Additionally, growing populations and increasing disposable incomes in emerging economies are driving the demand for LPG and other butane-based uses, contributing to overall market growth.

Report Coverage

This research report categorizes the market for the South Korea butane market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea butane market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea butane market.

South Korea Butane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.45% |

| 2035 Value Projection: | USD 3.55 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Application |

| Companies covered:: | Hanwha Total Energies petrochemical, Lotte Chemical, KCC Corporation, Isu Group, Namhe Chemical Corporation, HWASAN CO., LTD., ENK Co. Ltd., TAE YANG IND CO. Ltd, Marina Corporation, Korea National Oil Corporation, Korea Gas Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Demand for LPG for household use has increased, particularly in emerging nations. The use of liquefied cylinders in residential settings is being widely encouraged by governments in developing nations. A growing population and increasing disposable income are driving rapid growth in the hotel industry in emerging nations. It is anticipated that this would in turn lead to profitable growth prospects in the upcoming years. With the increased demand from the petrochemical and automotive industries, butane is becoming more and more in demand in South Korea.

Restraining Factors

The remaining price of gasoline is determined by refinery and distribution costs, company profits, and state and federal taxes. This is because of things like changes in supply and demand as well as fluctuations in the price of crude oil, butane prices are always changing. Therefore, it is anticipated that the profitability of butane producers will be adversely affected by the volatility of oil prices.

Market Segmentation

The South Korea butane market share is classified into application.

- The residential & commercial segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea butane market is segmented by application into residential & commercial, industrial, engine fuel, refinery, chemical feedstock, and others. Among these, the residential & commercial segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Consumption is increased by the rising demand for LPG in homes and businesses. Due to their limited natural resources and lack of a gas pipeline network, emerging countries have become increasingly dependent on LPG for cooking as their populations have grown.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea butane market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanwha Total Energies petrochemical

- Lotte Chemical

- KCC Corporation

- Isu Group

- Namhe Chemical Corporation

- HWASAN CO., LTD.

- ENK Co. Ltd.

- TAE YANG IND CO. Ltd

- Marina Corporation

- Korea National Oil Corporation

- Korea Gas Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea butane market based on the below-mentioned segments:

South Korea Butane Market, By Application

- Residential & Commercial

- Industrial, Engine Fuel

- Refinery

- Chemical Feedstock

- Others

Need help to buy this report?