South Korea Bottled Water Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Still, Carbonated, Flavored, Mineral), By Packaging Type (PET Bottles, Metal Cans, and Others) and South Korea Bottled Water Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Bottled Water Market Insights Forecasts to 2035

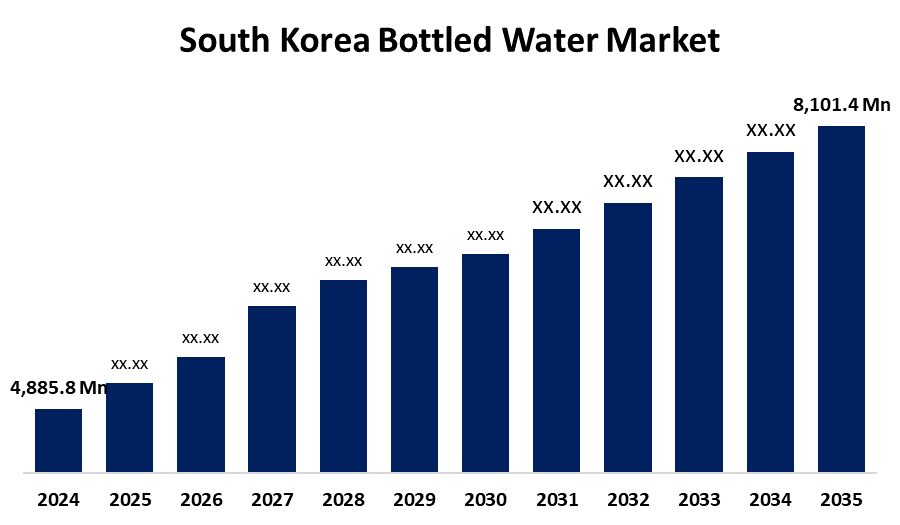

- The South Korea Bottled Water Market Size was Estimated at USD 4,885.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.70% from 2025 to 2035

- The South Korea Bottled Water Market Size is Expected to Reach USD 8,101.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Bottled Water Market Size is anticipated to reach USD 8,101.4 Million by 2035, Growing at a CAGR of 4.70% from 2025 to 2035. The market is being driven by South Korea's fast urbanization and shifting lifestyles, which have raised consumer demand for convenient, packaged goods like bottled water.

Market Overview

The commercial industry that produces, distributes, and sells bottled water products in South Korea is known as the "South Korean bottled water market." Spring water, purified water, mineral water, sparkling water, and other varieties of bottled water are all included in this market. These water types are packaged in PET bottles, glass bottles, and metal cans. Supermarkets, convenience stores, e-commerce sites, and foodservice businesses like hotels and restaurants are some of the channels via which these products are distributed. Additionally, in an effort to draw in customers, manufacturers are always introducing novel flavors and inventive formulations. The safety and quality of bottled water are top priorities for South Korean consumers. To guarantee that bottled water satisfies exacting quality standards, the government has put in place stringent regulations. In order to guarantee the purity of their products, manufacturers follow these rules and frequently make investments in cutting-edge water purification and filtration technologies. South Korea has several well-established domestic brands in the bottled water market.

Report Coverage

This research report categorizes the market for the South Korea bottled water market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea bottled water market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea bottled water market.

South Korea Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,885.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.70% |

| 2035 Value Projection: | USD 8,101.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type and By Packaging Type |

| Companies covered:: | Nongshim Co., Ltd., Dongsuh Foods Corporation, S-Oil Corporation, Imported brands, HiteJinro Co., Ltd., and Others |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for bottled water in South Korea has grown significantly in recent years thanks to a number of important factors. First off, a major factor fueling the spike in demand for bottled water has been consumers' growing health consciousness. People are more likely to choose convenient and easily accessible bottled water options as they grow more conscious of the value of staying hydrated and the possible health advantages linked to consistent water consumption. Additionally, the market's growth has been greatly aided by shifting lifestyles and an increasing emphasis on convenience for those who are constantly on the go. Consumer preferences are shifting toward portable and easily accessible hydration solutions as a result of busy schedules and urbanization; bottled water is becoming a popular option for people with hectic schedules.

Restraining Factors

One of the main causes of environmental pollution is the widespread use of single-use plastic bottles. South Korea struggles with high levels of pollution and waste generation even with its sophisticated recycling systems. Bottled water companies are under pressure to implement sustainable practices as a result of consumers' growing preference for eco-friendly packaging options brought on by their growing awareness of these problems.

Market Segmentation

The South Korea Bottled Water Market share is classified into product type and Packaging type.

- The still segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea bottled water market is segmented by product type into still, carbonated, flavored, and mineral. Among these, the still segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Both spring and purified water, which are the most popular varieties of bottled water in the nation, are included in this category. Because it is seen as a pure and unadulterated source of hydration, still water is preferred by consumers who are health-conscious and looking for natural and clean drinking options. Further supporting still water's market dominance is the fact that its lack of carbonation makes it more adaptable for a range of consumption occasions.

- The PET bottles segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea bottled water market is segmented by packaging type into PET bottles, metal cans, and others. Among these, the PET bottles segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This preference is explained by the affordability, adaptability, and recyclable nature of PET bottles. They come in a range of sizes to meet the needs of different customers and work with different kinds of closures to improve convenience and the overall customer experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea bottled water market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nongshim Co., Ltd.

- Dongsuh Foods Corporation

- S-Oil Corporation

- Imported brands

- HiteJinro Co., Ltd.

- Others

Recent Developments:

- In October 2024, Starting with the Murabel product "Jeju Samdasoo Green," Jeju Samdasoo began reducing plastic. In 2021, the Jeju Development Corporation unveiled the "Green Hall Process," an environmentally friendly management vision, and put forth a plan to increase the percentage of Murabel products produced to 50% by 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Bottled Water Market based on the below-mentioned segments:

South Korea Bottled Water Market, By Product Type

- Still

- Carbonated

- Flavored

- Mineral

South Korea Bottled Water Market, By Packaging Type

- PET Bottles

- Metal Cans

- Others

Need help to buy this report?