South Korea Blood Glucose Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Self-Monitoring Blood Glucose Devices, Continuous Glucose Monitoring System), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Retail), and South Korea Blood Glucose Monitoring Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Blood Glucose Monitoring Market Insights Forecasts to 2035

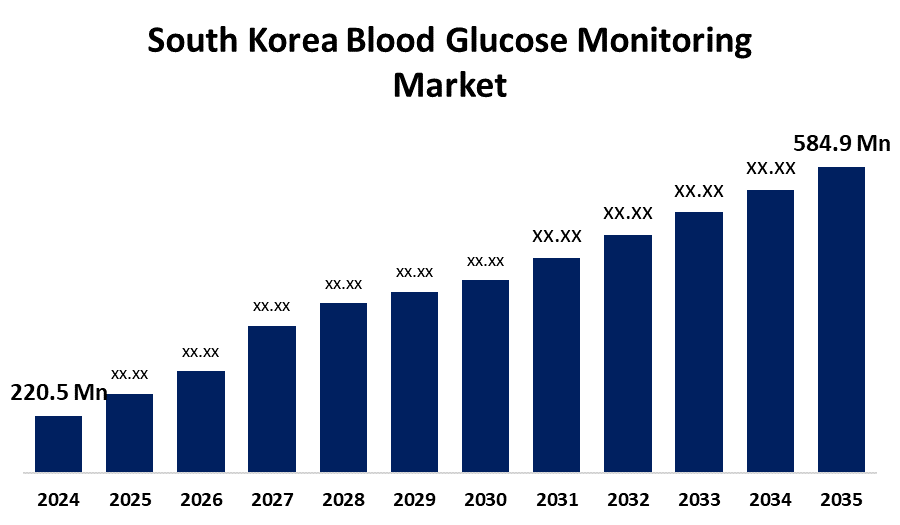

- The South Korea Blood Glucose Monitoring Market Size was estimated at USD 220.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.27% from 2025 to 2035

- The South Korea Blood Glucose Monitoring Market Size is Expected to Reach USD 584.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Blood Glucose Monitoring Market Size is anticipated to reach USD 584.9 Million by 2035, growing at a CAGR of 9.27% from 2025 to 2035. The increased interest in health and wellness, rising awareness of the need to manage diabetes and detect disease at an early stage, and easy access to health insurance policies are some of the major forces propelling the market.

Market Overview

The South Korea blood glucose monitoring market involves the production, distribution, and use of devices that allow people most especially those with diabetes to effectively monitor and control their blood glucose levels. These devices are important in achieving optimal glucose management and avoiding diabetes-associated complications. Additionally, the growing demands for contemporary blood glucose monitoring devices that support data sharing with healthcare professionals and relatives are one of the key drivers of the market in a positive direction in South Korea. Furthermore, the growing use of blood glucose monitoring devices among the elderly population, as they are more susceptible to diabetes, is driving the market growth in the nation. Moreover, the increasing use of blood glucose monitors with remote monitoring features, which enable timely interventions, is driving the market growth.

Report Coverage

This research report categorizes the market for the South Korea blood glucose monitoring market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea blood glucose monitoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea blood glucose monitoring market.

South Korea Blood Glucose Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 220.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.27% |

| 2035 Value Projection: | USD 584.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 273 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product Type and By Distribution Channel |

| Companies covered:: | Abbott Korea Co. Ltd., Arkray Inc., Ascensia Diabetes Care Korea Ltd., Dexcom Inc., Senseonics Holdings Inc, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean government has undertaken numerous measures to encourage diabetes awareness and management. Public health campaigns and medical device subsidies have increased access to blood glucose monitoring. The government's investment in digital health technologies and healthcare infrastructure also aids the uptake of sophisticated monitoring solutions. Furthermore, the convergence of blood glucose monitoring devices with digital health platforms improves patient monitoring and management. Mobile apps that connect with monitoring devices enable individuals to monitor their glucose levels, receive notifications, and transfer data to healthcare providers. This interaction enables improved decision-making and customized care.

Restraining Factors

Sophisticated monitoring devices, like Continuous Glucose Monitoring (CGM) systems, are typically costly. Even with advancements, insurance coverage is still limited, and patients have to pay considerable out-of-pocket costs. The cost limitation reduces access, especially for low-income individuals, and impedes broad adoption.

Market Segmentation

The South Korea blood glucose monitoring market share is classified into product type and distribution channel.

- The continuous glucose monitoring system segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea blood glucose monitoring market is segmented by product type into self-monitoring blood glucose devices, continuous glucose monitoring system. Among these, the continuous glucose monitoring system segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment's expansion is facilitated by ongoing advances in sensor technology, battery life, and smart capabilities that improve monitoring accuracy and ease of use. Suppliers are putting into place innovative production technologies and quality control systems that improve sensor dependability and maximize power savings. The convergence of enhanced sensor algorithms and smart notification has significantly improved the identification of glucose changes and possible complications.

- The hospital pharmacies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea blood glucose monitoring market is segmented by distribution channel into hospital pharmacies, retail pharmacies, online retail. Among these, the hospital pharmacies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is aided by high investments in pharmacy infrastructure, patient education programs and healthcare provider training at South Korea's key healthcare hubs. Hospital pharmacies are specifically inclined towards providing high-end monitoring devices that are capable of accommodating unique patient needs while ensuring consistency in accuracy and reliability. Integration of sophisticated inventory management systems and healthcare information technology allows for better coordination among manufacturers, pharmacies and healthcare providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea blood glucose monitoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Korea Co. Ltd.

- Arkray Inc.

- Ascensia Diabetes Care Korea Ltd.

- Dexcom Inc.

- Senseonics Holdings Inc

- Others

Recent Developments:

- In March 2024, Roche Diagnostics launched the Accu-Chek SmartGuide continuous glucose monitoring (CGM) system, which featured AI-powered predictive algorithms. The system provided real-time glucose levels every five minutes and predicted glucose trends for the next 30 minutes and two hours. Additionally, it offered a risk prediction for nocturnal hypoglycemia, addressing major challenges in diabetes treatment. The solution received CE Mark, paving the way for its commercialization in targeted European markets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea blood glucose monitoring market based on the below-mentioned segments:

South Korea Blood Glucose Monitoring Market, By Product Type

- Self-Monitoring Blood Glucose Devices

- Continuous Glucose Monitoring System

South Korea Blood Glucose Monitoring Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Retail

Need help to buy this report?