South Korea Benzene Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Alkyl Benzene, Cumene, Cyclohexane, Ethyl Benzene, Nitro Benzene, Aniline, Toluene, Phenol, Styrene, and Others), By Application (Solvent, Chemical Intermediates, Surfactants, Plastics, Rubber Manufacturing, Detergent, Explosives, Lubricants, Pesticides, Anti-Knock Additives, and Others), and South Korea Benzene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Benzene Market Insights Forecasts to 2035

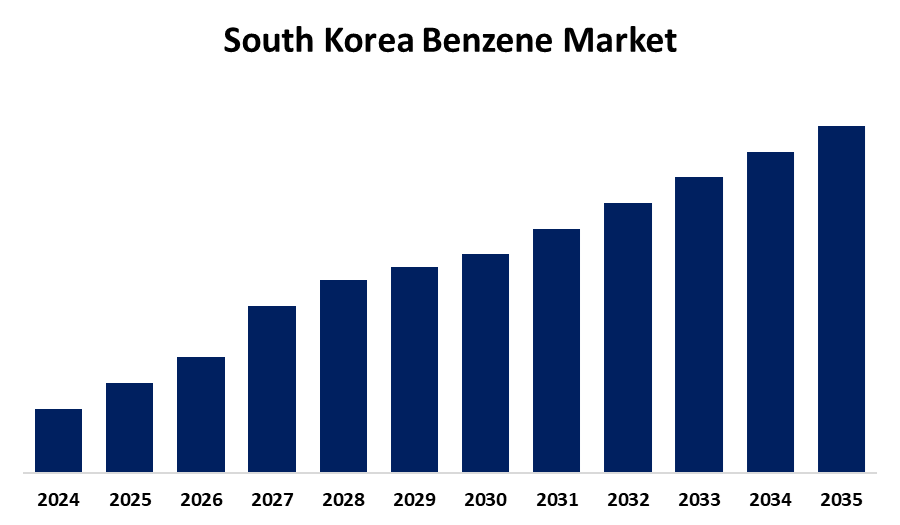

- The South Korea Benzene Market Size is Expected to Grow at a CAGR of around 5.1% from 2025 to 2035

- The South Korea Benzene Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Benzene Market Size is Expected to hold a significant share by 2035. The market is expanding due to the rising demand for benzene as styrene is used to make tires and various body pieces for cars that run on gasoline or diesel as well as electric vehicles.

Market Overview

The trade and consumption of benzene, a colorless, flammable liquid and essential aromatic hydrocarbon, are referred to as the benzene market. These substances are essential to the production of synthetic fibers, resins, polymers, and rubber. Benzene is essential to the packaging, electronics, automotive, and construction industries since it is used in the manufacturing of common plastics including nylon, polystyrene, and polyurethane. Products generated from benzene are increasingly being used in electronic gadgets, insulating materials, and automotive components as the need for strong, lightweight materials continues to expand. Additionally, the compound is essential to the manufacturing of synthetic rubber, which is used in tires, belts, and hoses, particularly in the automotive sector.

In 2024, South Korea exported $2.95 billion worth of Benzene, making it the country's 30th most exported product out of 5,432. During the same year, South Korea imported $92.8 million worth of Benzene, ranking it as the 763rd most imported product. The fastest-growing sources of Benzene imports to South Korea between 2023 and 2024, while the fastest-growing markets for South Korean Benzene exports. Many governments have put trade agreements and incentives in place to promote the export of benzene and its derivatives in response to South Korea's need, which has increased production and opened up new markets abroad.

Report Coverage

This research report categorizes the market for the South Korea benzene market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea benzene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea benzene market.

South Korea Benzene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 242 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Derivative, By Application |

| Companies covered:: | LG Chem, Lotte Chemical, SK Geo Centric, Hanwha Solutions, Kumho Petrochemical, Yeochun NCC, OCI Holdings, ISU Chemical, KCC Corporation, Hyosung Chemical, Namhae Chemical, Taekwang Industrial, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A crucial raw material for styrene, which is used to make synthetic rubbers, a variety of plastics, and packaging materials, is benzene. This need is further driven by the growing automobile industry, especially for electric vehicles, and the use of styrene in tires and body parts. Other derivatives of benzene, such as phenol, nitrobenzene, and aniline, are also produced from it and have a variety of uses in the paint, dye, and pharmaceutical sectors. Developing nations' fast industrialization and urbanization raise demand for consumer goods, building supplies, and other items, which in turn raises demand for benzene.

Restraining Factors

Tighter controls on the handling, transportation, and disposal of benzene have been brought about by strict rules and increased environmental consciousness, which can restrict market expansion. While drops in crude oil prices may boost overall earnings, increases may have a detrimental effect on the cost of producing benzene. The benzene supply chain may experience delays and disruptions as a result of disturbances in the supply of natural gas and crude oil, which are utilized in the manufacturing of benzene.

Market Segmentation

The South Korea benzene market share is classified into derivative and application.

- The ethyl benzene segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea benzene market is segmented by derivatives into alkyl benzene, cumene, cyclohexane, ethyl benzene, nitro benzene, aniline, toluene, phenol, styrene, and others. Among these, the ethyl benzene segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing need for ethyl benzene in the production of styrene. For instance, the International Energy Agency (IEA) reported in 2018 that the demand for benzene is increasing.

- The rubber manufacturing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea benzene market is segmented by application into solvent, chemical intermediates, surfactants, plastics, rubber manufacturing, detergent, explosives, lubricants, pesticides, anti-knock additives, and others. Among these, the rubber manufacturing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing use of benzene in automotive and construction items, including tires, adhesives, fiberglass, paints, and flooring.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea benzene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Chem

- Lotte Chemical

- SK Geo Centric

- Hanwha Solutions

- Kumho Petrochemical

- Yeochun NCC

- OCI Holdings

- ISU Chemical

- KCC Corporation

- Hyosung Chemical

- Namhae Chemical

- Taekwang Industrial

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea benzene market based on the below-mentioned segments:

South Korea Benzene Market, By Derivatives

- Alkyl Benzene

- Cumene

- Cyclohexane

- Ethyl Benzene

- Nitro Benzene

- Aniline

- Toluene

- Phenol

- Styrene

- Others

South Korea Benzene Market, By Application

- Solvent

- Chemical Intermediates

- Surfactants

- Plastics

- Rubber Manufacturing

- Detergent

- Explosives

- Lubricants

- Pesticides

- Anti-Knock Additives

- Others

Need help to buy this report?