South Korea Bariatric Surgery Market Size, Share, and COVID-19 Impact Analysis, By Devices (Assisting Devices, Implantable Devices, and Others), and South Korea Bariatric Surgery Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSouth Korea Bariatric Surgery Market Insights Forecasts to 2035

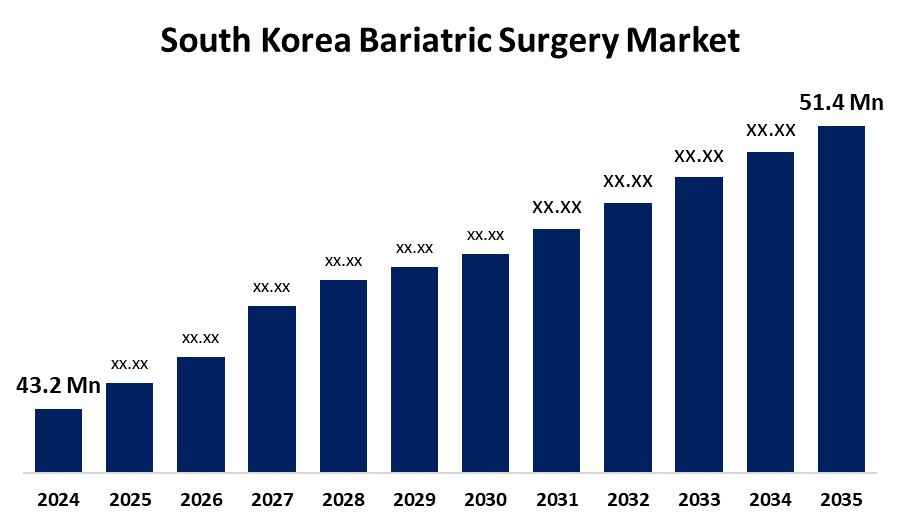

- The South Korea Bariatric Surgery Market Size was estimated at USD 43.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.59% from 2025 to 2035

- The South Korea Bariatric Surgery Market Size is Expected to Reach USD 51.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Bariatric Surgery Market Size is Anticipated to reach USD 51.4 Million By 2035, Growing at a CAGR of 1.59% from 2025 to 2035. The increasing prevalence of obesity among the masses, heightened awareness regarding the significance of psychosocial and mental factors in weight control, and enhanced refinement and diversification of surgical techniques are some of the primary drivers of the market

Market Overview

The South Korea bariatric surgery market refers to medical treatments for severe obesity, usually characterized by a Body Mass Index (BMI) of 40 or more, or 35 and over accompanied by accompanying conditions of obesity. The surgeries are undertaken when other forms of weight reduction, including diet and exercise, have failed. Additionally, the increasing obese population as a result of the intake of calorie-dense foods and the embracement of unhealthy lifestyles is one of the key drivers pushing the South Korean market's growth. The increased awareness among people regarding the necessity of efficient, long-term weight control solutions is driving demand for bariatric surgical procedures. In addition, the sophistication and diversification of surgical procedures, including laparoscopic and robotic-assisted operations, are minimizing post-operative complications and recovery, and thus rendering bariatric surgery an appealing option for obese patients.

Report Coverage

This research report categorizes the market for the South Korea bariatric surgery market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea bariatric surgery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea bariatric surgery market.

South Korea Bariatric Surgery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 43.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.59% |

| 2035 Value Projection: | USD 51.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Devices and COVID-19 Impact Analysis |

| Companies covered:: | Ethicon Inc. (Johnson and Johnson), Apollo Endosurgery Inc., Aspire Bariatrics Inc., Intuitive Surgical Inc., B. Braun Melsungen AG, Olympus Corporation, The Cooper Companies, Conmed Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expanding uptake of minimally invasive (MI) procedures, since these procedures have a number of benefits such as reduced incisions, less pain, quicker recovery, and shorter stays in the hospital, is providing an upbeat market scenario in the nation. The growing realization of the significance of mental health as well as psychosocial aspects in obesity management is also encouraging more cooperation between bariatric surgeons and mental health experts.

Restraining Factors

The South Korean health system is also plagued with doctor shortages, especially in the specialist areas, and burned-out medical personnel. These can have an impact on the availability and quality of bariatric surgical procedures, causing longer waiting times and possible delays in treatment

Market Segmentation

The South Korea bariatric surgery market share is classified into devices.

- The assisting device segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea bariatric surgery market is segmented by devices into assisting devices, implantable devices, and others. Among these, the Assisting device segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The prevalence of supporting devices is explained by their adaptability and the expanding popularity of minimally invasive surgery. Advances lead to better patient outcomes and reduced recovery time.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea bariatric surgery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ethicon Inc. (Johnson and Johnson)

- Apollo Endosurgery Inc.

- Aspire Bariatrics Inc.

- Intuitive Surgical Inc.

- B. Braun Melsungen AG

- Olympus Corporation

- The Cooper Companies

- Conmed Corporation

- Others

Recent Developments:

- In May 2025, Medtronic Korea gained regulatory clearance for its Hugo robotic-assisted surgery (RAS) system in 2024, marking a giant step forward for minimally invasive surgical procedures. Launched officially at Seoul National University Hospital (SNUH), the system became a pioneering tool for bariatric and other complex procedures, increased accuracy, lowered the risk of complications, and shortened patient recovery time.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea bariatric surgery market based on the below-mentioned segments:

South Korea Bariatric Surgery Market, By Devices

- Assisting Devices

- Implantable Devices

- Others

Need help to buy this report?