South Korea Balsa Wood Market Size, Share, and COVID-19 Impact Analysis, By Type (’Grain A’ Type, ’Grain B’ Type, ’Grain C’ Type), By Application (Aerospace& Defense, Renewable Energy, Marine, Road & Rail, Industrial Construction, Others), and South Korea Balsa Wood Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Balsa Wood Market Insights Forecasts to 2035

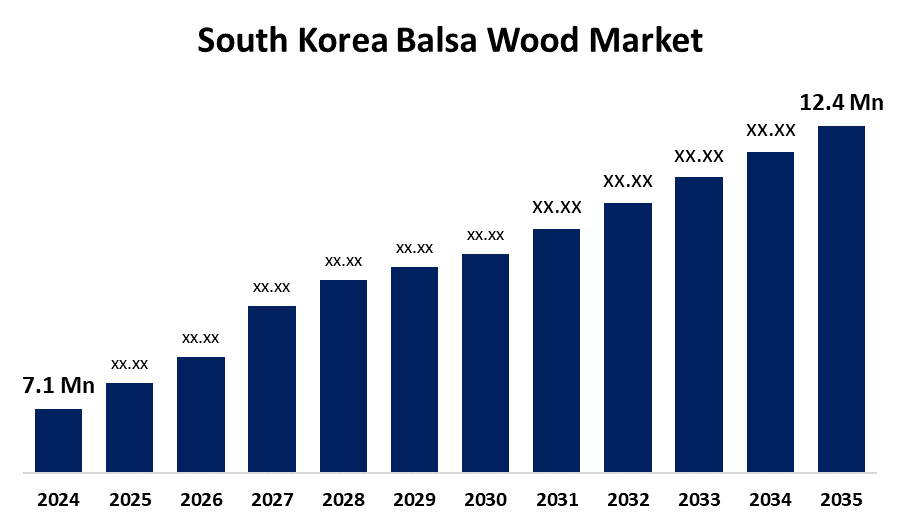

- The South Korea Balsa Wood Market Size was Estimated at USD 7.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.2% from 2025 to 2035

- The South Korea Balsa Wood Market Size is Expected to Reach USD 12.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Balsa Wood Market Size is anticipated to reach USD 12.4 Million by 2035, growing at a CAGR of 5.2% from 2025 to 2035. Demand for renewable resources, lightweight composites, and environmentally friendly building practices. Because of its superior strength-to-weight ratio, buoyancy, and insulation qualities, balsa wood is perfect for use in interior design, wind energy, marine, and aerospace applications.

Market Overview

The South Korea Balsa Wood Market refers to the domestic industry devoted to the import, distribution, and use of balsa wood a renewable, ultra-lightweight material renowned for its high strength-to-weight ratio, buoyancy, and insulation is referred to as the South Korea Balsa Wood Market. It provides services to important industries like interior design, industrial construction, marine, renewable energy, and aerospace & defense. The market is influenced by South Korea's increasing focus on environmentally friendly architecture, lightweight composites for advanced manufacturing, and sustainable materials. Additionally, technological and manufacturing developments can improve the availability and quality of balsa wood, which could draw in more customers. In keeping with South Korea's design philosophy, which prioritizes sustainability and minimalism, there has been a noticeable trend in recent years toward the use of balsa wood in environmentally friendly interior design and home furnishings. This trend encourages a lifestyle that values simplicity and the environment, which is in line with the national goal of lowering carbon footprints. Furthermore, partnerships between designers, manufacturers, and environmental organizations are encouraging creativity and developing new uses for balsa wood. These changes demonstrate the South Korean balsa wood market's flexibility in responding to shifting consumer demands and wider environmental regulations.

Report Coverage

This research report categorizes the market for the South Korea balsa wood market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea balsa wood market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea balsa wood market.

South Korea Balsa Wood Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.2% |

| 2035 Value Projection: | USD 12.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type and By Application |

| Companies covered:: | Daehan New Materials, Korea Balsa, Unid BT Plus Co., Ltd., Eagon Industrial Co., Ltd., Younglim Forestry Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for balsa wood in South Korea is expanding significantly due to rising consumer demand for environmentally friendly and sustainable products. Government initiatives to support eco-friendly products and green building demonstrate South Korea's dedication to sustainability. The South Korean Ministry of Environment projects that the use of sustainable building materials will increase by more than 15% a year, in line with a national movement to improve energy efficiency and lower carbon footprints. This initiative is well suited to balsa wood, which is a popular choice for a variety of applications such as construction, furniture, and model making due to its strength-to-weight ratio and low weight. This market expansion is being further accelerated by groups like the Korea Green Building Council, which are spearheading initiatives to inform consumers and builders about sustainable practices.

Restraining Factors

South Korean manufacturers' procurement costs and pricing stability may be impacted by changes in the price of balsa wood globally brought on by weather, export restrictions, or geopolitical tensions.

Market Segmentation

The South Korea balsa wood market share is classified into type and application.

- The ‘grain a’ segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea balsa wood market is segmented by type into 'grain a' type, 'grain b' type, and 'grain c' type. Among these, the ‘grain a’ segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Grain A type is a popular choice for industries like model building and lightweight structure manufacturing because of its exceptional quality attributes. Because Grain A is lightweight and strong, it meets the need for materials that improve performance and fuel efficiency in the automotive and aerospace industries.

- The aerospace & defense segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea balsa wood market is segmented by application into aerospace & defense, renewable energy, marine, road & rail, industrial construction, and others. Among these, the aerospace & defense segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Balsa wood is frequently used in aerospace and defense for its strength and low weight, which makes it perfect for aircraft models and components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea balsa wood market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daehan New Materials

- Korea Balsa

- Unid BT Plus Co., Ltd.

- Eagon Industrial Co., Ltd.

- Younglim Forestry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Balsa Wood Market based on the below-mentioned segments:

South Korea Balsa Wood Market, By Type

- 'Grain A' Type

- 'Grain B' Type

- 'Grain C' Type

South Korea Balsa Wood Market, By Application

- Aerospace & Defense

- Renewable Energy

- Marine

- Road & Rail

- Industrial Construction

- Others

Need help to buy this report?