South Korea B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, Cross-Border Payments), By Payment mode (Traditional, Digital), and South Korea B2B Payments Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea B2B Payments Market Insights Forecasts to 2035

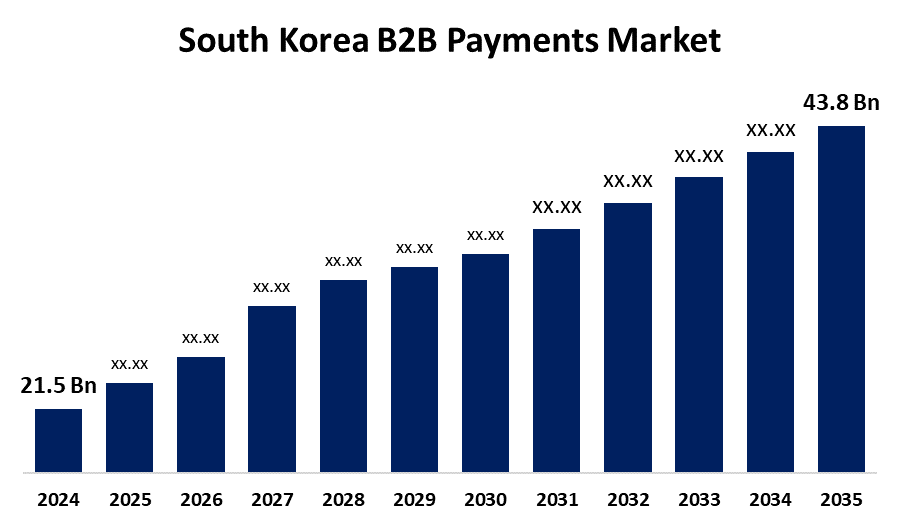

- The South Korea B2B Payments Market Size was estimated at USD 21.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.68% from 2025 to 2035

- The South Korea B2B Payments Market Size is Expected to Reach USD 43.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea B2B Payments Market Size is anticipated to reach USD 43.8 Billion by 2035, growing at a CAGR of 6.68% from 2025 to 2035. The market is being driven by the expansion of online marketplaces and e-commerce as well as the requirement for effective B2B payment systems to enable business-to-business transactions.

Market Overview

The South Korea B2B (business-to-business) payments market encompasses financial transactions for goods, services, or other business-related exchanges between companies are included in the South Korean B2B (business-to-business) payments market. Usually larger and more intricate than consumer payments, these transactions use a variety of payment methods, including digital payment systems, wire transfers, invoices, and electronic funds transfers (EFT). Additionally, A number of important factors are driving a transformative phase in South Korea's B2B payments market. First and foremost, a key factor that has made financial transactions between companies easier and more efficient is the growing digitization of business processes. Simultaneously, the growing need for safe and instantaneous payment processing has spurred the creation of cutting-edge technologies in the B2B payments market. The B2B payments market's trajectory has also been significantly shaped by the constantly changing regulatory environment. Businesses are looking for reliable payment solutions that meet strict regulatory standards as such of compliance requirements and the need for transparent financial transactions.

Report Coverage

This research report categorizes the market for the South Korea B2B payments market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea B2B payments market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea B2B payments market.

South Korea B2B Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.68% |

| 2035 Value Projection: | USD 43.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Payment Type and By Payment mode |

| Companies covered:: | Kakao Pay Corp., NHN PAYCO Corp., Samsung Electronics Co. Ltd., Naver Corporation, Visa Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The businesses are investing in advanced B2B payment solutions as a consequence of the growing customer expectations for convenient and customized payment experiences. Additionally, the market for business-to-business payments has been greatly boosted by the continuous transition to cloud-based solutions. Cloud technology increases the scalability and flexibility of payment systems in addition to improving accessibility. In conclusion, the B2B payments market in South Korea is driven ahead by a combination of digitization, regulatory dynamics, customer expectations, and cloud adoption, which determines both its present trajectory and its potential for the future.

Restraining Factors

The South Korea B2B payments market faces restraints such as regulatory complexity, cybersecurity risks, high implementation costs, late payments, and infrastructure challenges, limiting adoption and efficiency, especially among small and medium enterprises.

Market Segmentation

The South Korea B2B payments market share is classified into type and mode.

- The domestic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea B2B payments market is segmented by type into domestic payments and cross-border payments. Among these, the domestic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This market is dominated by the nation's high volume of business transactions, which are facilitated by robust banking infrastructure, real-time transfers, and digital payment solutions.

- The digital segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea B2B payments market is segmented by mode into traditional and digital. Among these, the digital segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the nation's robust fintech sector, widespread smartphone use, and government backing for cashless transactions. Because real-time digital payment solutions are more efficient, secure, and economical than traditional methods, businesses are increasingly choosing them.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea B2B payments market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kakao Pay Corp.

- NHN PAYCO Corp.

- Samsung Electronics Co. Ltd.

- Naver Corporation

- Visa Inc.

- Others

Recent Developments:

- In May 2025, to bolster international expansion, Sinsang Market, the top B2B fashion platform in South Korea, introduced its global ambassador program, "Sinsang Linkers." The program sought to strengthen ties with international fashion communities and linked Korean designers with buyers around the world.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea B2B Payments Market based on the below-mentioned segments:

South Korea B2B Payments Market, By Payment Type

- Domestic Payments

- Cross-Border Payments

South Korea B2B Payments Market, By Payment Mode

- Traditional

- Digital

Need help to buy this report?