South Korea Automotive LED Lighting Market Size, Share, and COVID-19 Impact Analysis, By Automotive Utility Lighting (Daytime Running Lights (DRL), Directional Signal Lights, Headlights, Reverse Light, Stop Light, Tail Light, and Others), By Automotive Vehicle Lighting (2 Wheelers, Commercial Vehicles, and Passenger Cars), and South Korea Automotive LED Lighting Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsSouth Korea Automotive LED Lighting Market Insights Forecasts to 2035

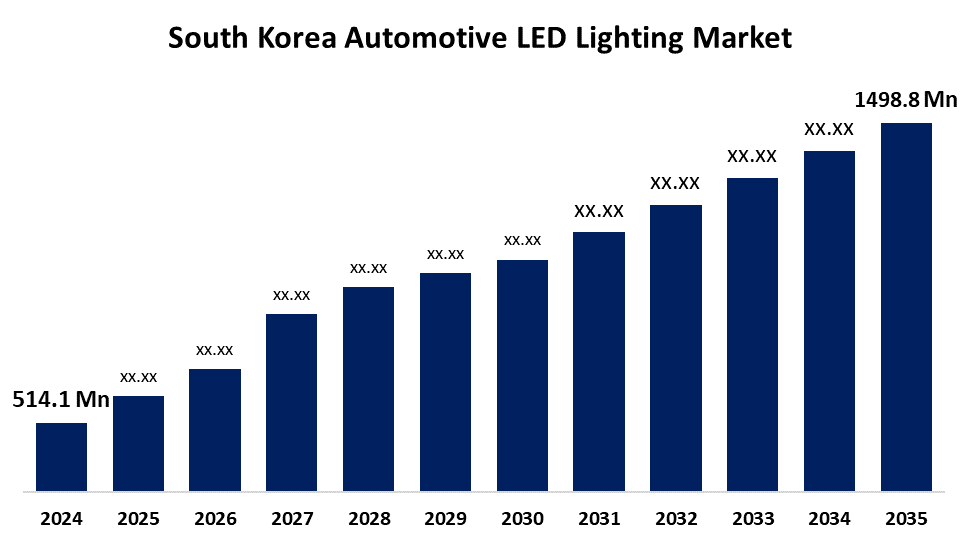

- The South Korea Automotive LED Lighting Market Size Was Estimated at USD 514.1Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.22% from 2025 to 2035

- The South Korea Automotive LED Lighting Market Size is Expected to Reach USD 1498.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Automotive LED Lighting Market Size is Anticipated to Reach USD 1498.8 Million by 2035, Growing at a CAGR of 10.22% from 2025 to 2035. Energy-efficient LED lighting is becoming more and more popular in South Korea due to the country's quick transition to electric vehicles (EVs), which supports national carbon neutrality goals.

Market Overview

The South Korea automotive LED lighting market refers to the industry sector devoted to the development, manufacturing, and incorporation of LED-based lighting systems in automobiles produced or marketed in South Korea is known as the South Korean automotive LED lighting market. Additionally, Strong cooperation between government programs and industry innovation defines the market. The development of next-generation lighting systems that meet strict safety regulations and provide cutting-edge features is the main focus of Korean auto lighting manufacturers. As it develops further, the Korea Motor Vehicle Safety Standard (KMVSS) adds new specifications for vehicle lighting that encourage innovation and safety. The government's dedication to environmentally friendly transportation and this regulatory framework are creating an atmosphere that is favorable to the creation and uptake of cutting-edge automotive LED lighting solutions. Leading this change are South Korean automakers, who are using these developments to improve the performance and safety of their vehicles.

Report Coverage

This research report categorizes the market for the South Korea automotive LED lighting market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea automotive LED lighting market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea automotive LED lighting market.

South Korea Automotive LED Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 514.1 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.22% |

| 2035 Value Projection: | USD 1498.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Automotive Utility Lighting, By Automotive Vehicle Lighting and COVID-19 Impact Analysis. |

| Companies covered:: | DH LIGHTING CO., LTD., GRUPO ANTOLIN IRAUSA, S.A., HELLA GmbH & Co. KGaA (FORVIA), Marelli Holdings Co., Ltd., Seoul Semiconductor Co., Ltd., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Focusing on technological innovation and integrating with new automotive trends is essential for established players to preserve and grow their market share. In order to support cutting-edge driver assistance systems and autonomous driving technologies, businesses must create comprehensive automotive lighting systems. Strong ties with automakers and the capacity to offer tailored solutions are essential for market success. In order to maintain cost competitiveness, players must also invest in manufacturing facilities that can produce next-generation lighting systems. Long-term success depends on the ability to adjust to shifting safety regulations and standards without sacrificing product quality.

Restraining Factors

The higher cost of LED lighting systems, particularly more sophisticated models like adaptive or matrix LEDs, compared to conventional halogen or HID systems restricts their use in low- and mid-range automobiles.

Market Segmentation

The South Korea automotive LED lighting market share is classified into automotive utility lighting and automotive vehicle lighting.

- The headlights segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea automotive LED lighting market is segmented by automotive utility lighting into daytime running lights (DRL), directional signal lights, headlights, reverse light, stop light, tail light, and others. Among these, the headlights segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driving by the growing use of cutting-edge automotive LED headlight technology in both two-wheelers and passenger cars. More advanced headlight solutions have been developed by manufacturers as a result of the increased focus on vehicle safety and visibility. Innovative LED headlight technologies are being actively adopted by major South Korean automakers, with an emphasis on improved heat dissipation and adaptive driving beam systems. The country's thriving electric vehicle market, where energy-efficient automotive LED headlight systems are becoming standard features, further supports the segment's growth.

- The passenger cars segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea automotive LED lighting market is segmented by automotive vehicle lighting into 2 wheelers, commercial vehicles, and passenger cars. Among these, the passenger cars segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. South Korea is the fourth-largest producer of passenger cars worldwide, demonstrating the region's robust automotive manufacturing base. Government programs encouraging vehicle electrification and the growing incorporation of cutting-edge lighting technologies in contemporary passenger cars serve to further solidify the segment's dominance. Leading automakers, including KG Mobility, Hyundai, Kia, GM Korea, and Renault Korea, are aggressively integrating LED lighting options into their car designs, especially for their electric vehicle models. The increasing sophistication of automotive exterior LED lighting solutions in the passenger car segment is demonstrated by the use of cutting-edge lighting technologies, such as Seoul Semiconductor's SunLike LED lights, in automobiles like the Volvo EX90 Electric SUV.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea automotive LED lighting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Recent Developments:

- In March 2023, HELLA expanded its Black Magic auxiliary headlamp series by introducing 32 new lightbars. The range expansion included 14 lightbars with ECE approval for on-road use and 18 lightbars designed for off-road applications.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Automotive LED Lighting Market based on the below-mentioned segments:

South Korea Automotive LED Lighting Market, By Automotive Utility Lighting

- Daytime Running Lights (DRL)

- Directional Signal Lights

- Headlights

- Reverse Light

- Stop Light

- Tail Light

- Others

South Korea Automotive LED Lighting Market, By Automotive Vehicle Lighting

- 2 Wheelers

- Commercial Vehicles

- Passenger Cars

Need help to buy this report?