South Korea ATM Market Size, Share, and COVID-19 Impact Analysis, By Solution (Deployment Solutions (Onsite ATMs, Offsite ATMs, Work Site ATMs, Mobile ATMs), Managed Services), By Screen Size (15" and Below and Above 15"), and South Korea ATM Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea ATM Market Insights Forecasts to 2035

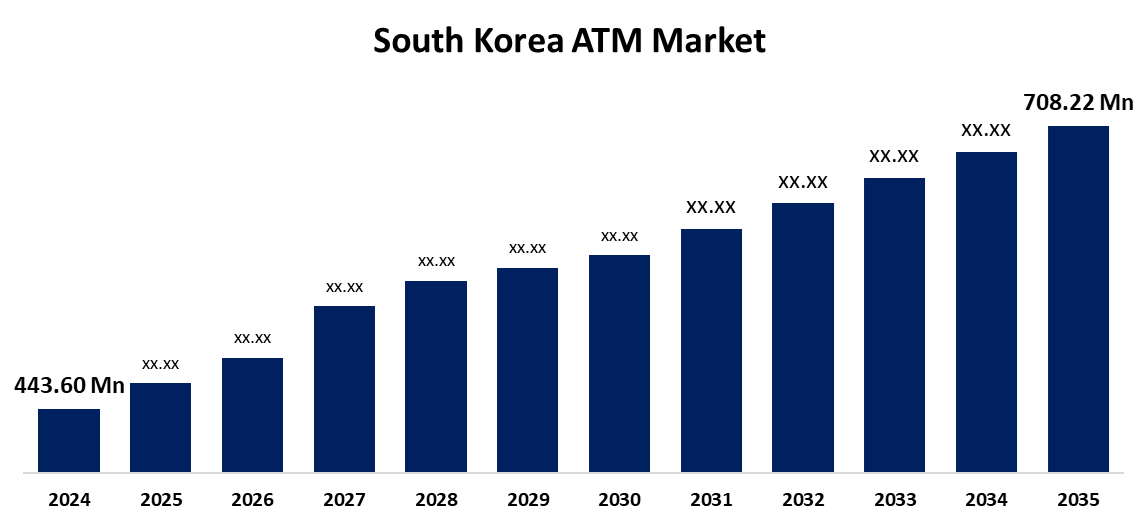

- The South Korea ATM Market Size was estimated at USD 443.60 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.34% from 2025 to 2035

- The South Korea ATM Market Size is Expected to Reach USD 708.22 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea ATM Market Size is anticipated to Reach USD 708.22 Million by 2035, Growing at a CAGR of 4.34% from 2025 to 2035. As smart technologies like biometric authentication and cash recycling are integrated, the market is changing. This tendency is also being driven by the growth of multipurpose ATMs in urban areas and the rising demand for easy, self-service banking. Strong fintech cooperation and assistance with digital banking also add to South Korea's dynamic ATM market share.

Market Overview

The South Korea ATM Market Size refers to the ecosystem of automated teller machines and associated services set up throughout the nation to enable self-service banking is referred to as the South Korean ATM market. Additionally, the deployment of cutting-edge technologies, such as biometric authentication, NFC capabilities, and cash recycling features, is greatly propelling the ATM market in South Korea. Cardless withdrawals, utility bill payments, and deposits are just a few of the multipurpose functions that smart ATMs are increasingly performing. By reducing wait times and providing a variety of financial services around-the-clock, these features enhance the client experience. To align with the country's broader push toward digitization, financial institutions modernize outdated automated teller machines. Furthermore, security features like encrypted software and facial recognition prevent fraud and boost user confidence. Notwithstanding the widespread use of mobile and internet-based banking, intelligent ATMs are solidifying their place in the modern financial system as consumers demand more from self-service banking.

Report Coverage

This research report categorizes the market for the South Korea ATM market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea ATM market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea ATM market.

South Korea ATM Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 443.60 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.34% |

| 2035 Value Projection: | USD 708.22 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Solution, By Screen Size |

| Companies covered:: | NCR Corporation, Diebold Nixdorf, Hyosung TNS, LG CNS, GRG Banking, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the ATM market is being largely driven by strategic alliances between South Korean banks and international technology companies. The goal of these partnerships is to provide high-tech, reasonably priced, and readily expandable ATM services. For example, financial institutions are contracting with tech firms that offer ATM-as-a-Service models to handle ATM management, which lowers operating costs while improving user experience. These partnerships also speed up the adoption of new features like multilingual interfaces, touchless access, and QR code functionality. These collaborations guarantee ATMs' competitiveness in a financial landscape that prioritizes digitalization.

Restraining Factors

The well-established ATM network in South Korea is already supported by the country's dense urban infrastructure, which restricts the potential for new deployments in major cities.

Market Segmentation

The South Korea ATM market share is classified into solution and screen size.

- The deployment solutions segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea ATM market is segmented by solution into deployment solutions and managed services. Among these, the deployment solutions segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These solutions continue to be crucial for preserving convenient banking and broad access to cash, particularly in cities and busy places.

- The above 15" segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea ATM market is segmented by screen size into 15" and below and above 15". Among these, the above 15" segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing need for multipurpose smart ATMs that accommodate cutting edge features like cash recycling, biometric authentication, and interactive user interfaces functions that profit from bigger, easier to use displays is what is driving this preference.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea ATM market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NCR Corporation

- Diebold Nixdorf

- Hyosung TNS

- LG CNS

- GRG Banking

- Others

Recent Developments:

- In May 2025, South Korea launched a new QR-based payment and ATM cash withdrawal service tailored for international travelers across Asia. This initiative built on the nation's ongoing efforts to upgrade its financial infrastructure, which also included the rollout of a digital currency pilot program. The service aimed to improve financial accessibility and convenience for Korean tourists and foreign visitors, particularly in areas where conventional payment options were less widely accepted.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea ATM Market based on the below-mentioned segments:

South Korea ATM Market, By Solution

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

South Korea ATM Market, By Screen Size

- 15" and Below

- Above 15"

Need help to buy this report?