South Korea Anti-hypertensive Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product (ACE Inhibitors (ACEIs), Angiotensin II Receptor Blockers (ARBs), Direct Renin Inhibitors, Calcium Channel Blockers, Diuretics, Mineralocorticoid Receptor Antagonists (MRAs), Beta-blockers, Alpha-1 Blockers, Central Alpha-2 Agonists, Direct Vasodilators, Fixed-dose Combinations (FDCs), and Others), By Type (Standard Hypertension, Treatment-resistant Hypertension, and Hypertensive Emergency/ Urgency), and South Korea Anti-hypertensive Drugs Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSouth Korea Anti-hypertensive Drugs Market Insights Forecasts to 2035

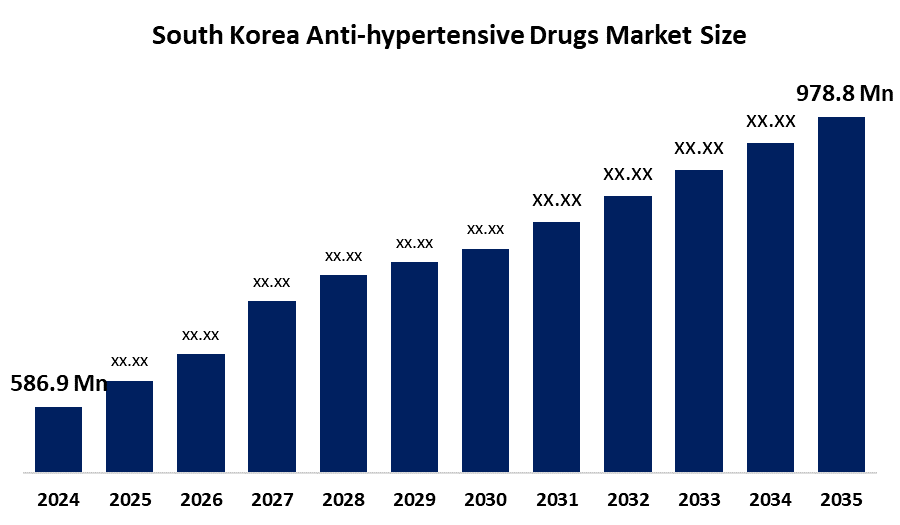

- The South Korea Anti-hypertensive Drugs Market Size Was Estimated at USD 586.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.76% from 2025 to 2035

- The South Korea Anti-hypertensive Drugs Market Size is Expected to Reach USD 978.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Anti-hypertensive Drugs market is anticipated to reach USD 978.8 Million by 2035, growing at a CAGR of 4.76% from 2025 to 2035. The South Korean anti-hypertensive drugs market is driven by rising hypertension prevalence, a rise in aging population, growing health awareness, and advancements in pharmaceutical research.

Market Overview

The South Korean Antihypertensive Drugs Market Size is an essential segment of the country's pharmaceutical industry, with emphasis on treating hypertension, a chronic condition characterized by chronically raised blood pressure. Antihypertensive medicines are used to treat high blood pressure and prevent complications such as heart disease, stroke, and kidney damage. These drugs include several classes, such as ACE inhibitors (ACEIs), angiotensin II receptor blockers (ARBs), direct renin inhibitors, calcium channel blockers, diuretics, mineralocorticoid receptor antagonists (MRAs), beta-blockers, alpha-1 blockers, central alpha-2 agonists, direct vasodilators, fixed-dose combinations (FDCs), and others. The rise in aging population is one of the major contributors to this market, as aging population is more prone to developing hypertension and related CV complications. The South Korean government has implemented initiatives to improve healthcare access, promote regular screening, which further support market expansion.

Report Coverage

This research report categorizes the market for the south Korea anti-hypertensive drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the south Korea anti-hypertensive drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea anti-hypertensive drugs market.

South Korea Anti-hypertensive Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 586.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.76% |

| 2035 Value Projection: | USD 978.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Mine Type, By Service |

| Companies covered:: | CJ CheilJedang Corporation, Nongshim Co., Ltd. (Spoon), Lotte Co., Ltd., Nestlé Purina PetCare Company, Mars, Incorporated (Royal Canin, Pedigree), Hill’s Pet Nutrition, Inc., Wellpet LLC, K9 Natural Ltd., Amano Foods Co., Ltd., V.I.P. Pet Foods, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of high blood pressure among South Korean adults leads to rising demand for antihypertensive medication, which further boosts the market growth. The rising awareness of cardiovascular risks is propelling the South Korean antihypertensive drugs market by encouraging patients to continuously follow recommended therapies. The development of better, safer, and more patient-friendly antihypertensive medicines drives the South Korean market by improving treatment results and raising patient demands. Additionally, government initiatives and lifestyle changes play an important role in market growth.

Restraining Factors

The expensive branded antihypertensive drugs limit the adoption among price-sensitive patients, which hinders he market growth. Additionally, a strengthened approval process may lead to complications and a product launch delay.

Market Segmentation

The South Korea anti-hypertensive drugs market share is classified into product and type

- The angiotensin II receptor blockers (ARBs) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea anti-hypertensive drugs market is segmented by product into ACE inhibitors (ACEIs), angiotensin II receptor blockers (ARBs), direct renin inhibitors, calcium channel blockers, diuretics, mineralocorticoid receptor antagonists (MRAs), beta-blockers, alpha-1 blockers, central alpha-2 agonists, direct vasodilators, fixed-dose combinations (FDCs), and others. Among these, the angiotensin II receptor blockers (ARBs) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its shown efficacy in decreasing blood pressure, excellent safety profile, and extensive use in the long-term therapy of hypertension and related cardiovascular diseases.

- The standard hypertension segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea anti-hypertensive drugs market is segmented by type into standard hypertension, treatment-resistant hypertension, and hypertensive emergency/ urgency. Among these, the standard hypertension segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the large number of patients whose blood pressure may be managed with one to three antihypertensive medications. This sector benefits from well-established treatment methods, broad availability of generic drugs, and higher patient adherence than more difficult resistant hypertension situations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea anti-hypertensive drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ CheilJedang Corporation

- Nongshim Co., Ltd. (Spoon)

- Lotte Co., Ltd.

- Nestlé Purina PetCare Company

- Mars, Incorporated (Royal Canin, Pedigree)

- Hill's Pet Nutrition, Inc.

- Wellpet LLC

- K9 Natural Ltd.

- Amano Foods Co., Ltd.

- V.I.P. Pet Foods

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea anti-hypertensive drugs market based on the below-mentioned segments

South Korea Anti-hypertensive Drugs Market, By Product

- ACE Inhibitors (ACEIs)

- Angiotensin II Receptor Blockers (ARBs)

- Direct Renin Inhibitor

- Calcium Channel Blockers

- Diuretics

- Mineralocorticoid Receptor Antagonists (MRAs)

- Beta-blockers

- Alpha-1 Blockers

- Central Alpha-2 Agonists

- Direct Vasodilators

- Fixed-dose Combinations (FDCs)

South Korea Anti-hypertensive Drugs Market, By Type

- Standard Hypertension

- Treatment-resistant Hypertension

- Hypertensive Emergency Urgency

Need help to buy this report?