South Korea Aluminum Market Size, Share, and COVID-19 Impact Analysis, By Type (Primary and Secondary), By Product Type (Flat Rolled, Castings, Extrusions, Rod Bar, Forgings, and Others), By Application (Building Construction, Automotive Transportation, Foil Packaging, Power, Machinery Equipment Industrial, Consumer Goods, and Others), and South Korea Aluminum Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Aluminum Market Insights Forecasts to 2035

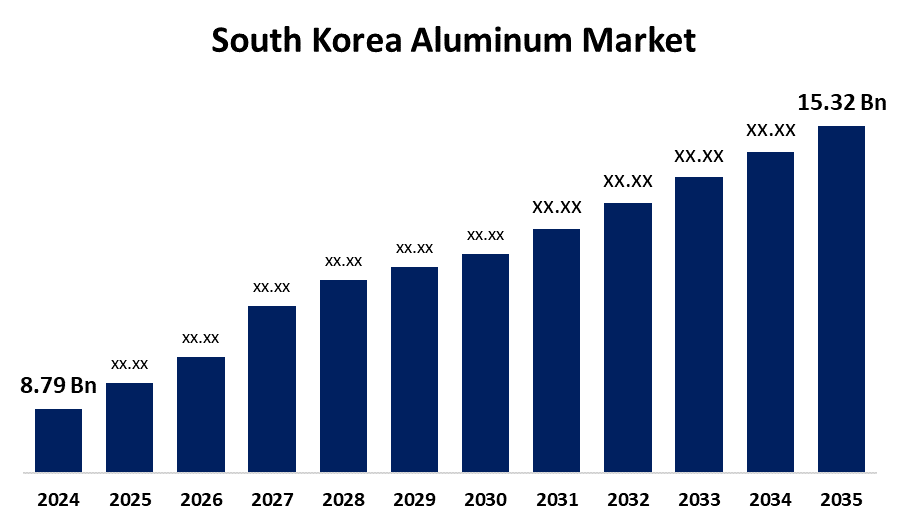

- The South Korea Aluminum Market Size Was Estimated at USD 8.79 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.18% from 2025 to 2035

- The South Korea Aluminum Market Size is Expected to Reach USD 15.32 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Aluminum Market Size is anticipated to reach USD 15.32 Billion by 2035, growing at a CAGR of 5.18 % from 2025 to 2035. The industrial structure and technical developments of the nation are driving a number of significant trends in the South Korea aluminum market.

Market Overview

The commerce in aluminum and its derivatives, such as primary aluminum, alloys, sheets, foils, rolled goods, manufactured goods, and materials for packaging, transportation, and construction, is included in the aluminum market. It also covers the global commerce in alumina and bauxite, the raw materials required to make aluminum. Because aluminum is easily molded and formed, it may be used in a variety of sectors to create complex designs and unique solutions. Aluminum's inherent ability to withstand corrosion makes it appropriate for outdoor settings and long-lasting. The need for aluminum in building and construction applications such as roofing, cladding, windows, and doors is being driven by growing urbanization and infrastructural development. Aluminum is a material that works well in a variety of climates and architectural styles because of its longevity and resistance to corrosion. The use of aluminum packaging, especially cans, which are very recyclable, is being derived from the rising demand for packaged foods and drinks as well as environmental concerns. By providing incentives for the production of high-value aluminum products, such as aerospace and automotive grade aluminum, these programs draw in investments and establish India as a major supplier in these specialized sectors. The sustainability profile of the aluminum sector has been further improved by investments in recycling and environmentally friendly production methods brought about by growing awareness of climate change.

Report Coverage

This research report categorizes the market for South Korea aluminum market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea aluminum market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each South Korea aluminum market sub-segment.

South Korea Aluminum Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.79 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.18% |

| 2035 Value Projection: | USD 15.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Type, By Product Type and By Application |

| Companies covered:: | Novelis Korea Limited, Lotte Aluminium Co., Ltd., Aluko Co., Ltd., CHOIL Aluminium Co., Ltd., SAMBO Industrial Co., Ltd., HIHO Light-Metal Co., Ltd., Namsun Aluminium Co., Ltd., Dongnam Co., Ltd., Sam-A Aluminium Co., Ltd., Sejin Metal Co., Ltd., Yoosung Aluminium Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Aluminum's low weight and excellent strength-to-weight ratio make it the perfect material for lowering vehicle weight and increasing fuel efficiency, which is one of the main factors driving the desire for lightweight, fuel-efficient automobiles. The increase in the manufacturing of electric vehicles (EVs), where aluminum is essential for lightweight battery packs and other parts, is another factor driving this. Aluminum's adaptability, toughness, and visual appeal make it a popular building material. With urbanization and the expansion of infrastructure, its use in windows, curtain walls, roofing, and cladding is growing, especially in emerging countries like China and India. The need for recycled aluminum and low-carbon aluminum production techniques is being driven by the increased emphasis on sustainability and lowering greenhouse gas emissions.

Restraining Factors

Raw materials used to make aluminum is bauxite, and changes in its price due to macroeconomic and geopolitical circumstances affect the cost of production as a whole. The cost of production is also influenced by the fluctuating prices of other necessary raw materials, such as electricity and caustic soda. Aluminum producers may find it difficult to increase capacity or carry out long-term plans as a result of these price swings, which might reduce their profit margins. Conflicts over trade and political upheaval can also affect demand and cause supply chain disruptions.

Market Segmentation

The South Korea aluminum market share is classified into type, product type, and application.

- The primary segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea aluminum market is segmented by type into primary and secondary. Among these, the primary segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The primary category is crucial because it represents aluminum that is made directly from bauxite ore using sophisticated extraction methods, which supports the expansion of the market as a whole.

- The flat rolled segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea aluminum market is segmented by product type into flat rolled, castings, extrusions, rod bar, forgings, and others. Among these, the flat rolled segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. flat Rolled products are important for the automotive and packaging industries, as their lightweight nature improves fuel efficiency and reduces material costs.

- The building construction segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea aluminum market is segmented by application into building construction, automotive transportation, foil packaging, power, machinery equipment industrial, consumer goods, and others. Among these, the building construction segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. The South Korea's continuous urbanization and infrastructure improvements, the building construction industry is very important.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea aluminum market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novelis Korea Limited

- Lotte Aluminium Co., Ltd.

- Aluko Co., Ltd.

- CHOIL Aluminium Co., Ltd.

- SAMBO Industrial Co., Ltd.

- HIHO Light-Metal Co., Ltd.

- Namsun Aluminium Co., Ltd.

- Dongnam Co., Ltd.

- Sam-A Aluminium Co., Ltd.

- Sejin Metal Co., Ltd.

- Yoosung Aluminium Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea aluminum market based on the below-mentioned segments:

South Korea Aluminum Market, By Type

- Primary

- Secondary

South Korea Aluminum Market, By Product Type

- Flat Rolled

- Castings

- Extrusions

- Rod Bar

- Forgings

- Others

South Korea Aluminum Market, By Application

- Building Construction

- Automotive Transportation

- Foil Packaging

- Power

- Machinery Equipment Industrial

- Consumer Goods

- Others

Need help to buy this report?