South Korea Aluminum Extrusion Market Size, Share, and COVID-19 Impact Analysis, By Product (Shapes, Rods & Bar, and Pipes & Tubes), By Application (Building & Construction, Automotive & Transportation, Consumer Goods, and Electrical & Energy), and South Korea Aluminum Extrusion Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsSouth Korea Aluminum Extrusion Market Insights Forecasts to 2035

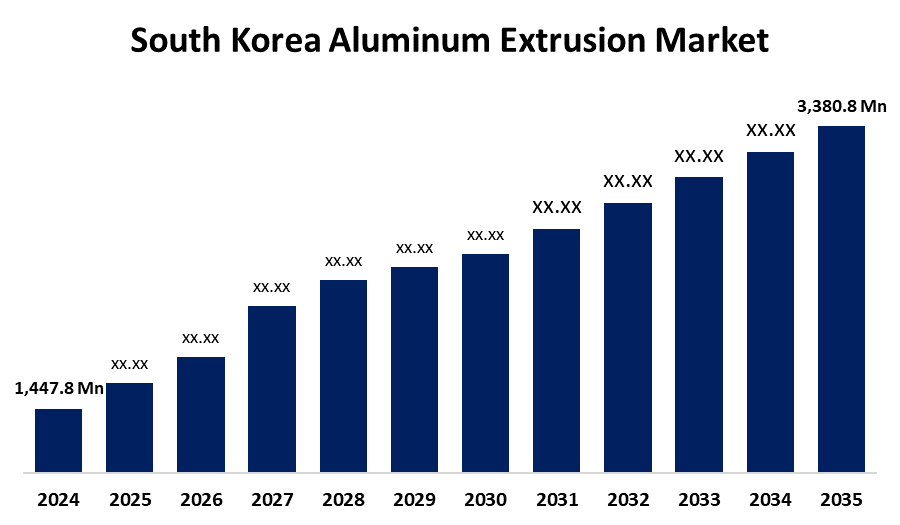

- The South Korea Aluminum Extrusion Market Size Was Estimated at USD 1,447.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.01% from 2025 to 2035

- The South Korea Aluminum Extrusion Market Size is Expected to Reach USD 3,380.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Aluminum Extrusion Market size is anticipated to reach USD 3,380.8 Million by 2035, growing at a CAGR of 8.01% from 2025 to 2035. The market is growing at a moderate rate, and this growth is accelerating. As lightweight aluminum parts are being adopted across various industries, including construction, automotive, and aerospace, the industry is characterized by a growing demand for extruded products and an increasing acceptance of aluminum extrusion. Changes in rules and the level of innovation have a significant effect on the sector.

Market Overview

The sale of aluminum extrusion goods and services, which are used to force aluminum alloys through a die with a desired cross-section to create certain shapes, is included in the aluminum extrusion market. These extruded goods are subsequently employed in a variety of industrial settings. Aluminum extrusions have a high strength-to-weight ratio, they are perfect for uses like construction and transportation where it is essential to reduce weight. Aluminum naturally resists corrosion, goods last longer and require less maintenance. Extrusion gives manufacturers versatility by enabling the fabrication of intricate shapes and designs that are suited to certain requirements. The production process is streamlined by the ease with which aluminum extrusions may be machined, welded, and constructed. The growing demand for environmentally friendly and energy-efficient building materials. Aluminum extrusions have a lot of prospects as the renewable energy industry expands, especially in the production of solar panels and wind turbines. Green building standards are being promoted by governments, which is increasing the use of recyclable and sustainable materials like aluminum. The market for aluminum extrusion is further driven by investments in infrastructure, such as energy and transportation, which call for strong and lightweight materials.

Report Coverage

This research report categorizes the market for South Korea aluminum extrusion market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea aluminum extrusion market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea aluminum extrusion market.

South Korea Aluminum Extrusion Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,447.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.01% |

| 2035 Value Projection: | USD 3,380.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product and By Application |

| Companies covered:: | ALUS Co., Ltd., Kyunghee Aluminum, Sunghwa Corp., Leader System Co., Ltd., Shin Yang Metal Ind Co., Ltd., Sang Shin Metallic Co., Ltd., ALUWIN, Poongsan Corporation, SeAH Steel Holdings, Hyosung Corporation, Sungho Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The requirement for lightweight materials in the automobile and aerospace industries. Its outstanding strength-to-weight ratio, aluminum extrusions reduce overall vehicle weight and increase fuel efficiency. The need for aluminum extrusions in construction is being driven by the rapid expansion of infrastructure and urbanization. Windows, doors, building facades, and other structural elements all use these extrusions.

Restraining Factors

Consumers and regulators are very concerned about the environmental effects of aluminum manufacturing, especially the energy use and greenhouse gas emissions, which may cause choose more environmentally friendly. Price fluctuations for aluminum and other raw materials might affect the profitability and costs of production, which could result in lower demand and higher final product pricing.

Market Segmentation

The South Korea Aluminum Extrusion Market share is classified into product and application.

- The shapes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea aluminum extrusion market is segmented by product into shapes, rods & bar, pipes & tubes. Among these, the shapes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Aluminum can be extruded into a wide variety of shapes with ease. This process involves heating aluminum billets and applying high pressure against steel dies using a hydraulic press. Aluminum shapes that exactly match the die outlines are produced.

- The building & construction segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea aluminum extrusion market is segmented by application into building & construction, automotive & transportation, consumer goods, and electrical & energy. Among these, the building & construction segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Investment in the housing industry has had a significant impact on the use of extruded goods in construction operations. In the upcoming years, this segment is expected to rise as a result of ongoing efforts by several nations to invest in the construction of new homes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea aluminum extrusion market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALUS Co., Ltd.

- Kyunghee Aluminum

- Sunghwa Corp.

- Leader System Co., Ltd.

- Shin Yang Metal Ind Co., Ltd.

- Sang Shin Metallic Co., Ltd.

- ALUWIN

- Poongsan Corporation

- SeAH Steel Holdings

- Hyosung Corporation

- Sungho Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea aluminum extrusion market based on the below-mentioned segments:

South Korea Aluminum Extrusion Market, By Product

- Shapes

- Rods & Bar

- Pipes & Tubes

South Korea Aluminum Extrusion Market, By Application

- Building & Construction

- Automotive & Transportation

- Consumer Goods, Electrical & Energy

Need help to buy this report?