South Korea Alcoholic Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Beer, Wine, Spirits, and Others), By Alcoholic Content (High, Medium, Low), and South Korea Alcoholic Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Alcoholic Beverages Market Insights Forecasts to 2035

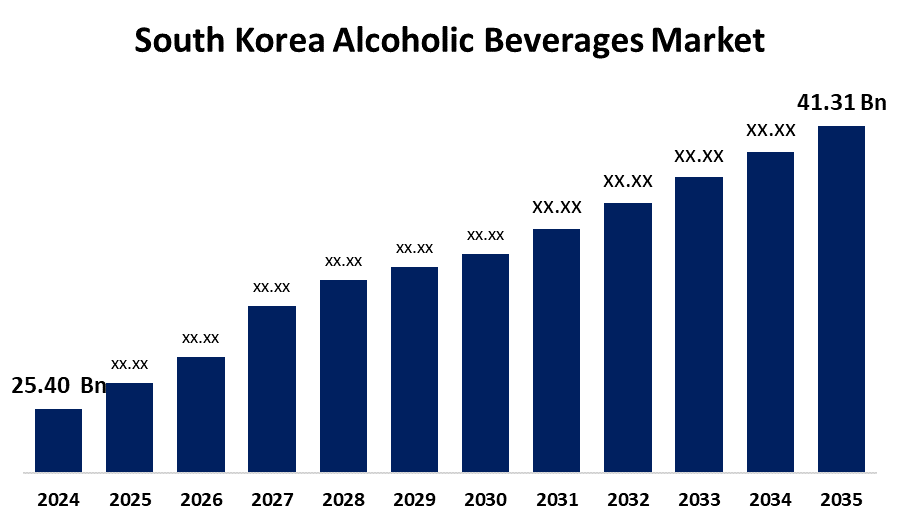

- The South Korea Alcoholic Beverages Market Size was estimated at USD 25.40 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.52% from 2025 to 2035

- The South Korea Alcoholic Beverages Market Size is Expected to Reach USD 41.31 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Alcoholic Beverages Market is anticipated to reach USD 41.31 billion by 2035, growing at a CAGR of 4.52% from 2025 to 2035. The growth of digital platforms and e-commerce, which has revolutionized the way alcoholic drinks are consumed by consumers, is driving the market. The growth of digital platforms and e-commerce, which has revolutionized the way alcoholic drinks are consumed by consumers, is fuelling the market growth in the nation.

Market Overview

The South Korean alcohol drinks market refers to the production, import, distribution, and consumption of alcoholic drinks in South Korea. The market is defined by a rich diversity of traditional drinks, including soju and makgeolli, with an increasing need for foreign and high-end offerings such as craft beer, wine, and spirits. Additionally, the alcoholic drinks sector is being driven by the readiness of consumers to spend on higher-quality and premium drinks, which offer unique flavour profiles and craftsmanship. Additionally, favourable policies by the government that promote competition, innovation, and moderation can drive market growth and investment in the sector. Moreover, there has been enhanced consumption of wine, particularly red wine, due to the growing middle-class population and its perceived health advantages. A dramatic increase in premium and imported goods has been observed in the later years of the historical period, which suggests that the consumer's preferences have shifted towards a more refined and wider range of products.

Report Coverage

This research report categorizes the market for the South Korea alcoholic beverages market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea alcoholic beverages market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea alcoholic beverages market.

South Korea Alcoholic Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 25.40 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.52% |

| 2035 Value Projection: | USD 41.31 Bllion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product Type, By Alcoholic Content and COVID-19 Impact Analysis |

| Companies covered:: | HiteJinro Co., Ltd., OB Beer Co., Ltd., Lotte Chilsung Beverage Co., Ltd., Muhak Co.LTD., Changhae Ethanol Co., LTD., Diageo Korea Co., Ltd., Brown Forman Korea Co., Ltd., Daesun distilling Co., Ltd., Bacardi Korea Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The demand for alcoholic drinks in South Korea is driven by the growth in the production of flavoured and functional drinks, ready-to-drink products, and alternative ingredient-based drinks like plant-based milk substitutes. These producers are creating single-serve and convenient packaging forms, including cans, pouches, and bottles, that can be consumed anywhere and anytime.

Restraining Factors

There is apparent decline in South Korea's cultural drinking habits, especially among younger generations. Contributing to this trend are higher health awareness, economic constraints, and changing societal values. As a result, facilities such as pubs and karaoke bars are seeing fewer visitors, challenging the alcoholic drinks industry to keep up with such changing consumer patterns.

Market Segmentation

The South Korea alcoholic beverages market share is classified into product type and alcoholic content

- The spirits segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea alcoholic beverages market is segmented by product type into beer, wine, spirits, and others. Among these, the spirits segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Spirits lead in the alcohol beverage market in South Korea, with soju, a local distilled spirit being the top category. Soju is hugely popular in South Korea because it is affordable, culturally relevant, and can be consumed in numerous types of social gatherings. As a result, it takes a prominent position in South Korean society, particularly in social and business gatherings.

- The high segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea alcoholic beverages market is segmented by alcoholic content into high, medium, low. Among these, the high segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. spirits with a high alcohol content, especially premium and import brands, tend to be linked to quality and prestige. People are willing to pay more for upscale products, making premium spirits popular.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea alcoholic beverages market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HiteJinro Co., Ltd.

- OB Beer Co., Ltd.

- Lotte Chilsung Beverage Co., Ltd.

- Muhak Co.LTD.

- Changhae Ethanol Co., LTD.

- Diageo Korea Co., Ltd.

- Brown Forman Korea Co., Ltd.

- Daesun distilling Co., Ltd.

- Bacardi Korea Ltd.

- Others

Recent Developments:

- In May 2024, Barrell Craft Spirits (BCS) officially launched its award-winning range of spirits in South Korea. UOT was selected as the on- and off-trade distributor for the brand.

- In February 2024, Korean travel retailer Lotte Duty-Free opened an online liquor exhibition featuring top brands with a special whiskey section. Consumers saved up to 55% during the spring season.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Alcoholic Beverages Market based on the below-mentioned segments:

South Korea Alcoholic Beverages Market, By Product Type

- Beer

- Wine

- Spirits

- Others

South Korea Alcoholic Beverages Market, By Alcoholic Content

- High

- Medium

- Low

Need help to buy this report?