South Korea Agrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Fertilizer Type (Nitrogen Fertilizer, Phosphatic Fertilizer, Potassic Fertilizer, and Others), By Pesticide Type (Fungicides, Herbicides, Insecticides, and Others), and South Korea Agrochemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureSouth Korea Agrochemicals Market Insights Forecasts to 2035

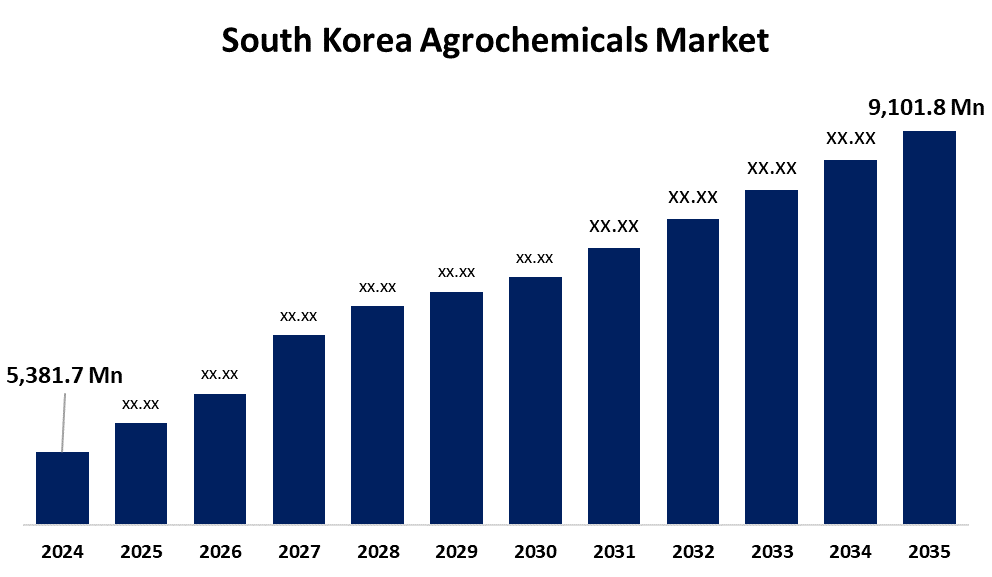

- The South Korea Agrochemicals Market Size was Estimated at USD 5,381.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.89% from 2025 to 2035

- The South Korea Agrochemicals Market Size is Expected to Reach USD 9,101.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Agrochemicals Market Size is anticipated to reach USD 9,101.8 Million by 2035, Growing at a CAGR of 4.89% from 2025 to 2035. The market is being driven by the growing use of contemporary agricultural techniques that can increase demand for agrochemicals, such as precision farming and the use of genetically modified crops.

Market Overview

The South Korean agrochemicals market encompasses a wide range of chemical and biological products used in agriculture to increase crop productivity, shield plants from pests and diseases, and improve soil quality are included in the South Korean agrochemicals market. These products include soil conditioners, growth regulators, fertilizers, and pesticides (including insecticides, fungicides, and herbicides). The South Korea's agrochemicals market has grown significantly thanks to a number of important factors. First, the demand for agrochemicals is driven by the need for greater agricultural productivity to meet food demands due to the growing regional population. Furthermore, farmers are turning to agrochemicals and advanced agricultural techniques in order to cultivate crops efficiently due to the ongoing trend of urbanization, which has resulted in a reduction of arable land. Furthermore, new formulations brought about by technological developments in the agrochemical industry have improved the effectiveness of pesticides, fertilizers, and herbicides. This has drawn farmers looking for high-yield, sustainable farming solutions, which has increased demand for agrochemicals.

Report Coverage

This research report categorizes the market for the South Korea agrochemicals market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea agrochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea agrochemicals market.

South Korea Agrochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,381.7 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 4.89% |

| 2035 Value Projection: | USD 9,101.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 191 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fertilizer Type, By Pesticide Type, and COVID-19 Impact Analysis |

| Companies covered:: | Namhae Chemical Corporation, KG Chemical Co., Ltd., Lotte Chemical Corporation, Kumho Petrochemical Co., Ltd., Daeil Fertilizer Co., Ltd., Dongbu Farm Hannong, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The use of agrochemicals has increased as farmers become more conscious of the advantages of integrated pest management and precision farming. The market has expanded as a result of favorable government regulations and programs that support contemporary farming methods. In keeping with the growing emphasis on sustainable agriculture, research institutions and agrochemical companies have collaborated extensively to develop economical and ecologically friendly solutions. In conclusion, a number of factors, such as urbanization, population growth, technological advancements, awareness, and regulatory support, are working together to drive the South Korean agrochemicals market's upward trajectory.

Restraining Factors

Environmental problems like soil erosion, water pollution, and negative impacts on non-target organisms like beneficial insects and aquatic life have been brought on by the use of agrochemicals. These worries have led to demands for stronger laws governing the use of chemicals and more environmentally friendly farming methods.

Market Segmentation

The South Korea agrochemicals market share is classified into fertilizer type and pesticide type.

- The nitrogen fertilizer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea agrochemicals market is segmented by fertilizer type into nitrogen fertilizer, phosphatic fertilizer, potassic fertilizer, and others. Among these, the nitrogen fertilizer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Since nitrogen-based fertilizers are crucial for increasing soil fertility and crop yield, they are widely used. The nation's emphasis on increasing agricultural productivity and guaranteeing food security is what is driving the demand for nitrogen fertilizers.

- The herbicides segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea agrochemicals market is segmented by pesticide type into fungicides, herbicides, insecticides, and others. Among these, the herbicides segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The herbicides crucial function in weed control, which is necessary to sustain crop yields, especially in rice and vegetable farming, is the reason for their dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea agrochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Namhae Chemical Corporation

- KG Chemical Co., Ltd.

- Lotte Chemical Corporation

- Kumho Petrochemical Co., Ltd.

- Daeil Fertilizer Co., Ltd.

- Dongbu Farm Hannong

- Others

Recent Developments:

- In June 2024, Authorities such as the Ministry of Agricultural, Food and Rural Affairs (MAFRA) implemented regulatory reforms aimed at enhancing environmental sustainability, which affected businesses like LG Chem and Dongbu Farm Hannong. These reforms encouraged the adoption of safer and greener agrochemical products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea agrochemicals market based on the below-mentioned segments:

South Korea Agrochemicals Market, By Fertilizer Type

- Nitrogen Fertilizer

- Phosphatic Fertilizer

- Potassic Fertilizer

- Others

South Korea Agrochemicals Market, By Pesticide Type

- Fungicides

- Herbicides

- Insecticides

- Others

Need help to buy this report?