South Korea Aerial Work Platform Rental Market Size, Share, and COVID-19 Impact Analysis, By Products (Boom Lifts, Scissor Lifts, Vertical Mass Lifts, Personal Portable Lifts), By Types (Electric, Engine Powered), By Platform Heights (Below 10 Meters, 10 to 20 Meters, 20 to 25 Meters, Above 25 Meters), By Application (Rental, Construction & Mining, Government, Transportation & Logistics, Utility), and South Korea Aerial Work Platform (AWP) Rental Market Insights Forecasts to 2033

Industry: Construction & ManufacturingSouth Korea Aerial Work Platform (AWP) Rental Market Insights Forecasts to 2033

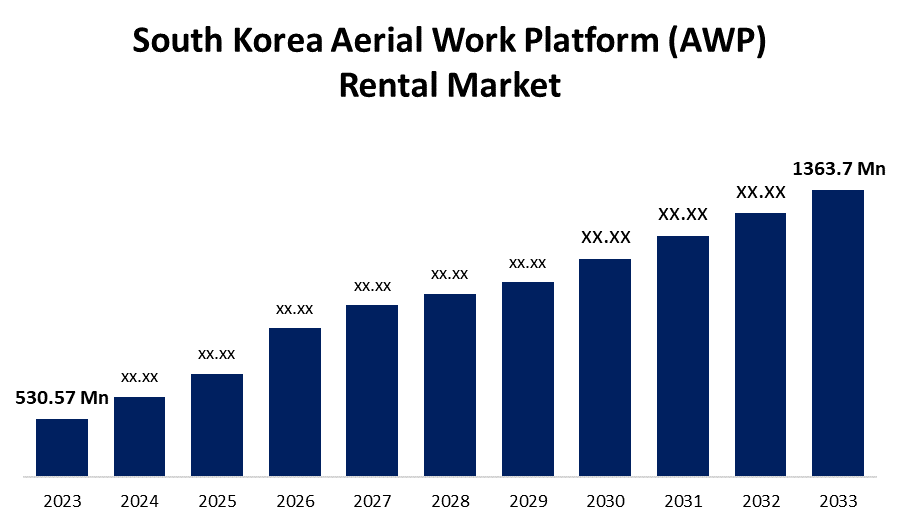

- The South Korea Aerial Work Platform (AWP) Rental Market Size was valued at USD 530.57 Million in 2023.

- The Market Size is Growing at a CAGR of 9.9% from 2023 to 2033.

- The South Korea Aerial Work Platform (AWP) Rental Market Size is Expected to Reach USD 1363.7 Million by 2033.

Get more details on this report -

The South Korea Aerial Work Platform (AWP) Rental Market Size is Expected to Reach USD 1363.7 Million by 2033, at a CAGR of 9.9% during the forecast period 2023 to 2033.

Market Overview

Aerial work platforms AWPs are pieces of lifting equipment that can be rented or leased for a set period of time. These rented platforms are frequently used for construction projects such as high-rise building, duct repair, and overhead cable repair. The main purpose of these systems is to provide equipment and employees with access to previously inaccessible areas at a specific height. Other features include compressed air installation, power tool sockets, and windowpane frame support. As the population grows, so does the demand for rural and urban infrastructure projects. This is the primary driver of the aerial work platform rental industry's growth during the forecast period. Furthermore, the construction and infrastructure development industries are expanding rapidly in South Korea.

Report Coverage

This research report categorizes the market for South Korea aerial work platform (AWP) rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea aerial work platform (AWP) rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South Korea aerial work platform (AWP) rental market.

South Korea Aerial Work Platform Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 530.57 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.9% |

| 2033 Value Projection: | USD 1363.7 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Products, By Types, By Platform Heights, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | SK Rental Co., Ltd., Korea Rental Corporation, Jeil Rental Co., Ltd., Korea EWP Co., Ltd., Doosan Mecatec Co., Ltd., Hyundai Rental Corporation, Hanjin Rental System Co., Ltd., Sambo EWP Co., Ltd., Kosin EWP Co., Ltd., CS Korea Rental Corp., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea's aerial work platform rental market is being boosted by the country's rapid expansion of the construction sector and several ongoing and upcoming infrastructure projects. These industries are increasingly relying on access platforms to improve operational efficiency and speed over traditional scaffolds and ladders. Lotte Tower, the Seoul-Pyongyang Rail Project, port development projects, and other major infrastructure projects are underway in the country. Aerial work platforms (AWPs) rental was first introduced in the South Korean industry by rental providers, who now own more than 90% of the total fleet available in the country. Furthermore, the high penetration of various leading manufacturers such as Samsung, Hyundai, LG, and others, as well as the growing demand for maintenance activities at these sites, serve as major drivers of South Korea aerial work platform (AWP) rental market growth.

Restraining Factors

The lack of awareness of advanced lifting technologies, as well as the scarcity of skilled operators to operate these machines, are factors impeding the growth of the South Korean aerial work platform rental market. The increased use of new advanced machinery over manual labor across all industries in South Korea is expected to promote the implementation of these machines. Furthermore, rental companies must provide appropriate training courses to operators in order to prevent future injuries and workplace accidents.

Market Segment

- In 2023, the scissor lifts segment accounted for the largest revenue share over the forecast period.

Based on the products, the South Korea aerial work platform (AWP) rental market is segmented into boom lifts, scissor lifts, vertical mass lifts, and personal portable lifts. Among these, the scissor lifts segment has the largest revenue share over the forecast period. Construction, maintenance, and warehousing are just a few of the industries that use it. They are versatile, easy to use, and suitable for a wide range of indoor and outdoor applications.

- In 2022, the electric segment accounted for the largest revenue share over the forecast period.

Based on the types, the South Korea aerial work platform (AWP) rental market is segmented into electric, and engine powered. Among these, the electric segment has the largest revenue share over the forecast period, owing to their low operating costs and suitability for indoor applications. They are frequently preferred in industries and settings where emissions, noise levels, and indoor air quality are major concerns. Electric aerial work platforms (AWPs) are commonly used in warehouses, manufacturing facilities, and retail spaces for tasks such as maintenance.

- In 2022, the 10 Meters segment accounted for the largest revenue share over the forecast period.

Based on the platform heights, the South Korea aerial work platform (AWP) rental market is segmented into below 10 Meters, 10 to 20 Meters, 20 to 25 Meters, and above 25 Meters. Among these, the 10 Meters segment has the largest revenue share over the forecast period. Indoor applications, routine maintenance, and tasks requiring access to relatively low heights are all possible. These are frequently used in industries such as warehousing, facility maintenance, and retail.

- In 2022, the construction & mining segment accounted for the largest revenue share over the forecast period.

Based on the application, the South Korea aerial work platform (AWP) rental market is segmented into rental, construction & mining, government, transportation & logistics, and utility. Among these, the construction & mining segment has the largest revenue share over the forecast period. Access to elevated work areas is frequently required in these industries for a variety of applications. AWPs are critical in construction for tasks such as building construction, maintenance, and repair work, as they provide a safe and efficient means of reaching heights that traditional methods cannot match.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea aerial work platform (AWP) rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SK Rental Co., Ltd.

- Korea Rental Corporation

- Jeil Rental Co., Ltd.

- Korea EWP Co., Ltd.

- Doosan Mecatec Co., Ltd.

- Hyundai Rental Corporation

- Hanjin Rental System Co., Ltd.

- Sambo EWP Co., Ltd.

- Kosin EWP Co., Ltd.

- CS Korea Rental Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the South Korea aerial work platform (AWP) rental market based on the below-mentioned segments:

South Korea Aerial Work Platform (AWP) Rental Market, By Products

- Boom Lifts

- Scissor Lifts

- Vertical Mass Lifts

- Personal Portable Lifts

South Korea Aerial Work Platform (AWP) Rental Market, By Types

- Electric

- Engine Powered

South Korea Aerial Work Platform (AWP) Rental Market, By Platform Heights

- Below 10 Meters

- 10 to 20 Meters

- 20 to 25 Meters

- Above 25 Meters

South Korea Aerial Work Platform (AWP) Rental Market, By Application

- Rental

- Construction & Mining

- Government

- Transportation & Logistics

- Utility

Need help to buy this report?