South Korea Adiponitrile Market Size, Share, and COVID-19 Impact Analysis, By Application (Nylon Synthesis, HDI, and Electrolyte Solution), By End Use (Automobile, Chemical Intermediate, and Electrical & Electronics), and South Korea Adiponitrile Market Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Adiponitrile Market Insights Forecasts to 2035

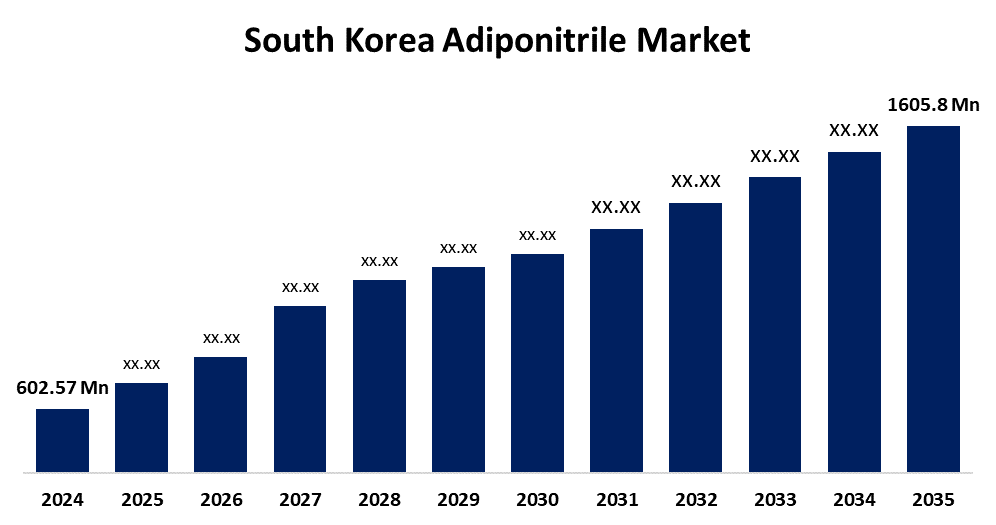

- The South Korea Adiponitrile Market Size Was Estimated at USD 602.57 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.32% from 2025 to 2035

- The South Korea Adiponitrile Market Size is Expected to Reach USD 1605.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Adiponitrile Market Size is anticipated to reach USD 1605.8 Million by 2035, growing at a CAGR of 9.32% from 2025 to 2035. Its growing use as a feedstock for the production of HDI and nylon 6,6 used in a variety of end-use sectors, including as electronics, chemicals, and vehicles.

Market Overview

The adiponitrile market involves the production and supply of adiponitrile, a crucial chemical intermediate primarily used in the manufacture of nylon 6,6 fibers and resins. Its benefits include enabling the production of strong, durable, and lightweight nylon materials used in textiles, automotive parts, and industrial applications. The growing demand in automotive lightweighting, electronics, and packaging industries. The market through initiatives promoting advanced manufacturing technologies, sustainable chemical production, and industrial innovation. These efforts aim to boost domestic chemical industries, reduce environmental impact, and enhance competitiveness, fostering growth and technological advancement in the adiponitrile market during the forecast period.

Report Coverage

This research report categorizes the market for South Korea adiponitrile market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea adiponitrile market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea adiponitrile market.

South Korea Adiponitrile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 602.57 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.32% |

| 2035 Value Projection: | USD 1605.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application and By End Use |

| Companies covered:: | LG Chem, Lotte Chemical, Kumho Petrochemical, Hyosung Chemical, Taekwang Industrial, SK Innovation, Hanwha Chemical, Samsung SDI, Hyundai Chemical, Daelim Industrial, OCI Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for nylon 6,6 in automotive, textile, and industrial applications due to its strength and durability. Rising automotive production, especially electric and lightweight vehicles, boosts the need for nylon components. Growth in the electronics and packaging sectors also fuels adiponitrile demand. Additionally, advancements in production technologies are improving efficiency and supporting market expansion.

Restraining Factors

Fluctuating raw material prices, particularly for butadiene and acrylonitrile, introduce volatility, affecting production costs and profit margins. Environmental regulations impose stringent standards on production processes, necessitating investments in cleaner technologies and increasing operational expenses. Additionally, competition from bio-based alternatives, which offer more sustainable options, may limit the demand for traditional adiponitrile.

Market Segmentation

The South Korea adiponitrile market share is classified into application and end-use.

- The nylon synthesis segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea adiponitrile market is segmented by application into nylon synthesis, HDI, and electrolyte solution. Among these, the nylon synthesis segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The high demand for nylon fibers in textiles, automotive, and industrial applications. Adiponitrile is a key raw material in producing hexamethylene diamine, essential for nylon manufacturing. Growing industrialization, rising consumer demand for durable and lightweight nylon products, and expanding applications in automotive and apparel sectors drive this demand.

- The automobile segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea adiponitrile market is segmented by end use into automobile, chemical intermediate, and electrical & electronics. Among these, the automobile segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing demand for lightweight, durable nylon components used in automotive manufacturing. Adiponitrile-derived nylon enhances fuel efficiency and vehicle performance by reducing weight without compromising strength. Increasing vehicle production, especially of electric and hybrid cars, fuels demand for advanced materials like nylon.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea adiponitrile market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Chem

- Lotte Chemical

- Kumho Petrochemical

- Hyosung Chemical

- Taekwang Industrial

- SK Innovation

- Hanwha Chemical

- Samsung SDI

- Hyundai Chemical

- Daelim Industrial

- OCI Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea adiponitrile market based on the below-mentioned segments:

South Korea Adiponitrile Market, By Application

- Nylon Synthesis

- HDI

- Electrolyte Solution

South Korea Adiponitrile Market, By End-use

- Automobile

- Chemical Intermediate

- Electrical & Electronics

Need help to buy this report?