South Korea Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Technology (Hot Melt, Reactive, Solvent-borne, UV Cured Adhesives, and Water-borne), By End Use Industry (Aerospace, Automotive, Building and Construction, Footwear and Leather, Healthcare, Packaging, Woodworking and Joinery, and Others), and South Korea Adhesives Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsSouth Korea Adhesives Market Insights Forecasts to 2035

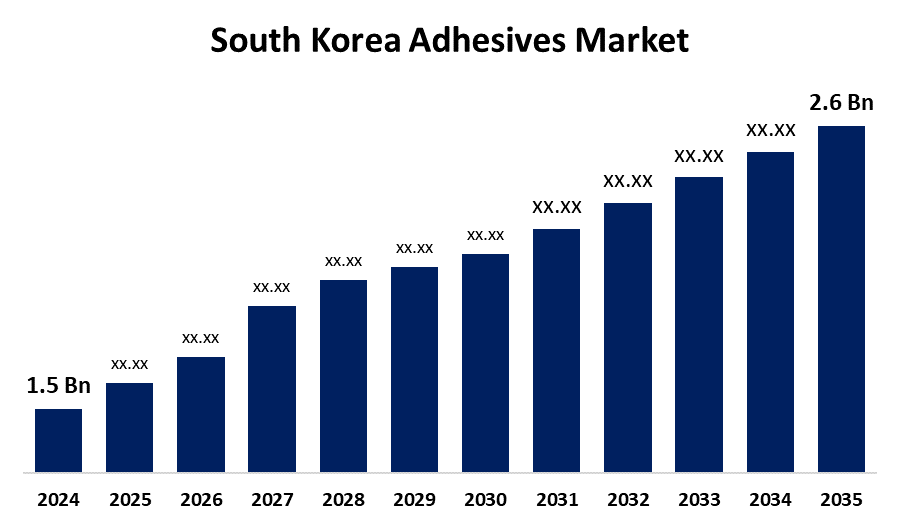

- The South Korea Adhesives Market Size was estimated at USD 1.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.13% from 2025 to 2035

- The South Korea Adhesives Market Size is Expected to Reach USD 2.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Adhesives Market Size is anticipated to reach USD 2.6 billion by 2035, growing at a CAGR of 5.13% from 2025 to 2035. The escalating need for automobiles with increased fuel efficiency and enhanced safety features, heightened manufacturing of smartphones, semiconductors, and displays demanding precision bonding solutions, and growing building construction activities are some of the foremost drivers behind the market.

Market Overview

The market for adhesives in South Korea includes a wide variety of bonding products used in a number of sectors, such as construction, automotive, healthcare, and packaging. Firms are highlighting green solutions, such as solvent-free and low-VOC bonding agents, to meet regulatory demands and evolving customer tastes. Operational flexibility is exhibited through investment in R&D infrastructure and manufacturing capacity to make rapid responses to market needs. Additionally, achievement in the South Korean adhesives industry more and more relies on firms' capacity to innovate while fulfilling sustainability needs. Traditional players are emphasizing the creation of environmentally friendly products and investment in sophisticated manufacturing technologies to secure their market shares.

Report Coverage

This research report categorizes the market for the South Korea adhesives market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea adhesives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea adhesives market.

South Korea Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.13% |

| 2035 Value Projection: | USD 2.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 271 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Technology and By End Use Industry |

| Companies covered:: | 3M, BURIM CHEMICAL CO., LTD, Henkel AG & Co. KGaA, OKONG Corp., Unitech Co., Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean construction industry is on the rise, with adhesives utilized in structural bonding, flooring, and insulation applications. Increasing construction work is driving demand for adhesives in South Korea. Moreover, the growing use of adhesives, since they enhance the overall performance of products by offering thermal insulation, electrical conductivity, or other desired characteristics, is one of the key drivers driving the market growth in South Korea.

Restraining Factors

The South Korea adhesives market faces several restraints that could hinder its growth. One significant restraint is the high cost of raw materials used in manufacturing these adhesives, such as polyurethane and silicone resins. These raw materials are subject to price fluctuations, which can lead to increased production costs and impact the affordability of moisture curing adhesives.

Market Segmentation

The South Korea adhesives market share is classified into technology and end use industry.

- The water-borne segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea adhesives market is segmented by technology into hot melt, reactive, solvent-borne, UV cured adhesives, water-borne. Among these, the water-borne segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their low VOC emissions, environmental compliance, and strong demand in packaging, automotive, and construction industries. Their versatility and eco-friendliness make them a preferred choice, especially amid tightening environmental regulations and a growing focus on sustainable solutions.

- The packaging segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea adhesives market is segmented by end use industry into aerospace, automotive, building and construction, footwear and leather, healthcare, packaging, woodworking and joinery, and others. Among these, the packaging segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This supremacy is driven by the nation's packaging industry's strong expansion in the consumer goods, cosmetics, food and beverage, and healthcare sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea adhesives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- BURIM CHEMICAL CO., LTD

- Henkel AG & Co. KGaA

- OKONG Corp.

- Unitech Co., Ltd

- Others

Recent Developments:

- In February 2025, LG Chem stated that it would partner with HL Mando, a top Korean auto parts supplier, to co-develop adhesives for electronic components used in cars. This is aimed at increasing LG Chem's market share in the car adhesive business.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea adhesives market based on the below-mentioned segments:

South Korea Adhesives Market, By Technology

- Hot Melt

- Reactive

- Solvent-borne

- UV Cured Adhesives

- Water-borne

South Korea Adhesives Market, By End Use Industry

- Aerospace

- Automotive

- Building and Construction

- Footwear and Leather

- Healthcare

- Packaging,

- Woodworking and Joinery

- Others

Need help to buy this report?